Neiman Marcus 2002 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Credit losses expected from the portfolio are based on historical write-off rates, adjusted for recent write-off trends and

management's outlook of future trends. To the extent there are positive or negative factors affecting the credit card customers'

ability or intent to pay off the outstanding balance (e.g., level of discretionary income, level of consumer debt, bankruptcy

legislation), the actual bad debts to be realized could exceed or be less than the amounts estimated. Credit losses in excess of

those estimated reduce the income earned by the Company. Conversely, credit losses less than those estimated increase the

income earned by the Company.

• The assumed cash flow discount rates are based on prevailing market interest rates and management's estimate of an appropriate

risk premium for each respective Retained Interest. The actual discount rates used are subject to interest rate fluctuations.

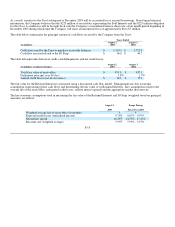

The most sensitive assumptions in calculating the fair values are the credit card customers' payment rate, the estimate for credit losses,

relative interest spreads and the assumed cash flow discount rates. Assumptions related to the future performance of the Company's

credit card portfolio have a significant impact on the calculation of the gain or loss on the sale of the Sold Interests, the carrying values

of the Retained Interests and the recognition of income on the Retained Interests.

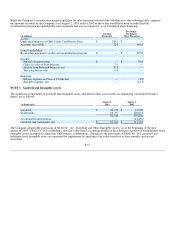

Accounts Receivable. Accounts receivable primarily consist of the Company's third-party credit card receivables and the net trade

receivables of Gurwitch Products, LLC and Kate Spade LLC.

Merchandise Inventories and Cost Of Goods Sold. The Company utilizes the retail method of accounting for substantially all of its

merchandise inventories. Merchandise inventories are stated at the lower of cost or market. The retail inventory method is widely

used in the retail industry due to its practicality.

Under the retail inventory method, the valuation of inventories at cost and the resulting gross margins are determined by applying a

calculated cost-to-retail ratio, for various groupings of similar items, to the retail value of inventories. The cost of the inventory

reflected on the consolidated balance sheet is decreased by charges to cost of sales at the time the retail value of the inventory is

lowered through the use of markdowns. Hence, earnings are negatively impacted when merchandise is marked down.

The Company's sales activities are conducted during two primary selling seasons — Fall and Spring. The Fall selling season is

conducted primarily in the Company's first and second quarters and the Spring selling season is conducted primarily in the third and

fourth quarters. During each season, the Company records markdowns to reduce the retail value of its inventories. Factors considered

in determining markdowns include current and anticipated demand, customer preferences, age of merchandise and fashion trends.

During the season, the Company records both temporary and permanent markdowns. Temporary markdowns are recorded at the time

of sale and reduce the retail value of only the goods sold. Permanent markdowns are designated for clearance activity and reduce the

retail value of all goods subject to markdown that are held by the Company. At the end of each selling season, the Company records

permanent markdowns for clearance goods remaining in ending inventory.

The areas requiring significant management judgment related to the valuation of the Company's inventories include 1) setting the

original retail value for the merchandise held for sale, 2) recognizing merchandise for which the customer's perception of value has

declined and appropriately marking the retail value of the merchandise down to the perceived value and 3) estimating the shrinkage

that has occurred between physical inventory counts. These judgments and estimates, coupled with the averaging processes within the

retail method can, under certain circumstances, produce varying financial results. Factors that can lead to different financial results

include 1) setting original retail values for merchandise held for sale incorrectly, 2) failure to identify a decline in perceived value of

inventories and process the appropriate retail value markdowns and 3) overly optimistic or conservative shrinkage estimates. The

Company believes it has the appropriate merchandise valuation and pricing controls in place to minimize the risk that its inventory

values would be materially misstated.

F-9