Nordstrom 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

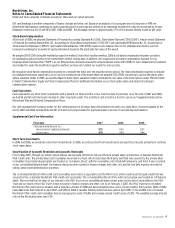

Derivatives Policy

We periodically enter into foreign currency purchase orders denominated in Euros for apparel, accessories and shoes. We use forward contracts to

hedge against fluctuations in foreign currency prices. These forward contracts do not qualify for derivative hedge accounting. The notional amounts

of our foreign currency forward contracts at the contract rates were $10 at the end of both 2007 and 2006. We also use derivative financial

instruments to manage our interest rate risks. See Note 8: Long-term debt for a further description of our interest rate swap.

Recent Accounting Pronouncements

In September 2006, the FASB issued Statement of Financial Accounting Standards No. 157,

Fair Value Measurements

(“SFAS 157”). SFAS 157 defines fair

value, establishes a framework for measuring fair value, and expands disclosures about fair value measurements. In February 2008, the FASB issued

FASB Staff Position No. FAS 157-1 (“FSP FAS 157-1”) and FASB Staff Position No. FAS 157-2, (“FSP FAS 157-2”), affecting implementation of SFAS 157. FSP FAS

157-1 excludes FASB Statement No. 13,

Accounting for Leases

(“SFAS 13”), and other accounting pronouncements that address fair value measurements

under SFAS 13, from the scope of SFAS 157. FSP FAS 157-2 delays the effective date of SFAS 157 for nonfinancial assets and nonfinancial liabilities, except

for items that are recognized or disclosed at fair value on a recurring basis, to fiscal years beginning after November 15, 2008. For all other items, SFAS

157 was effective for Nordstrom as of February 3, 2008. We have adopted SFAS 157 as amended by FSP FAS 157-1 and FSP FAS 157-2 as of February 3, 2008.

This adoption will not have a material effect on our consolidated financial statements.

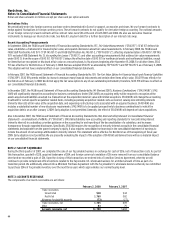

In February 2007, the FASB issued Statement of Financial Accounting Standards No. 159,

The Fair Value Option for Financial Assets and Financial Liabilities

(“SFAS 159”). SFAS 159 permits entities to choose to measure many financial instruments and certain other items at fair value. SFAS 159 was effective for

Nordstrom as of February 3, 2008. We did not apply the fair value option to any of our outstanding instruments; therefore, SFAS 159 will have no effect on

our consolidated financial statements.

In December 2007, the FASB issued Statement of Financial Accounting Standards No. 141 (Revised 2007),

Business Combinations

(“SFAS 141(R)”). SFAS

141(R) will significantly change the accounting for business combinations. Under SFAS 141(R), an acquiring entity will be required to recognize all the

assets acquired and liabilities assumed in a transaction at the acquisition-date fair value with limited exceptions. SFAS 141(R) will change the accounting

treatment for certain specific acquisition-related items, including expensing acquisition-related costs as incurred, valuing noncontrolling interests

(minority interests) at fair value at the acquisition date, and expensing restructuring costs associated with an acquired business. SFAS 141(R) also

includes a substantial number of new disclosure requirements. SFAS 141(R) is to be applied prospectively to business combinations for which the

acquisition date is on or after January 1, 2009. Early adoption is not permitted. Generally, the effect of SFAS 141(R) will depend on future acquisitions.

Also in December 2007, the FASB issued Statement of Financial Accounting Standards No. 160,

Noncontrolling Interests in Consolidated Financial

Statements – an amendment of ARB No. 51

(“SFAS 160”). SFAS 160 establishes new accounting and reporting standards for noncontrolling interest

(minority interest) in a subsidiary, provides guidance on the accounting for and reporting of the deconsolidation of a subsidiary, and increases

transparency through expanded disclosures. Specifically, SFAS 160 requires the recognition of minority interest as equity in the consolidated financial

statements and separate from the parent company’s equity. It also requires consolidated net earnings in the consolidated statement of earnings to

include the amount of net earnings attributable to minority interest. This statement will be effective for Nordstrom as of the beginning of fiscal year

2009. Early adoption is not permitted. We are presently evaluating the impact of the adoption of SFAS 160 and believe there will be no material impact

on our consolidated financial statements.

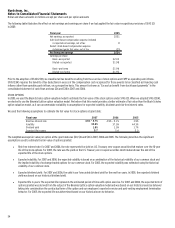

NOTE 2: SALE OF FAÇONNABLE

During the third quarter of 2007, we completed the sale of our Façonnable business in exchange for cash of $216, net of transaction costs. As part of

this transaction, goodwill of $28, acquired tradename of $84, and foreign currency translation of $16 were removed from our consolidated balance

sheet and we recorded a gain of $34. Upon the closing of this transaction, we entered into a Transition Services Agreement, whereby we will

continue to provide certain back office functions related to the Façonnable U.S. wholesale business for a limited amount of time as part of a

transition period. We additionally entered into a Minimum Purchase Agreement with the Façonnable U.S. wholesale business whereby we committed

to purchase $246 of Façonnable inventory over the next three years which approximates our normal buying level.

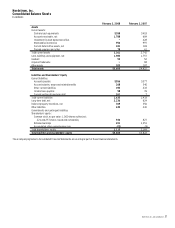

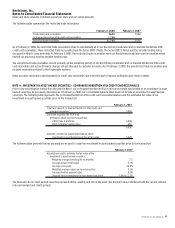

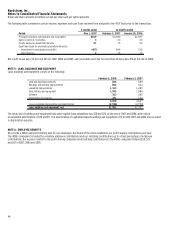

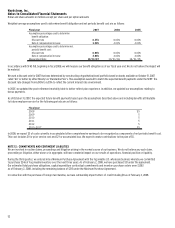

NOTE 3: ACCOUNTS RECEIVABLE

The components of accounts receivable are as follows:

February 2, 2008 February 3, 2007

Trade receivables:

Unrestricted $18 $44

Restricted 1,760 582

Allowance for doubtful accounts (73) (17)

Trade receivables, net 1,705 609

Other 83 75

Accounts receivable, net $1,788 $684