Neiman Marcus 2002 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

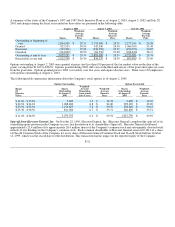

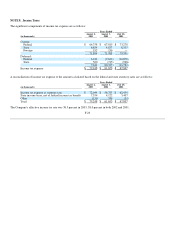

Income Taxes. The Company is routinely under audit by federal, state or local authorities in the areas of income taxes. These audits

include questioning the timing and amount of deductions and the allocation of income among various tax jurisdictions. In evaluating

the exposure associated with various tax filing positions, the Company accrues charges for probable exposures. Based on its annual

evaluations of tax positions, the Company believes it has appropriately accrued for probable exposures. To the extent the Company

were to prevail in matters for which accruals have been established or be required to pay amounts in excess of recorded reserves, the

Company's effective tax rate in a given financial statement period could be materially impacted.

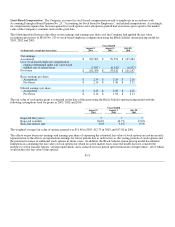

Basic and Diluted Net Income Per Share. Basic net income per share is computed by dividing net income by the weighted average

number of shares of common stock outstanding. The dilutive effect of stock options and other common stock equivalents, including

contingently returnable shares, is included in the calculation of diluted earnings per share using the treasury stock method.

NOTE 2. Securitization of Credit Card Receivables

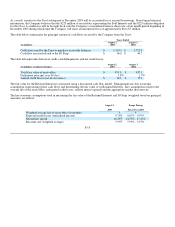

Pursuant to a revolving credit card securitization program, the Company transfers substantially all of its credit card receivables to a

wholly-owned subsidiary, Neiman Marcus Funding Corporation, which in turn sells such receivables to the Trust. The Trust has

issued certificates representing undivided interests in the credit card receivables to both third-party investors (Sold Interests) and to the

Company (Retained Interests).

The Company continues to service the credit card receivables and receives a contractually defined servicing fee. Total credit card

receivables held by the Trust and serviced by the Company aggregated $471.0 million as of August 2, 2003. Servicing fees earned by

the Company were $6.3 million in each of 2003 and 2002.

The Sold Interests are represented by Class A Certificates, aggregating $225 million at face value. The holders of the Class A

Certificates are entitled to monthly interest distributions at the contractually-defined rate of one month LIBOR plus 0.27 percent

annually. The distributions to the Class A Certificate holders are payable from the finance charge income generated by the credit card

receivables held by the Trust.

The Retained Interests held by the Company are represented by the Class B Certificate ($23.8 million face value), the Class C

Certificate ($68.2 million face value) and the Seller's Certificate (representing the excess of the total receivables sold to the Trust over

the Sold Interests and the Class B and Class C Certificates). Pursuant to the terms of the Trust, the Company's rights to payments

with respect to the Class B Certificate, the Class C Certificate, the Seller's Certificate and the IO Strip are subordinated to the rights of

the holders of the Class A Certificates. As a result, the credit quality of the Class A Certificates is enhanced, thereby lowering the

interest cost paid by the Trust on the Class A Certificates. The Company's credit risk associated with the Trust is limited to the

carrying value of the Retained Assets.

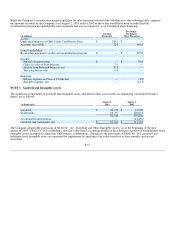

In order to maintain the committed level of securitized assets, cash collections on the securitized receivables are used by the Trust to

purchase new credit card balances from the Company in accordance with the terms of the revolving credit card securitization

program. Beginning in April 2005, cash collections will be used by the Trust to repay the principal balance of the Class A Certificates

in six monthly installments of $37.5 million (Amortization Period). As a result of certain provisions in the securitization agreement,

the Company holds certain rights to repurchase the Class A Certificates (Repurchase Option) subsequent to the commencement of the

Amortization Period and, therefore, has the ability to regain effective control over the credit card receivables held by the Trust at the

time the Repurchase Option becomes exercisable. The Company currently believes that the Repurchase Option will become

exercisable in September 2005 and that the revolving transfers of credit card receivables to the Trust will cease to qualify for off-

balance sheet sales type treatment beginning in December 2003, the date when the contractual life of the transferred receivables is

estimated to extend to September 2005.

F-14