Nordstrom 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Nordstrom, Inc. and subsidiaries 7

BRAND AND REPUTATION

We have a well-recognized brand that is synonymous with the highest level of customer service and quality merchandise. Any significant damage to our

brand or reputation may negatively impact same-store sales, lower employee morale and productivity, and diminish customer trust, resulting in a reduction

in shareholder value.

CAPITAL EFFICIENCY AND PROPER ALLOCATION

Our goal is to invest capital to maximize our overall long-term returns. This includes spending on inventory, capital projects and expenses, managing

debt levels, managing accounts receivable through our credit business, and returning value to our shareholders through dividends and share

repurchases. To a large degree, capital efficiency reflects how well we manage the other key risks to our Company. The actions taken to address other

specific risks may affect how well we manage the more general risk of capital efficiency. If we do not properly allocate our capital to maximize returns,

we may fail to produce financial results that our shareholders have come to expect and we may experience a reduction in shareholder value.

HUMAN RESOURCE REGULATIONS

Our policies and procedures are designed to comply with human resource laws such as wage and hour, meal and rest period, and commissions. Federal

and state wage and hour laws are complex, and the related enforcement is increasingly aggressive, particularly in the state of California. Failure to

comply with these laws could result in damage to our reputation, class action lawsuits and dissatisfied employees.

EMPLOYMENT AND DISCRIMINATION LAWS

State and federal employment and discrimination laws and the related case law continue to evolve, making ongoing compliance in this area a

challenge. Failure to comply with these laws may result in damage to our reputation, legal and settlement costs, disruption of our business, and loss of

customers and employees, which would result in a loss of sales, increased employment costs, low employee morale and attendant harm to our business

and results of operations.

TECHNOLOGY

We make investments in information technology to sustain our competitive position. We expect our combined capitalized and expense spend to be

approximately $180 each year on information technology operations and system development, which is key to our growth. We must monitor and choose

the right investments and implement them at the right pace. Targeting the wrong opportunities, failing to make the best investment, or making an

investment commitment significantly above or below the requirements of the business opportunity may result in the loss of our competitive position.

In addition, an inadequate investment in maintaining our current systems may result in a loss of system functionality and increased future costs to

bring our systems up to date.

We may implement too much technology, or change too fast, which could result in failure to adopt the new technology if the business is not ready or

capable of accepting it. Excessive technological change affects the effectiveness of adoption, and could adversely affect the realization of benefits

from the technology. However, not implementing enough technology could compromise our competitive position.

DISTRIBUTION AND FULFILLMENT CENTERS

We depend on the orderly operation of the receiving and distribution process, which depends, in turn, on adherence to shipping schedules and effective

management of our six distribution centers and our Direct fulfillment center. Although we believe that our receiving and distribution process is

efficient, unforeseen disruptions in operations due to fires, hurricanes or other catastrophic events, labor disagreements or shipping problems, may

result in delays in the delivery of merchandise to our stores and our customers. Although we maintain business interruption and property insurance,

management cannot be assured that our insurance coverage will be sufficient, or that insurance proceeds will be timely paid to us, if any of the

distribution centers are shut down for any reason.

FOREIGN CURRENCY

We purchase a portion of our inventory from foreign suppliers whose cost to us is affected by the fluctuation of their local currency against the dollar

or who price their merchandise in currencies other than the dollar. We source goods from numerous countries and thus are affected by changes in

numerous currencies and generally, by fluctuations in the U.S. dollar relative to such currencies. Accordingly, changes in the value of the dollar relative

to foreign currencies may increase our cost of goods sold and if we are unable to pass such cost increases on to our customers, our gross margins, and

ultimately our earnings, would decrease. Foreign currency fluctuations could have a material adverse effect on our business, financial condition and

results of operations in the future.

SEASONALITY

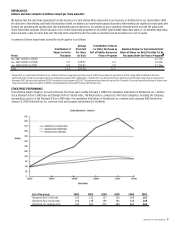

Our business is seasonal in nature. Due to our anniversary sale in July and the holidays in December, sales are higher for our Retail Stores in the

second and fourth quarters of the fiscal year than in the first and third quarters. Accordingly, our results may vary considerably from quarter to

quarter. In addition, we have significant additional cash requirements in the period leading up to the months of November and December in anticipation

of higher sales volume in those months, including expenses for additional inventory, advertising and employees.

REGULATORY COMPLIANCE

Our policies and procedures are designed to comply with all applicable laws and regulations, including those imposed by the SEC, NYSE, the banking

industry and foreign countries. Additional legal and regulatory requirements, such as those arising under the Sarbanes-Oxley Act and the fact that

foreign laws occasionally conflict with domestic laws, have increased the complexity of the regulatory environment and the cost of compliance. Failure

to comply with the various regulations may result in damage to our reputation, civil and criminal liability, fines and penalties, increased cost of

regulatory compliance and restatements of our financial statements.