Nordstrom 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

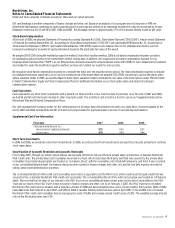

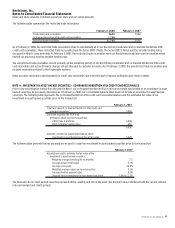

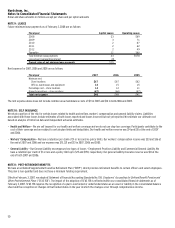

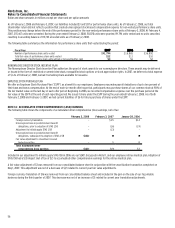

Deferred income taxes reflect the net tax effect of temporary differences between amounts recorded for financial reporting purposes and amounts

used for tax purposes. The major components of deferred tax assets and liabilities are as follows:

February 2, 2008 February 3, 2007

Compensation and benefits accruals $105 $86

Accrued expenses 56 52

Merchandise inventories 28 25

Securitization — 24

Land, buildings and equipment basis and

depreciation differences — 15

Gift cards and gift certificates 15 13

Loyalty reward certificates 10 9

Allowance on accounts receivables 28 6

Federal benefit of state taxes 9—

Other 13 —

Total deferred tax assets 264 230

Land, buildings and equipment basis and

depreciation differences (4) —

Other — (8)

Total deferred tax liabilities (4) (8)

Net deferred tax assets $260 $222

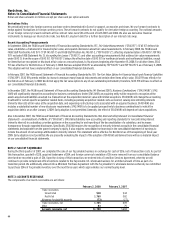

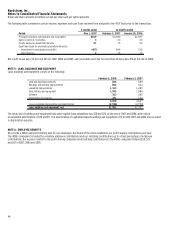

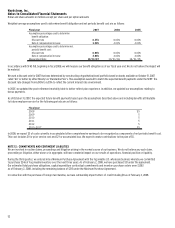

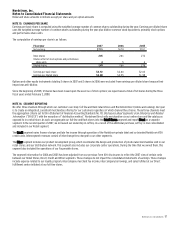

NOTE 8: LONG-TERM DEBT

We hold both secured and unsecured debt. The primary collateral for our secured debt is our Nordstrom private label card and co-branded

Nordstrom VISA credit card receivables. A summary of long-term debt is as follows:

February 2, 2008 February 3, 2007

Secured

Series 2007-1 Class A Notes, 4.92%, due April 2010 $326 —

Series 2007-1 Class B Notes, 5.02%, due April 2010 24 —

Series 2007-2 Class A Notes, one-month LIBOR plus 0.06%

per year, due April 2012 454 —

Series 2007-2 Class B Notes, one-month LIBOR plus 0.18%

per year, due April 2012 46 —

Mortgage payable, 7.68%, due April 2020 67 $70

Other 19 14

936 84

Unsecured

Senior notes, 5.625%, due January 2009 250 250

Senior notes, 6.25%, due January 2018, net of unamortized discount 646 —

Senior debentures, 6.95%, due March 2028 300 300

Senior notes, 7.00%, due January 2038, net of unamortized discount 342 —

Other 22 6

Fair market value of interest rate swap 1(9)

1,561 547

Total long-term debt 2,497 631

Less current portion (261) (7)

Total due beyond one year $2,236 $624

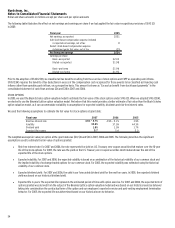

Both the Series 2007-1 Class A & B Notes and the Series 2007-2 Class A & B Notes are secured by substantially all of the Nordstrom private label card

receivables and a 90% interest in the co-branded Nordstrom VISA credit card receivables.

Our mortgage payable is secured by an office building which had a net book value of $86 at the end of 2007.

Other secured and unsecured debt consists primarily of capital lease obligations and liabilities related to the acquisition of Jeffrey.