Neiman Marcus 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

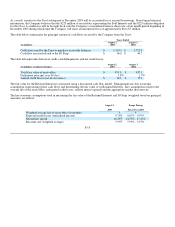

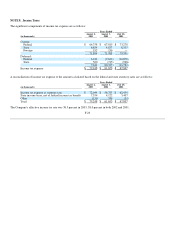

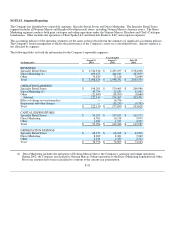

Significant components of the Company's net deferred income tax asset are as follows:

(in thousands)

August 2,

2003

August 3,

2002

Deferred income tax assets:

Accruals and reserves $ 29,096 $ 34,124

Employee benefits 41,079 27,933

Other 1,845 1,372

Total deferred tax assets $ 72,020 $ 63,429

Deferred income tax liabilities:

Inventory $ (6,602) $ (2,627)

Depreciation and amortization (36,803) (40,229)

Other (3,714)(5,078)

Total deferred tax liabilities (47,119)(47,934)

Net deferred income tax asset $ 24,901 $ 15,495

Net deferred income tax asset:

Current $ 17,586 $ 17,746

Non-current 7,315 (2,251)

Total $ 24,901 $ 15,495

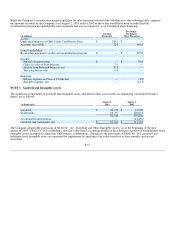

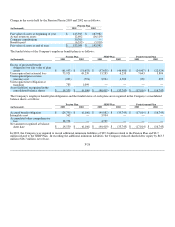

The net deferred tax asset increased by $9.4 million in 2003 due to deferred tax benefits of $16.8 million (related primarily to the

recording of an additional minimum pension liability of $39.3 million) credited to shareholders' equity, offset by a $7.4 million

deferred tax provision charged to earnings. The net deferred tax asset increased by $9.1 million in 2002 due to deferred tax benefits of

$10.3 million credited to earnings and a deferred tax provision of $1.2 million charged to shareholders' equity. The Company believes

it is more likely than not that it will realize the recorded deferred tax assets through future taxable earnings.

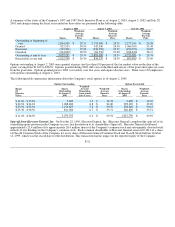

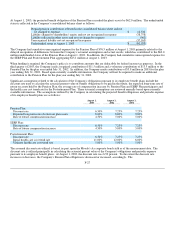

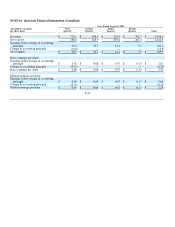

NOTE 9. Employee Benefit Plans

The Company sponsors a defined benefit Pension Plan covering substantially all full-time employees. The Company also sponsors an

unfunded supplemental executive retirement plan (SERP Plan) which provides certain employees additional pension benefits.

Benefits under both plans are based on the employees' years of service and compensation over defined periods of employment. When

funding is required, the Company's policy is to contribute amounts that are deductible for federal income tax purposes. Pension Plan

assets consist primarily of equity and fixed income securities.

The components of pension expense for the Pension Plan are as follows:

Years Ended

(in thousands)

August 2,

2003

August 3,

2002

July 28,

2001

Service cost $ 9,110 $ 8,422 $ 6,740

Interest cost 15,196 13,571 12,037

Expected return on plan assets (14,591) (14,389) (15,718)

Net amortization of losses (gains) and prior service costs 407 283 (289)

Pension Plan expense $ 10,122 $ 7,887 $ 2,770

F-24