Nordstrom 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 43

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

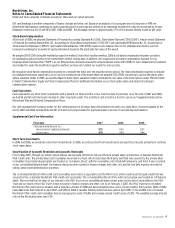

Foreign Currency Translation

As of the end of 2007, we no longer own any material foreign subsidiaries, and so no longer recognize any foreign currency translation in

accumulated other comprehensive earnings. Prior to the sale of the Façonnable business in the third quarter of 2007, the assets and liabilities of our

foreign subsidiaries were translated to U.S. dollars using the exchange rates effective on the balance sheet date, while income and expense accounts

were translated at the average rates in effect during the year. The resulting translation adjustments were recorded in accumulated other

comprehensive earnings.

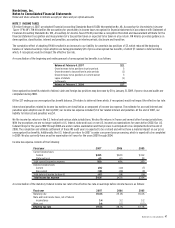

Income Taxes

We use the asset and liability method of accounting for income taxes. Using this method, deferred tax assets and liabilities are recorded based on

differences between financial reporting and tax basis of assets and liabilities. The deferred tax assets and liabilities are calculated using the enacted

tax rates and laws that are expected to be in effect when the differences are expected to reverse. We establish valuation allowances for tax benefits

when we believe it is not likely that the related expense will be deductible for tax purposes.

Effective February 4, 2007, we adopted Financial Accounting Standards Board (FASB) Interpretation No. 48,

Accounting for Uncertainty in Income

Taxes

(“FIN 48”). FIN 48 clarifies the accounting for uncertainty in income taxes recognized in financial statements in accordance with Statement of

Financial Accounting Standards No. 109

, Accounting for Income Taxes

. In accordance with FIN 48, we regularly evaluate the likelihood of recognizing

the benefit for income tax positions we have taken in various federal, state, and foreign filings by considering all relevant facts, circumstances, and

information available. For those benefits we believe more likely than not will be sustained, we recognize the largest amount we believe is

cumulatively greater than 50% likely to be realized.

Other Current Liabilities

Included in other current liabilities were gift card liabilities of $188 and $172 at the end of 2007 and 2006.

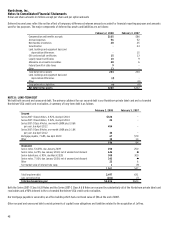

Loyalty Program

Customers who reach a cumulative purchase threshold when using our Nordstrom private label cards or our co-branded Nordstrom VISA credit cards

receive Nordstrom Notes®. These Nordstrom Notes can be redeemed for goods or services in our stores. We estimate the net cost of the Nordstrom

Notes that will be issued and redeemed and record this cost as rewards points are accumulated. In addition to this long-standing benefit, in April

2007 we launched an enhanced loyalty program, Fashion RewardsTM. Under this program, Nordstrom customers receive higher levels of cumulative

benefits based on their annual spend. We record the cost of the loyalty program benefits in cost of sales and selling, general and administrative

expenses. These expenses are recorded based on estimates of benefits expected to be accumulated and redeemed in relation to sales.

Vendor Allowances

We receive allowances from merchandise vendors for cosmetic selling expenses, purchase price adjustments, cooperative advertising programs, and

vendor sponsored contests. Allowances for cosmetic selling expenses are recorded in selling, general and administrative expenses as a reduction to

the related cost when incurred. Purchase price adjustments are recorded as a reduction of cost of sales at the point they have been earned and the

related merchandise has been sold. Allowances for cooperative advertising and promotion programs and vendor sponsored contests are recorded in

cost of sales and selling, general and administrative expenses as a reduction to the related cost when incurred. Any allowances in excess of actual

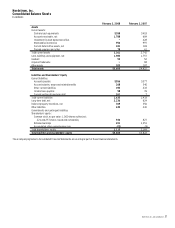

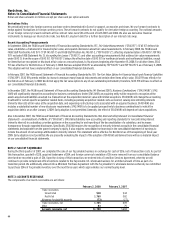

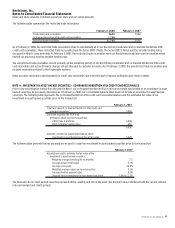

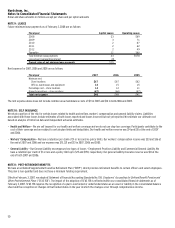

costs incurred that are recorded in selling, general and administrative expenses are recorded as a reduction to cost of sales. The following table

shows vendor allowances earned during the year:

Fiscal year 2007 2006 2005

Cosmetic selling expenses $120 $121 $107

Purchase price adjustments 86 70 58

Cooperative advertising and promotion 61 67 58

Vendor sponsored contests 23 4

Total vendor allowances $269 $261 $227

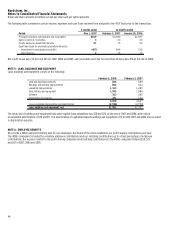

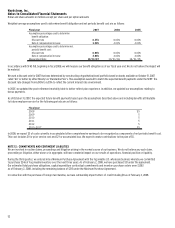

Allowances were recorded in our consolidated statements of earnings as follows:

Fiscal year 2007 2006 2005

Cost of sales $146 $138 $118

Selling, general and administrative expenses 123 123 109

Total vendor allowances $269 $261 $227

Fair Value of Financial Instruments

The carrying amounts of cash equivalents approximate fair value. See Note 8: Long-term debt for the fair values of our long-term debt and interest

rate swap agreement.