Nordstrom 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

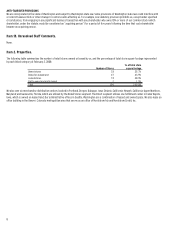

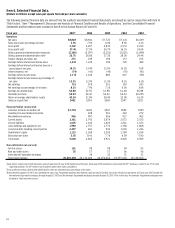

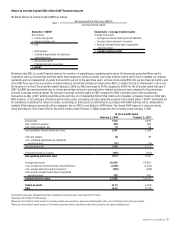

Selling, General and Administrative Expenses

Fiscal year 2007 2006 2005

Selling, general and administrative expenses $2,360 $2,297 $2,101

Selling, general and administrative rate 26.7% 26.8% 27.2%

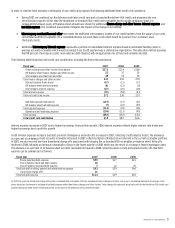

2007 VS 2006 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

The increase in selling, general and administrative dollars in 2007 compared to 2006 is largely due to an increase in bad debt expense. In addition to

the incremental bad debt expense related to the transition of our accounting treatment for our co-branded Nordstrom VISA credit card receivables to

on-balance sheet, we observed an increase in delinquency and loss rates. However, our credit card delinquency rates, while rising, remain below the

rates for the industry and major card issuers. The increase in bad debt expense was partially offset by decreases in our incentive costs tied to company

performance. Our selling, general and administrative rate improved 9 basis points year over year due to the reduction in incentive costs tied to

company performance being mostly offset by higher bad debt expense.

2006 VS 2005 SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

The changes in selling, general and administrative expense dollars in 2006 compared to 2005 are largely a result of increases in variable expenses such

as labor and stock option expense. The increase in selling labor directly correlates to our sales growth. Our other costs are mostly fixed and as sales

increased they provided selling, general and administrative rate improvement. Non-selling labor dollars increased over the prior year, but at a lower

rate than our sales growth. Additionally, stock option expense was included in our consolidated statement of earnings for the first time in 2006 as a

result of adopting Statement of Financial Accounting Standards 123(R),

Share-Based Payment

(“SFAS 123(R)”).

In 2005, our selling, general and administrative rate was reduced by 24 basis points for favorable developments in our workers’ compensation reserve.

Legislation was enacted in 2003 and 2004 that positively impacted the cost of California workers’ compensation claims. In addition to an improved

regulatory climate in California, our workers’ compensation reserve was also positively impacted by a significant reduction in the number of claims

that involved employees requiring time away from work.

2008 FORECAST OF SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

In 2008, our selling, general and administrative rate is expected to increase by 60 to 80 basis points driven by a lower same-store sales plan and

continued investment in our long-term growth. Our operating model normally results in an improved selling, general and administrative rate when we

achieve a minimum of low single-digit same-store sales. The combination of our lower same-store sales plan as well as our planned new stores and the

related pre-opening costs will likely cause our 2008 selling, general and administrative rate to increase when compared to prior years. We will continue

to invest in high return projects, including new stores, which we believe will create long-term value.

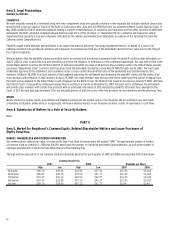

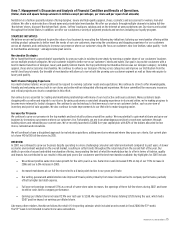

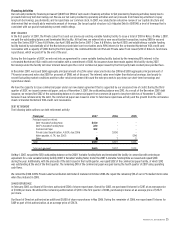

Finance Charges and Other, Net

Fiscal year 2007 2006 2005

Finance charges and other, net $271 $239 $196

Finance charges and other, net as a percentage

of net sales 3.1% 2.8% 2.5%

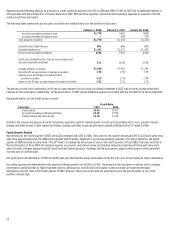

2007 VS 2006 FINANCE CHARGES AND OTHER, NET

Finance charges and other, net increased $32, primarily due to converting the Nordstrom private label card and co-branded Nordstrom VISA credit card

receivables into one securitization program on May 1, 2007. Prior to May 1, 2007, the co-branded Nordstrom VISA was “off-balance sheet” and revenues were

recorded net of interest and write-offs. The co-branded Nordstrom VISA credit card portfolio was brought on-balance sheet and from May 1, 2007, all of the

finance charges and other income related to the portfolio, net of transitional write-offs, were recorded in finance charges and other, net.

2006 VS 2005 FINANCE CHARGES AND OTHER, NET

Finance charges and other, net increased $43, primarily due to growth in the co-branded Nordstrom VISA credit card program. The principal balances of

receivables in the co-branded Nordstrom VISA credit card portfolio, which in 2006 were held by a separate trust in which we held retained interests,

increased 22.9% during 2006. The receivables growth increase produced an increase in the trust’s earnings and as a result, the income recorded in our

consolidated statement of earnings.

In addition, income from finance charges on our private label card increased due to program growth.

In July 2006, we received $6 of proceeds from the VISA Check/Master Money Antitrust Litigation. These proceeds were recorded as a gain in the second

quarter of 2006 in finance charges and other, net.

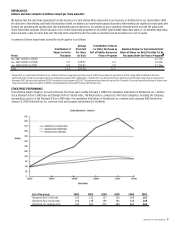

2008 FORECAST OF FINANCE CHARGES AND OTHER, NET

We expect finance charges and other, net, to increase $50 to $60 in 2008 due to growth in credit card income related to the increased volume on our

co-branded Nordstrom VISA credit card which will be partially offset by lower interest rates on customer accounts. Additionally, there is the year over

year impact of $21 of transitional write-offs on the co-branded Nordstrom VISA credit cards which lowered finance charges and other, net. These

transitional write-offs were due to the securitization transaction that occurred in early 2007 and these charges will not recur in 2008.