Nordstrom 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 47

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

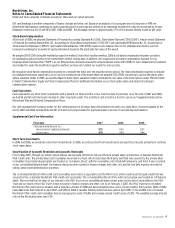

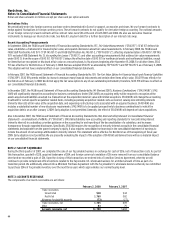

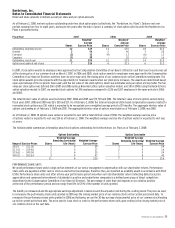

NOTE 7: INCOME TAXES

Effective February 4, 2007, we adopted Financial Accounting Standards Board (FASB) Interpretation No. 48,

Accounting for Uncertainty in Income

Taxes

(“FIN 48”). FIN 48 clarifies the accounting for uncertainty in income taxes recognized in financial statements in accordance with Statement of

Financial Accounting Standards No. 109

, Accounting for Income Taxes

. FIN 48 prescribes a recognition threshold and measurement attribute for the

financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. FIN 48 also provides guidance on

derecognition, classification, interest and penalties, accounting in interim periods, disclosure and transition.

The cumulative effect of adopting FIN 48 resulted in an increase to our liability for uncertain tax positions of $3, which reduced the beginning

balance of retained earnings. Upon adoption we had approximately $21 of gross unrecognized tax benefits, of which $7 relates to deferred items

which, if recognized, would not impact the effective tax rate.

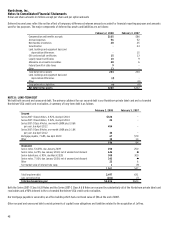

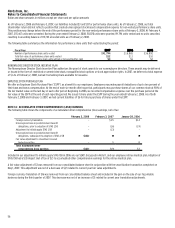

A reconciliation of the beginning and ending amount of unrecognized tax benefits is as follows:

Balance at February 4, 2007 $21

Gross increase to tax positions in prior periods 5

Gross decrease to tax positions in prior periods (1)

Gross increase to tax positions in current period 3

Lapse of statute (1)

Settlements -

Balance at February 2, 2008 $27

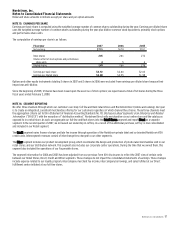

Unrecognized tax benefits related to federal, state and foreign tax positions may decrease by $1 by January 31, 2009, if years close and audits are

completed during 2008.

Of the $27 ending gross unrecognized tax benefit balance, $9 relates to deferred items which, if recognized, would not impact the effective tax rate.

Interest and penalties related to income tax matters are classified as a component of income tax expense. The estimate for accrued interest and

penalties upon adoption was $1. During 2007, our income tax expense included $3 of tax-related interest and penalties. At the end of 2007, our

liability for interest and penalties was $4.

We file income tax returns in the U.S. federal and various state jurisdictions. We also file returns in France and several other foreign jurisdictions.

With few exceptions, we are no longer subject to U.S. federal, state and local, or non-U.S. income tax examinations for years before 2002. Our U.S.

federal filings for the years 2002 through 2006 are under routine examination and that process is anticipated to be completed before the end of

2008. The completion and ultimate settlement of these IRS audit years is expected to be a refund and will not have a material impact on our gross

unrecognized tax benefits. Additionally, the U.S. federal tax return for 2007 is under concurrent year processing, which is expected to be completed

in 2009. We also currently have an active examination in France for the years 2001 through 2004.

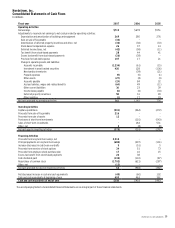

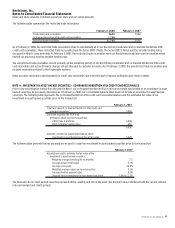

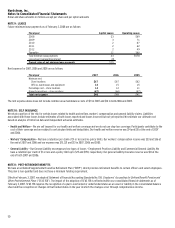

Income tax expense consists of the following:

Fiscal year 2007 2006 2005

Current income taxes:

Federal $435 $423 $312

State and local 65 63 38

Total current income tax expense 500 486 350

Deferred income taxes:

Current (24) (10) (7)

Non-current (18) (48) (9)

Total deferred income tax benefit (42) (58) (16)

Total income tax expense $458 $428 $334

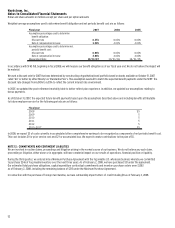

A reconciliation of the statutory Federal income tax rate to the effective tax rate on earnings before income taxes is as follows:

Fiscal year 2007 2006 2005

Statutory rate 35.0% 35.0% 35.0%

State and local income taxes, net of federal

income taxes 3.4 3.2 3.2

Other, net 0.6 0.5 (0.5)

Effective tax rate 39.0% 38.7% 37.7%