Nordstrom 2007 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Nordstrom, Inc. and subsidiaries 53

Nordstrom, Inc.

Notes to Consolidated Financial Statements

Dollar and share amounts in millions except per share and per option amounts

NOTE 13: SHAREHOLDERS’ EQUITY AND STOCK COMPENSATION PLANS

Share Repurchase Program

In February 2005, our Board of Directors authorized $500 of share repurchases. Overall for 2005, we purchased 8 shares for $287 at an average price

of $33.80 per share. We utilized the remaining authorization of $213 in the first quarter of 2006, purchasing 6 shares at an average price of $39.27

per share.

Our Board of Directors authorized an additional $1,000 of share repurchases in May 2006. During the remainder of 2006, we repurchased 11 shares for

$409 as part of this authorization, at an average price of $36.74.

During the first half of 2007 we repurchased 11 shares for $590 as part of the existing authorization from May 2006, including $300 repurchased as

part of an accelerated share repurchase program. In May 2007, we entered into an accelerated share repurchase agreement with Credit Suisse

International to repurchase shares of our common stock for an aggregate purchase price of $300. We purchased 5 shares of our common stock on

May 23, 2007 at $55.17 per share. Under the terms of the agreement, we received less than one share in June 2007 at no additional cost, based on the

volume weighted average price of our common stock from June 1, 2007 to June 26, 2007. This resulted in an average price per share of $51.69 for the

accelerated share repurchase as a whole.

In August 2007, our Board of Directors authorized a $1,500 share repurchase program. In November 2007, our Board of Directors authorized an

increase of $1,000 to the share repurchase program. During the second half of 2007, we purchased 28 shares for $1,137 at an average price of $41.05,

using the remaining $1 on the May 2006 authorization and beginning to use the August and November 2007 authorizations. As of February 2, 2008

the unused authorization was $1,364. Repurchases under the program may be made through the end of 2009. The actual amount and timing of future

share repurchases will be subject to market conditions and applicable SEC rules.

Dividends

In 2007, we paid dividends of $0.54 per share. We paid dividends of $0.42 and $0.32 in 2006 and 2005.

Stock Compensation Plans

We currently grant stock options, performance share units and common shares under our 2004 Equity Incentive Plan.

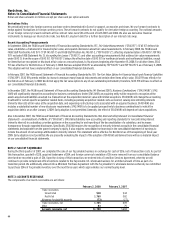

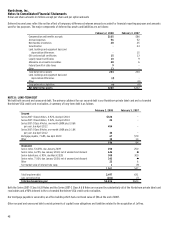

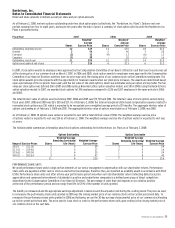

The following table summarizes our stock-based compensation expense:

Fiscal year 2007 2006 2005

Stock options $23 $27 -

Employee stock purchase plan 22 -

Performance share units (1) 7 $12

Other 21 1

Total stock-based compensation expense before income tax benefit 26 37 13

Income tax benefit (9) (13) (5)

Total stock-based compensation expense, net of income tax benefit $17 $24 $8

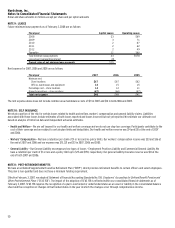

The stock-based compensation expense before income tax benefit was recorded in our consolidated statements of earnings as follows:

Fiscal year 2007 2006 2005

Cost of sales and related buying and occupancy costs $10 $12 -

Selling, general and administrative expenses 16 25 $13

Total stock-based compensation expense before income tax benefit $26 $37 $13

Prior to the adoption of Financial Accounting Standard No. 123(R),

Share-Based Payment

(“SFAS 123(R)”), we applied APB Opinion No. 25,

Accounting

for Stock Issued to Employees

(“APB 25”) to measure compensation costs for our stock-based compensation programs. Under APB 25, we recorded no

compensation expense for stock options granted to employees and directors because the options’ strike price was equal to the closing market price

of our common stock on the grant date. Also, in 2005 we recorded no compensation expense in connection with our Employee Stock Purchase Plan

(“ESPP”). In 2005, we presented the effect on net earnings and earnings per share of the fair value provisions of Statement of Financial Accounting

Standard No. 123,

Accounting for Stock-Based Compensation

(“SFAS 123”) in the Notes to Consolidated Financial Statements.