Nordstrom 2007 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.6

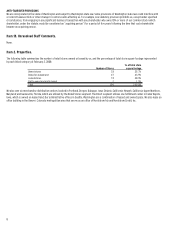

Item 1A. Risk Factors.

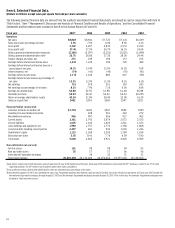

(Dollars in millions)

Our business faces many risks. We believe the risks described below outline the items of most concern to us. However, these risks are not the only ones

we face. Additional risks and uncertainties, not presently known to us or that we currently deem immaterial, may also impair our business operations.

ABILITY TO RESPOND TO THE BUSINESS ENVIRONMENT AND FASHION TRENDS

Our sales and operating results depend in part on our ability to predict or respond to changes in fashion trends and consumer preferences in a timely

manner and to match our merchandise mix to prevailing consumer tastes. Any sustained failure to identify and respond to emerging trends in lifestyle

and consumer preferences could force us to sell our merchandise at higher average markdown levels and lower average margins, which could have a

material adverse affect on our business. In addition, consumer spending at our stores may be affected by many factors outside of our control, including

consumer confidence, weather and other hazards of nature that affect consumer traffic, and general economic conditions.

INVENTORY MANAGEMENT

We strive to ensure the merchandise we offer remains fresh and compelling to our customers. If we are not successful at predicting our sales trends

and adjusting our purchases accordingly, we may have excess inventory, which would result in additional markdowns and reduce our operating

performance. This could have an adverse effect on margins and operating income.

IMPACT OF COMPETITIVE MARKET FORCES

The retail industry environment continues to change for many of our vendors and customers. In the future, our competition may partner more

effectively with vendors to serve the market’s needs. If we do not effectively respond to changes in our environment, we may see a loss of market

share to competitors, declining same-store sales, and declining profitability due to higher markdowns.

STORE GROWTH PLAN

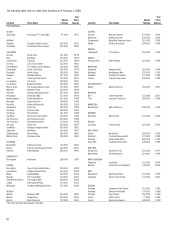

As of February 2008, our five-year strategic growth plan includes opening 31 new or relocated full-line stores and remodeling 29 existing full-line

stores. We compete with other retailers and businesses for suitable locations for our stores. Local land use and other regulations may impact our

ability to find suitable locations. New store openings also involve certain risks, including constructing, furnishing and supplying a store in a timely and

cost effective manner and accurately assessing the demographic or retail environment for a particular location. Our future sales at new, relocated or

remodeled stores may not meet our projections, which could adversely impact our return on investment. Performance in our new stores could also

be negatively impacted by our inability to hire employees who are able to deliver the level of service our customers have come to expect when

shopping at our stores. In the past, our expected operating dates have sometimes been delayed because of developer plan delays. Our inability to

execute our store growth strategy in a manner that generates appropriate returns on investment could have an adverse impact on our future growth

and profitability.

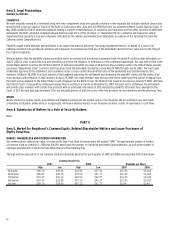

BANKING OPERATIONS

Our credit card operations, conducted through our federal thrift subsidiary, facilitate sales in our stores, allow our stores to avoid third-party

transaction fees and generate additional revenues by extending credit. Our finance charge revenue is subject to changes in interest rates which

fluctuate based on market conditions. The market conditions influencing interest rates are based on economic factors that are beyond our control and

include, but are not limited to, recession, inflation, deflation, consumer credit availability, consumer debt levels, tax rates and policy, unemployment

trends and other matters that influence consumer confidence and spending. Our ability to extend credit to our customers and to collect payments from

them depends on many factors including compliance with applicable laws and regulations, any of which may change from time to time. Changes in

credit card use, payment patterns and default rates may result from a variety of economic, legal, social and other factors that we cannot control or

predict with certainty. Changes that adversely impact our ability to extend credit and collect payments could negatively affect our results.

INFORMATION SECURITY AND PRIVACY

The protection of our customer, employee, and company data is critical to us. The regulatory environment surrounding information security and

privacy is increasingly demanding, with the frequent imposition of new and constantly changing requirements across our business units. In addition,

our customers have a high expectation that we will adequately protect their personal information. A significant breach of customer, employee or

company data could damage our reputation and result in lost sales, fines and lawsuits.

LEADERSHIP DEVELOPMENT AND SUCCESSION PLANNING

The training and development of our future leaders is critical to our long-term growth. If we do not effectively implement our strategic and business

planning processes to train and develop future leaders, our long-term growth may suffer. In addition, if unexpected leadership turnover occurs without

established succession plans, our business may suffer.

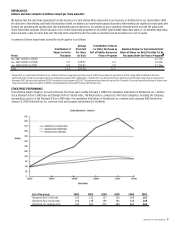

MULTI-CHANNEL STRATEGY EXECUTION

In 2005, we started to make changes in our Direct business that better align our online shopping environment and catalog with the customer experience in

our full-line stores. These changes included: aligning our Direct merchandise offering with our full-line stores to create a seamless experience for our

customers between our stores, catalogs and Web site, linking the full-line stores and Direct merchandise organizations; reducing the number and frequency

of our Direct catalog mailings; and transitioning our Direct inventory system onto our full-line store platform. Our inability to successfully execute this

strategy could impact our future operating performance.