Neiman Marcus 2002 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

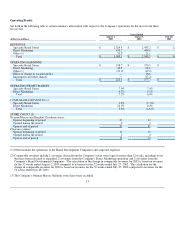

Leases for substantially all of the Company's stores, including renewal options, range from 15 to 99 years. The lease on the Bergdorf

Goodman Main Store expires in 2050 and the lease on the Bergdorf Goodman Men's Store expires in 2010, with two 10-year renewal

options. Most leases provide for monthly fixed amount rentals or contingent rentals based upon sales in excess of stated amounts and

normally require the Company to pay real estate taxes, insurance, common area maintenance costs and other occupancy costs.

The Company owns approximately 34 acres of land in Longview, Texas, where its National Service Center is located. The National

Service Center occupies a 502,000 square foot facility and is the principal merchandise processing and distribution facility for Neiman

Marcus stores. The Company also owns approximately 50 acres of land in Irving, Texas, where its 705,000 square foot Neiman

Marcus Direct operating headquarters and distribution facility is located.

For further information on the Company's properties and lease obligations, see Item 7, "Management's Discussion and Analysis of

Financial Condition and Results of Operations" and Note 12 of the Notes to the Consolidated Financial Statements in Item 15. For

more information about the Company's plans to open additional stores, see "Description of Operations" in Item 1.

ITEM 3. LEGAL PROCEEDINGS

The Company presently is engaged in various legal actions that are incidental to the ordinary conduct of its business. The Company

believes that any liability arising as a result of these actions and proceedings will not have a material adverse effect on the Company's

financial position, results of operations or cash flows.

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS

No matters were submitted to a vote of security holders of the Company during the quarter ended August 2, 2003.

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY AND RELATED SHAREHOLDER MATTERS

The Company's Class A Common Stock and Class B Common Stock are currently traded on the New York Stock Exchange under the

symbols NMG.A and NMG.B, respectively. As of September 15, 2003, there were 9,699 record holders of the Company's Class A

Common Stock and 3,450 record holders of the Company's Class B Common Stock. The Company currently does not intend to pay

cash dividends on its common stock.

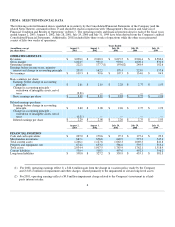

The following table indicates the quarterly stock price ranges for 2003 and 2002:

2003 NMG.A NMG.B

Quarter High Low High Low

First $ 31.70 $ 24.95 $ 28.79 $ 22.70

Second 31.58 28.01 29.05 25.61

Third 32.05 26.05 30.10 23.87

Fourth $ 40.30 $ 31.75 $ 37.60 $ 29.45

2002 NMG.A NMG.B

Quarter High Low High Low

First $ 33.25 $ 23.76 $ 31.75 $ 22.85

Second 34.05 25.95 31.95 24.80

Third 38.95 32.50 36.87 30.80

Fourth $ 39.55 $ 24.88 $ 37.33 $ 22.65

5