Neiman Marcus 2002 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

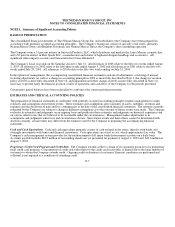

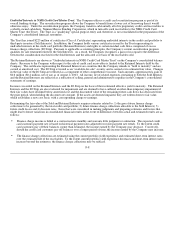

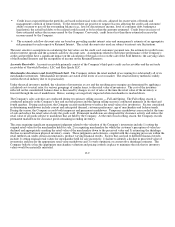

Stock-Based Compensation. The Company accounts for stock-based compensation awards to employees in accordance with

Accounting Principles Board Opinion No. 25, "Accounting for Stock Issued to Employees," and related interpretations. Accordingly,

no compensation expense has been recognized for stock options since all options granted had an exercise price equal to the market

value of the Company's common stock on the grant date.

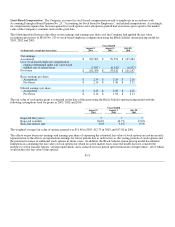

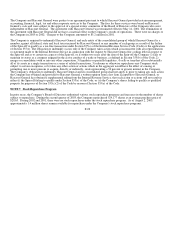

The following table illustrates the effect on net earnings and earnings per share as if the Company had applied the fair value

recognition provisions of SFAS No. 123 to stock-based employee compensation using the Black-Scholes option-pricing model for

2003, 2002 and 2001:

Years Ended

(in thousands, except per share data)

August 2,

2003

August 3,

2002

July 28,

2001

Net earnings:

As reported $ 109,303 $ 99,574 $ 107,484

Less: stock-based employee compensation

expense determined under fair value based

method, net of related taxes (7,847)(6,542)(6,337)

Pro forma $ 101,456 $ 93,032 $ 101,147

Basic earnings per share:

As reported $ 2.30 $ 2.10 $ 2.28

Pro forma $ 2.14 $ 1.96 $ 2.15

Diluted earnings per share:

As reported $ 2.29 $ 2.08 $ 2.26

Pro forma $ 2.12 $ 1.94 $ 2.13

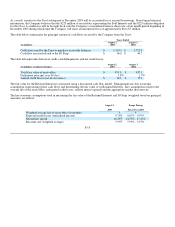

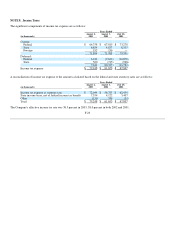

The fair value of each option grant is estimated on the date of the grant using the Black-Scholes option pricing model with the

following assumptions used for grants in 2003, 2002 and 2001:

Years Ended

August 2,

2003

August 3,

2002

July 28,

2001

Expected life (years) 5 7 7

Expected volatility 36.6% 40.7% 37.6%

Risk-free interest rate 3.0% 5.4% 5.5%

The weighted-average fair value of options granted was $11.40 in 2003, $12.73 in 2002 and $17.80 in 2001.

The effects on pro forma net earnings and earnings per share of expensing the estimated fair value of stock options are not necessarily

representative of the effects on reported net earnings for future periods due to such factors as the vesting periods of stock options and

the potential issuance of additional stock options in future years. In addition, the Black-Scholes option-pricing model has inherent

limitations in calculating the fair value of stock options for which no active market exists since the model does not consider the

inability to sell or transfer options, vesting requirements and a reduced exercise period upon termination of employment - all of which

would reduce the fair value of the options.

F-13