Neiman Marcus 2002 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

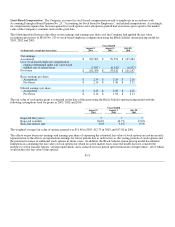

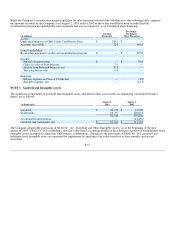

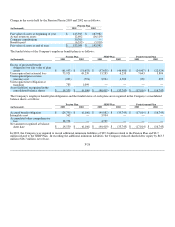

While the Company's securitization program qualifies for sales treatment related to the Sold Interests, the following table compares

the amounts recorded by the Company as of August 2, 2003 and for 2003 to those that would have been recorded had the

securitization program not qualified for sales treatment and was accounted for as an on-balance sheet financing:

(in millions)

Amounts

Recorded

Pro forma -

On-Balance

Sheet Financing

Assets:

Undivided interests in NMG Credit Card Master Trust $ 243.1 $ —

Accounts receivable 22.6 484.0

Long-term liability:

Borrowings pursuant to credit card securitization program $ — $ 225.0

Income:

Finance charge income $ — $ 70.6

Gains on sales of Sold Interests 7.1 —

Income from Retained Interests, net 39.9 —

Servicing fee income 6.3 —

Expenses:

Interest expense on Class A Certificates — (3.9)

Bad debt expense, net — (14.3)

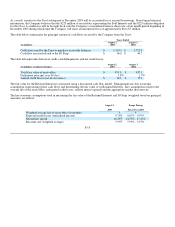

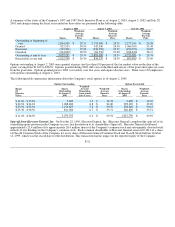

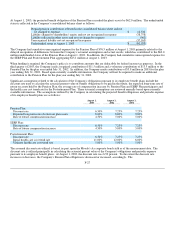

NOTE 3. Goodwill and Intangible Assets

The significant components of goodwill and intangible assets, included in other assets in the accompanying consolidated balance

sheets, are as follows:

(in thousands)

August 2,

2003

August 3,

2002

Goodwill $ 23,747 $ 33,202

Trademarks 68,797 126,654

92,544 159,856

Accumulated amortization — (42,432)

Goodwill and trademarks, net $ 92,544 $ 117,424

The Company adopted the provisions of SFAS No. 142, "Goodwill and Other Intangible Assets" as of the beginning of the first

quarter of 2003. SFAS No. 142 established a new fair value-based accounting model for the valuation of goodwill and indefinite-lived

intangible assets recorded in connection with business combinations. Pursuant to the provisions of SFAS No. 142, goodwill and

indefinite-lived intangible assets are measured for impairment by applying a fair value-based test at least annually and are not

amortized.

F-17