Nordstrom 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 41

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

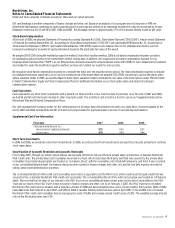

Gift card breakage is another component of finance charges and other, net. Based on an analysis of our program since its inception in 1999, we

determined that balances remaining on cards issued beyond five years ago are unlikely to be redeemed and therefore may be recognized as income.

Breakage income was $6, $5 and $8 in 2007, 2006 and 2005. This breakage income is approximately 3.7% of the amount initially issued as gift cards.

Stock-Based Compensation

At the start of 2006, we adopted Statement of Financial Accounting Standard No. 123(R),

Share-Based Payment

(“SFAS 123(R)”), which revised Statement

of Financial Accounting Standard No. 123,

Accounting for Stock-Based Compensation

(“SFAS 123”) and superseded APB Opinion No. 25,

Accounting for

Stock Issued to Employees

(“APB 25”) and related interpretations. SFAS 123(R) requires us to measure the cost of employee and director services

received in exchange for an award of equity instruments based on the grant-date fair value of the award.

We adopted SFAS 123(R) using the modified prospective method. Under this transition method, 2006 stock-based compensation expense considers

all outstanding options that have not reached their earliest vesting date. In addition, we recognized stock-based compensation expense for our

Employee Share Purchase Plan (“ESPP”), as our 10% purchase discount exceeds the amount allowed under SFAS 123(R) for non-compensatory treatment.

As provided for under the modified prospective method, we have not restated our results for prior periods.

We recognize stock-based compensation expense on a straight-line basis over the requisite service period. The total compensation expense is reduced

by estimated forfeitures expected to occur over the vesting period of the award. When we adopted SFAS 123(R), we elected to use the Binomial Lattice

option valuation model. In 2005, we used the Black-Scholes option valuation model to estimate the fair value of the stock options under SFAS 123. Refer

to Note 13: Shareholders’ Equity and Stock Compensation Plans for additional information on our stock option plans and related stock-based

compensation expense.

Cash Equivalents

Cash equivalents are short-term investments with a maturity of three months or less from the date of purchase. As of the end of 2007 and 2006,

we had $0 and $8 restricted cash included in other long-term assets. The restricted cash is held in a trust for use by our Supplemental Executive

Retirement Plan and Deferred Compensation Plans.

Our cash management system provides for the reimbursement of all major bank disbursement accounts on a daily basis. Accounts payable at the

end of 2007 and 2006 included $46 and $41 of checks not yet presented for payment drawn in excess of our bank deposit balances.

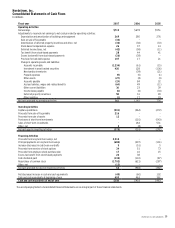

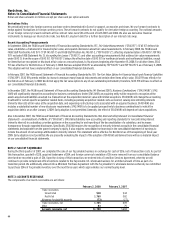

Supplemental Cash Flow Information

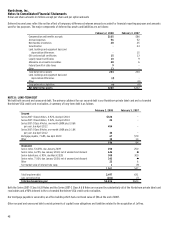

Fiscal year 2007 2006 2005

Cash paid during the year for:

Interest (net of capitalized interest) $75 $55 $57

Income taxes 478 449 344

Short-term Investments

In 2005 and 2006, we invested in short-term investments. In 2006, we sold our short-term investments and used the proceeds primarily for common

stock repurchases.

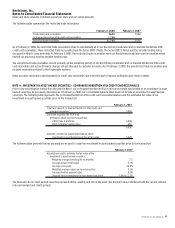

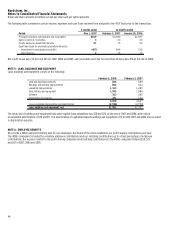

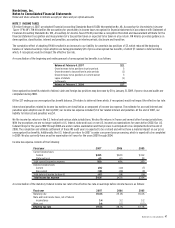

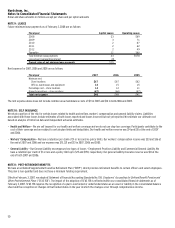

Securitization of Accounts Receivable and Accounts Receivable

Prior to May 2007, through our wholly owned federal savings bank, Nordstrom fsb, we offered a private label card and two co-branded Nordstrom

VISA credit cards. The private label card receivables were held in a trust, which could issue third-party debt that was secured by the private label

receivables; the private label program was treated as ‘on-balance sheet,’ with the receivables, net of bad debt allowance, and debt, if any, recorded

on our consolidated balance sheet, the finance charge income recorded in finance charges and other, net, and the bad debt expense recorded in

selling, general and administrative expenses.

The co-branded Nordstrom VISA credit card receivables were held in a separate trust (the VISA Trust), which could issue third-party debt that was

secured by the co-branded Nordstrom VISA credit card receivables. The co-branded Nordstrom VISA credit card program was treated as ‘off-balance

sheet.’ We recorded the fair value of our interest in the VISA Trust on our consolidated balance sheet, gains on the sale of receivables to the VISA

Trust and our share of the VISA Trust’s finance income in finance charges and other, net. As of February 3, 2007, the VISA Trust had co-branded

Nordstrom VISA credit card receivables with a total face amount of $908 and had outstanding two series of notes held by third parties: $200 of 2002

Class A&B notes that matured in April 2007, and $350 of 2004-2 variable funding notes that were paid in April 2007. In fiscal 2006, the co-branded

Nordstrom VISA credit card receivables had an average gross yield of 16.8% and average annual credit losses of 2.8%. The weighted average interest

rate on the third-party notes was 5.3%.