Neiman Marcus 2002 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

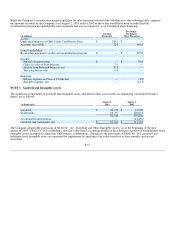

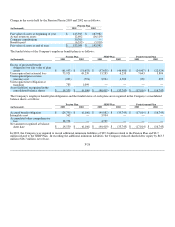

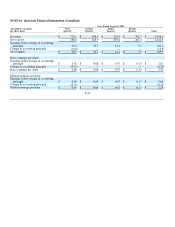

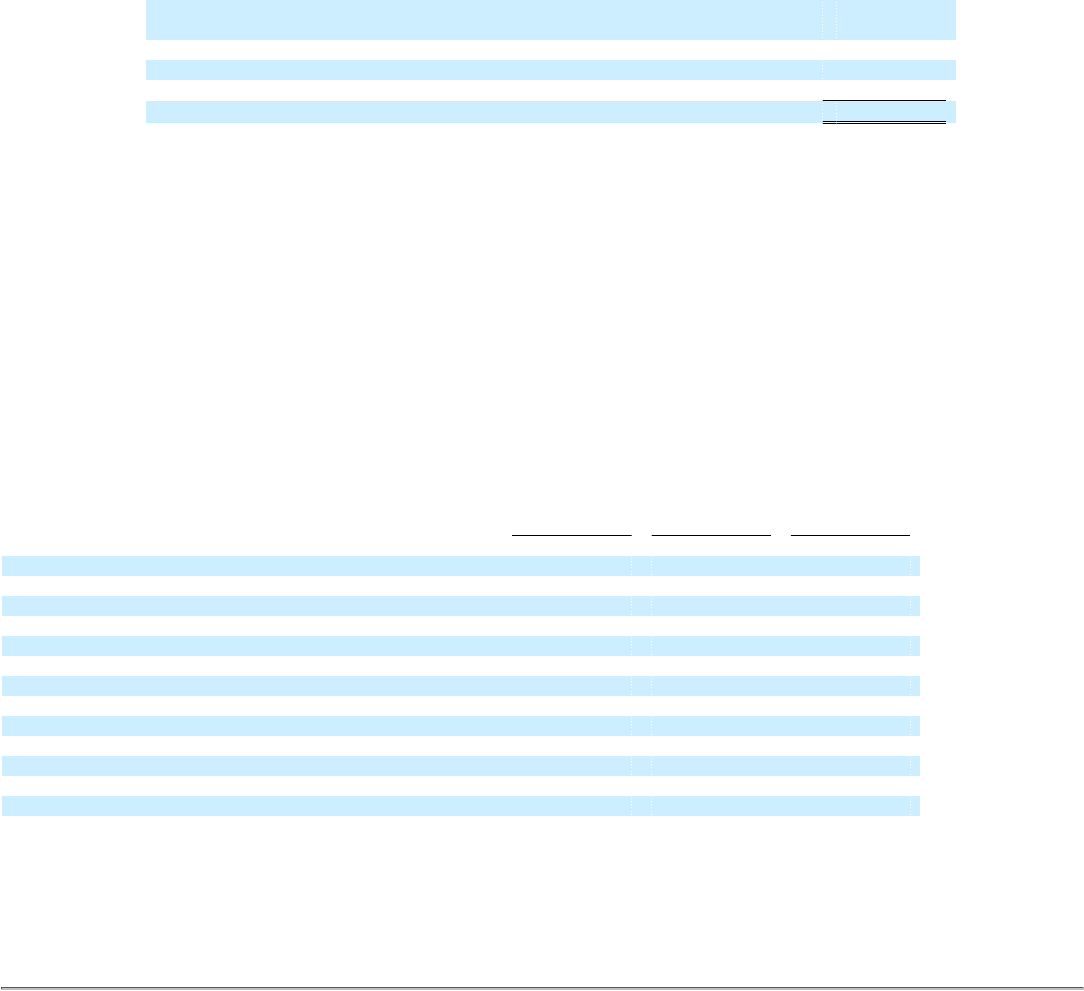

At August 1, 2003, the projected benefit obligation of the Pension Plan exceeded the plan's assets by $62.0 million. The underfunded

status is reflected in the Company's consolidated balance sheet as follows:

Prepaid pension contribution reflected in the consolidated balance sheet and not

yet charged to expense $ 14,530

Liability charged to shareholders' equity and not yet recognized in expense (38,758)

Liability reflected in other assets and not yet charged to expense (562)

Unrecognized liability not yet recognized in expense (37,163)

Underfunded status at August 1, 2003 $ (61,953)

The Company had cumulative unrecognized expense for the Pension Plan of $76.5 million at August 1, 2003 primarily related to the

delayed recognition of differences between the Company's actuarial assumptions and actual results, which has contributed to the $62.0

million underfunded status of the Pension Plan at August 1, 2003. In addition, the Company had cumulative unrecognized expense for

the SERP Plan and Postretirement Plan aggregating $25.1 million at August 1, 2003.

When funding is required, the Company's policy is to contribute amounts that are deductible for federal income tax purposes. In the

third quarter of 2003, the Company made a required contribution of $11.5 million and a voluntary contribution of $13.5 million to the

Pension Plan for the plan year ended July 31, 2002. In addition, the Company made contributions of $5.8 million in 2003 for the plan

year ending July 31, 2003. Based upon currently available information, the Company will not be required to make an additional

contribution to the Pension Plan for the plan year ending July 31, 2003.

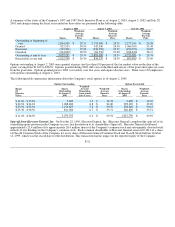

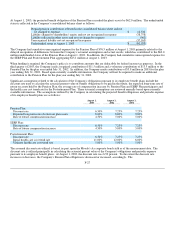

Significant assumptions related to the calculation of the Company's obligations pursuant to its employee benefit plans include the

discount rate used to calculate the actuarial present value of benefit obligations to be paid in the future, the expected long-term rate of

return on assets held by the Pension Plan, the average rate of compensation increase by Pension Plan and SERP Plan participants and

the health care cost trend rate for the Postretirement Plan. These actuarial assumptions are reviewed annually based upon currently

available information. The assumptions utilized by the Company in calculating the projected benefit obligations and periodic expense

of its employee benefit plans are as follows:

August 1,

2003

August 1,

2002

August 1,

2001

Pension Plan:

Discount rate 6.50% 7.25% 7.25%

Expected long-term rate of return on plan assets 8.00% 8.00% 9.00%

Rate of future compensation increase 4.50% 5.00% 5.00%

SERP Plan:

Discount rate 6.50% 7.25% 7.25%

Rate of future compensation increase 4.50% 5.00% 5.00%

Postretirement Plan:

Discount rate 6.50% 7.25% 7.25%

Initial health care cost trend rate 11.00% 12.00% 6.00%

Ultimate health care cost trend rate 5.00% 5.00% 5.00%

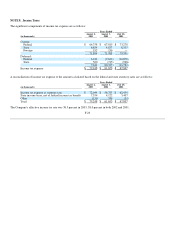

The assumed discount rate utilized is based, in part, upon the Moody's Aa corporate bond yield as of the measurement date. The

discount rate is utilized principally in calculating the actuarial present value of the Company's obligations and periodic expense

pursuant to its employee benefit plans. At August 1, 2003, the discount rate was 6.50 percent. To the extent the discount rate

increases or decreases, the Company's Pension Plan obligation is decreased or increased, accordingly. The

F-27