Nordstrom 2007 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2007 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

16

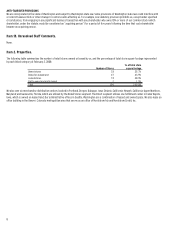

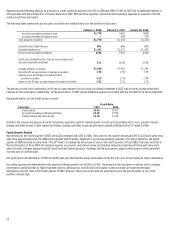

Securitization of Accounts Receivable

On May 1, 2007, we converted the Nordstrom private label card and co-branded Nordstrom VISA credit card programs into one securitization program,

which is accounted for as a secured borrowing (on-balance sheet). When we combined the securitization programs, our investment in asset backed

securities was converted from available-for-sale securities to receivables. Based on past payment patterns, our receivable portfolio was repaid within

approximately eight months. During that time, we transitioned the co-branded Nordstrom VISA credit card receivable portfolio to historical cost, net of

bad debt allowances, on our balance sheet.

Substantially all of the Nordstrom private label receivables and 90% of the co-branded Nordstrom VISA credit card receivables are securitized.

Under the securitization, the receivables are transferred to a third-party trust on a daily basis. The balance of the receivables transferred to the trust

fluctuates as new receivables are generated and old receivables are retired (through payments received, charge-offs, or credits for merchandise

returns). On May 1, 2007, the trust issued securities that are backed by the receivables. These combined receivables back the Series 2007-1 Notes,

the Series 2007-2 Notes, and an unused variable funding note that is discussed in Note 8: Long-term debt.

Prior to May 1, 2007, the co-branded Nordstrom VISA was “off-balance sheet” and finance charges and other income were recorded net of interest and

write-offs. The co-branded Nordstrom VISA credit card portfolio was brought on-balance sheet and from May 1, 2007, all of the finance charges and other

income related to the portfolio, net of transitional write-offs, were recorded in finance charges and other, net.

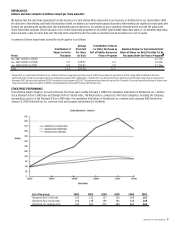

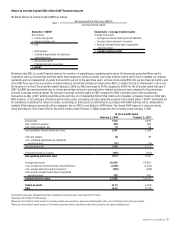

RESULTS OF OPERATIONS

Net Sales

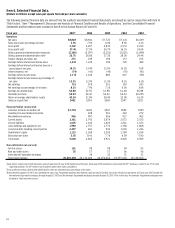

Fiscal year 2007 2006 2005

Net sales $8,828 $8,561 $7,723

Net sales increase 3.1% 10.8% 8.3%

Same-store sales increase 3.9% 7.5% 6.0%

Percentage of net sales by merchandise category:

Women’s apparel 35% 35% 35%

Shoes 20% 20% 21%

Men’s apparel 18% 18% 18%

Cosmetics 11% 11% 11%

Women’s accessories 11% 10% 9%

Children’s apparel 3% 3% 3%

Other 2% 3% 3%

2007 VS 2006 NET SALES

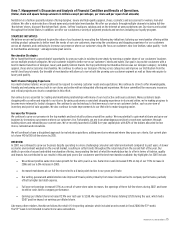

Our full-line stores had a 2.5% same-store sales increase in 2007, on top of 5.9% in the same period in 2006. The Midwest, South and Northwest

were our strongest performing regions during 2007. By category, our largest same-store sales increases came from our designer apparel, women’s

accessories and men’s merchandise categories. The designer category, which benefited from additional investment as an important component of our

merchandise strategy, had a double-digit same-store sales increase. Designer apparel offers fashion-forward and aspirational products, which drove

the increase. Women’s accessories benefited from increased sales of handbags and fashion jewelry. The increase in men’s apparel was in part due to

growth in our younger contemporary offering.

Our Rack same-store sales increased 8.7% in 2007, in addition to last year’s 10.9% increase. Rack purchases the majority of its merchandise from third

parties and serves as a clearance channel for our full-line stores. The sales growth came from all regions and merchandise categories. Same-store

sales were consistent across all regions, which showed high single-digit increases. Merchandise categories driving the largest same-store sales

increases for Rack were the accessories and cosmetics category and the men’s category. The men’s increase reflects sales from premium denim,

suits and dress shirts. High performance bodywear, watches and sunglasses led the accessories and cosmetics categories.

Nordstrom Direct’s 2007 total net sales increased 16.7% to $633. The growth in our Direct business was driven by our efforts to better align our online

shopping environment with the customer experience in our full-line stores. This includes aligning our merchandise offering with the full-line stores to

create a seamless experience for customers.

Total company net sales increased 3.1% as a result of our same-store sales increases as well as from the three full-line stores and one Rack store

opened during fiscal 2007. The 2006 fiscal calendar had 53 weeks compared to our normal operating calendar of 52 weeks. In the 53rd week of 2006,

we had sales of $118. Excluding the extra week of sales in fiscal 2006, total sales increased 4.6% in fiscal year 2007.