Nordstrom 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 25

Financing Activities

Our net cash provided by financing increased $1,048 from $984 of cash used in financing activities to $64 provided by financing activities mainly due to

proceeds from long-term borrowings, net. We use our net cash provided by operating activities and our proceeds from financing activities to repay

long-term borrowings, pay dividends, and to repurchase our common stock. In 2007, we conducted an extensive review of our capital structure and

determined that we should add a moderate amount of leverage. Our target capital structure is 2x Adjusted Debt to EBITDAR, a level of leverage that is

consistent with our goal of maintaining current credit ratings.

DEBT ISSUANCE

In the first quarter of 2007, the Private Label Trust used our previously existing variable funding facility to issue a total of $150 in Notes. On May 1, 2007,

we paid the outstanding balance and terminated this facility. At that time, we entered into a new securitization transaction, issuing $850 in secured

notes (the Series 2007-1 Class A & B Notes, due April 2010 and the Series 2007-2 Class A & B Notes, due April 2012) and establishing a variable funding

facility backed by substantially all of the Nordstrom private label card receivables and a 90% interest in the co-branded Nordstrom VISA credit card

receivables with a capacity of $300. During the third quarter, the combined Nordstrom VISA and Private Label Trust issued $220 of Notes to fund share

repurchases, which we paid off by the end of the year.

During the third quarter of 2007, we entered into an agreement for a new variable funding facility backed by the remaining 10% interest in the

co-branded Nordstrom VISA credit card receivables with a commitment of $100. No issuances have been made against this facility during 2007.

Borrowings under the facility will incur interest based upon the cost of commercial paper issued by the third party bank conduit plus specified fees.

In December 2007, we issued $650 aggregate principal amount of 6.25% senior unsecured notes due 2018 and $350 aggregate principal amount of

7% senior unsecured notes due 2038 for proceeds of $988, net of discount. The interest rates were higher than historical average, due largely to

recent fluctuating market conditions and the softer retail environment. We used the note proceeds to pay down our short-term borrowings and

repurchase shares.

We have the capacity to issue commercial paper under our new dealer agreement that is supported by our unsecured line of credit. During the third

quarter of 2007, we issued commercial paper, and as of November 3, 2007, the outstanding balance was $392. As a result of the December 2007 debt

issuance, we reclassified $302 of the outstanding balance of commercial paper from commercial paper to long-term debt as of November 3, 2007,

because it was refinanced by the debt. The commercial paper was issued in order to fund share repurchase activity and the growth from the on-balance

sheet co-branded Nordstrom VISA credit card receivables.

DEBT RETIREMENT

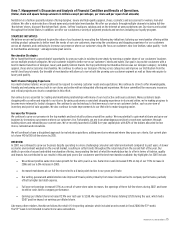

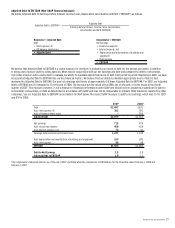

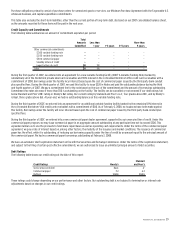

The following table outlines our debt retirement activity:

Fiscal year 2007 2006 2005

Principal repaid or retired:

2001-1 Variable Funding Note $150 — —

2007-A Variable Funding Note 220 — —

Commercial Paper 302 — —

Private Label Securitization, 4.82%, due 2006 — $300 —

Notes payable, 6.7%, due 2005 — — $96

Other 8 7 5

Total $680 $307 $101

Total cash payment $680 $307 $101

On May 1, 2007, we paid the $150 outstanding balance on the 2001-1 Variable Funding Note and terminated the facility in connection with entering an

agreement for a new variable funding facility (2007-A Variable Funding Note). Under the 2007-A Variable Funding Note we issued and repaid $220

during the year. Additionally, with the proceeds of the debt issued in the fourth quarter, we repaid $302 of the commercial paper facility, of which $392

was outstanding at the end of the third quarter. The remaining $90 of the commercial paper was paid during the fourth quarter of 2007 using operating

cash flows.

We retired the $300 4.82% Private Label Securitization debt when it matured in October 2006. We repaid the remaining $96 of our 6.7% medium-term notes

when they matured in 2005.

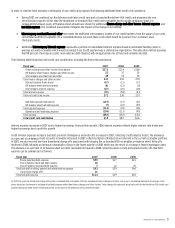

SHARE REPURCHASE

In February 2005, our Board of Directors authorized $500 of share repurchases. Overall for 2005, we purchased 8 shares for $287 at an average price

of $33.80 per share. We utilized the remaining authorization of $213 in the first quarter of 2006, purchasing 6 shares at an average price of $39.27

per share.

Our Board of Directors authorized an additional $1,000 of share repurchases in May 2006. During the remainder of 2006, we repurchased 11 shares for

$409 as part of this authorization, at an average price of $36.74.