Neiman Marcus 2002 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

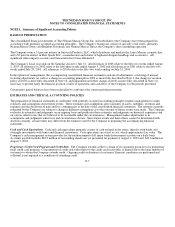

Advertising and Catalogue Costs. The Company's direct response advertising relates primarily to the production, printing and

distribution of catalogues. These costs are amortized during the periods the expected revenues from such catalogues are expected to

be generated, generally three to six months. Deferred direct response advertising amounts included in other current assets in the

consolidated balance sheets were $11.0 million as of August 2, 2003 and $7.1 million as of August 3, 2002. All other advertising

costs, including costs incurred by the Company's online operations related to website design and advertising, are expensed in the

period incurred. Net advertising expenses were $113.7 million in 2003, $110.3 million in 2002 and $113.9 million in 2001.

Consistent with industry practice, the Company receives advertising allowances from certain of its merchandise vendors.

Substantially all the advertising allowances received represent reimbursements of direct, specific and incremental costs incurred by the

Company to promote the vendor's merchandise in connection with the Company's various advertising programs, primarily catalogues

and other print media. As a result, these allowances are recorded as a reduction of the Company's advertising costs included in the

selling, general and administrative expenses when earned. Vendor allowances earned and recorded as a reduction to selling, general

and administrative expenses aggregated approximately $53.2 million in 2003, $49.8 million in 2002 and $55.5 million in 2001.

Beginning in the third quarter of 2003, the Company began to record the portion of advertising allowances received by the Company

not representing the reimbursement of direct, specific and incremental advertising costs as a reduction of the cost of merchandise

purchased in accordance with the provisions of Emerging Issues Task Force Issue (EITF) 02-16, "Accounting by a Customer

(Including a Reseller) for Cash Consideration Received from a Vendor." Under the new rules, these allowances are realized and

recorded by the Company as a reduction of cost of goods sold in the periods in which the goods are sold. These allowances were

previously recorded as a reduction of selling, general and administrative expenses when received.

The Company believes that the impact of the accounting change related to the implementation of the provisions of EITF 02-16 does

not have a material impact on the year-to-year comparison of its operating results for 2003 compared to 2002.

Loyalty Programs. The Company maintains customer loyalty programs in which customers receive points annually for qualifying

purchases. Upon reaching certain levels, customers may redeem their points for gifts. Generally, points earned in a given year must

be redeemed no later than ninety days subsequent to the end of the annual program period. The Company accrues the estimated costs

of the anticipated redemptions of the points earned by its customers at the time of the initial customer purchase and charges such costs

to selling, general and administrative expense. The estimates of the costs associated with the loyalty programs require the Company to

make assumptions related to customer purchasing levels, redemption rates and costs of awards to be chosen by its customers.

F-12