Neiman Marcus 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

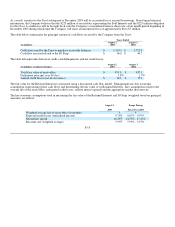

NOTE 6. Common Shareholders' Equity

Authorized Capital. On September 15, 1999, the shareholders of the Company approved a proposal to amend the Company's Restated

Certificate of Incorporation to increase the Company's authorized capital to 250 million shares of common stock consisting of 100

million shares of Class A Common Stock, 100 million shares of Class B Common Stock, 50 million shares of a new Class C Common

Stock (having one-tenth [1/10] of one vote per share) and 50 million shares of preferred stock.

Common Stock. Common stock is entitled to dividends if and when declared by the Board of Directors and each share of Class A and

Class B Common Stock outstanding carries one vote. Holders of Class A Common Stock have the right to elect up to 18 percent of

the Board of Directors and holders of Class B Common Stock have the right to elect at least 82 percent of the Board of Directors. The

Class A Common Stock and Class B Common Stock are identical in all other respects. Holders of common stock have no cumulative

voting, conversion, redemption or preemptive rights.

Shareholder Rights Plan. In October 1999, the Company adopted a shareholder rights plan designed to ensure that its shareholders

receive fair and equal treatment in the event of any proposed takeover of the Company and to guard against partial tender offers and

other abusive takeover tactics to gain control of the Company without paying all shareholders a fair price. The rights plan was not

adopted in response to any specific takeover proposal.

Under the rights plan, one right (Right) is attached to each share of The Neiman Marcus Group, Inc. Class A, Class B and Class C

Common Stock. Each Right will entitle the holder to purchase one one-thousandth of a share of a corresponding series of

participating preferred stock, with a par value of $.01 per share, at an exercise price of $100.00 per one one-thousandth of a share of

such series. The Rights are not currently exercisable and will become exercisable only in the event a person or group acquires

beneficial ownership of 15 percent or more of the shares of Class B Common Stock or 15 percent or more of total number of shares of

Common Stock outstanding. The Rights expire on October 6, 2009 if not earlier redeemed or exchanged.

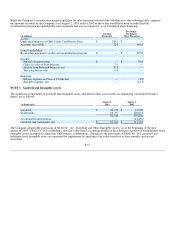

Executive Stock Purchase Loan Plan. Effective July 30, 2002, the Executive Stock Purchase Loan Plan (Loan Plan) was terminated.

Prior to termination, the Company had previously made loans in accordance with the provisions of the Loan Plan to certain executive

officers to acquire shares of common stock in the open market pursuant to stock option exercises or to discharge certain tax liabilities

incurred in connection with the exercise of stock options and the release of restrictions on previous grants of restricted common stock.

The loans are secured by a pledge of the purchased shares and bear interest at an annual rate of 5.0 percent, payable quarterly.

Pursuant to the terms of the Loan Plan, each executive officer's loan will become due and payable seven months after his or her

employment with the Company terminates. Loans outstanding were $0.6 million and $1.2 million as of August 2, 2003 and August 3,

2002, respectively. The Company made no new executive stock purchase loans in 2002 or 2003.

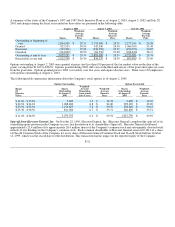

Common Stock Incentive Plans. The Company has established common stock incentive plans allowing for the granting of stock

options, stock appreciation rights and stock-based awards to its employees. Compensation cost for restricted stock is recognized on a

straight-line basis over the expected life of the award with the offsetting entry to additional paid-in capital. For performance

accelerated restricted stock, the expected life is determined based on management's best estimate of the number of years from the

grant date to the date at which it is probable that the performance targets will be met (four or five years, depending on the grant).

Compensation cost is calculated as if all instruments granted that are subject only to a service requirement will vest.

The Company previously adopted the 1997 Incentive Plan (1997 Plan) which is currently used for grants of equity-based awards to

employees. All outstanding equity-based awards at August 2, 2003 were granted under the Company's 1997 Plan and the 1987 Stock

Incentive Plan. At August 2, 2003, there were 2.6 million shares of common stock available for grant under the 1997 Plan.

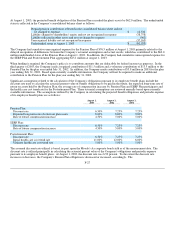

In 2003, the Company made stock-based awards in the form of 1) restricted stock awards for which there was no exercise price

payable by the employee and 2) purchased restricted stock awards for which the exercise price was equal to 50 percent of the fair

value of the Company's common stock on the date of grant. The restricted stock and purchased restricted stock awards aggregated

105,110 shares of restricted common stock at a weighted-average fair value of $21.47 as of the grant date. The Company did not

make any restricted stock grants in 2002 or in 2001. Compensation expense related to restricted stock grants was $2.4 million in

2003, $2.4 million in 2002 and $3.0 million in 2001.

F-20