Neiman Marcus 2002 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

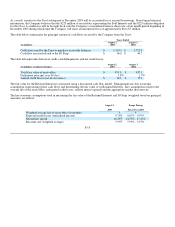

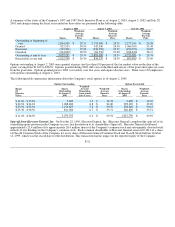

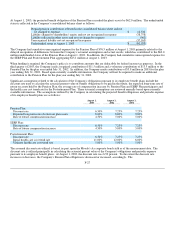

In connection with the adoption of the provisions of SFAS No. 142, the Company engaged third party appraisal experts to assist with

the determination of the fair value of its goodwill and intangible assets. Fair value was determined using a discounted cash flow

methodology. For each of the Company's operating segments, a summary of the intangible assets recorded by the Company as of the

beginning of the first quarter of 2003 in accordance with the cost-based accounting model established by previous accounting

principles and the adjustments required during 2003 in accordance with the fair value model of SFAS No. 142 are as follows:

(in thousands)

Carrying

Value at

August 4,

2002

SFAS No. 142 Adjustments

Adjusted

Carrying

Value

At

Adoption

During

2003

Direct Marketing

Goodwill $ 23,747 $ — $ — $ 23,747

Indefinite-lived tradenames 60,732 (24,066)(814)35,852

Other

Indefinite-lived tradenames 32,945 — — 32,945

$ 117,424 $ (24,066)$ (814)$ 92,544

The $24.1 million writedown in the carrying value of the indefinite-lived intangible assets of the Company's Direct Marketing

segment required upon adoption of SFAS No. 142 is reflected as a change in accounting principle ($14.8 million, net of taxes) in the

accompanying consolidated statements of earnings. The additional writedown of $0.8 million was required in 2003 based upon

current estimates of future cash flows and is included in selling, general and administrative expenses.

The Company ceased amortization of its goodwill and indefinite-lived intangible assets as of the beginning of 2003. Amortization

expense was approximately $5.3 million for 2002 and reduced diluted earnings per share by $0.07 for the period. Amortization

expense was approximately $5.9 million for 2001 and reduced diluted earnings per share by $0.08 for the period.

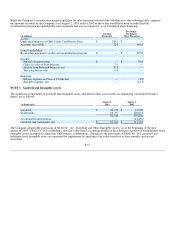

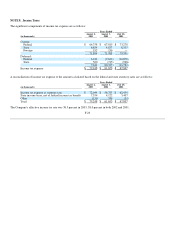

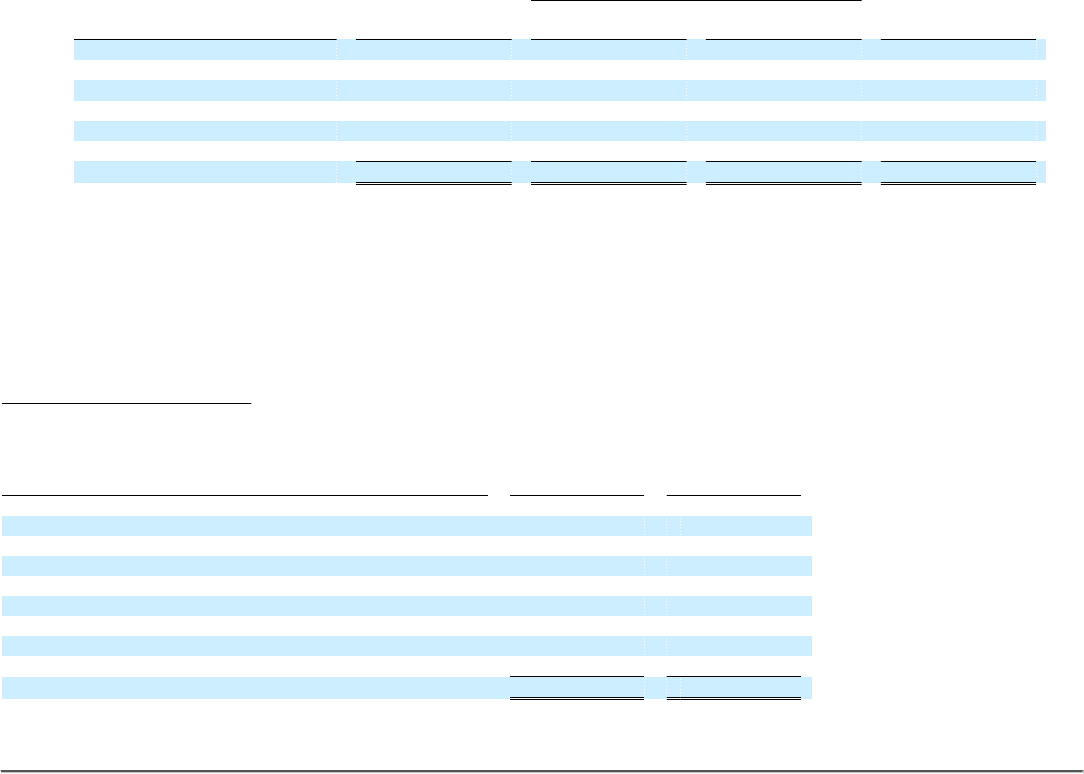

NOTE 4. Accrued Liabilities

The significant components of accrued liabilities are as follows:

(in thousands)

August 2,

2003

August 3,

2002

Accrued salaries and related liabilities $ 43,704 $ 33,993

Self-insurance reserves 34,897 31,991

Amounts due customers 36,770 40,882

Income taxes payable 28,994 31,489

Sales returns 26,674 24,162

Sales tax 21,341 25,127

Loyalty program liability 11,514 7,066

Other 62,365 65,090

Total $ 266,259 $ 259,800

F-18