Neiman Marcus 2002 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

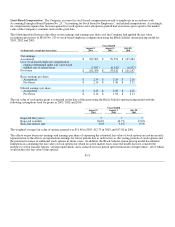

Undivided Interests in NMG Credit Card Master Trust. The Company utilizes a credit card securitization program as part of its

overall funding strategy. The securitization program allows the Company to benefit from a lower cost of borrowing than it would

otherwise enjoy. Under the securitization program, the Company transfers substantially all of its proprietary credit card receivables to

a wholly-owned subsidiary, Neiman Marcus Funding Corporation, which in turn sells such receivables to the NMG Credit Card

Master Trust (the Trust). The Trust is a "qualifying" special purpose entity and, therefore, is not consolidated in the preparation of the

Company's consolidated financial statements.

The Trust has issued $225 million of certificates (Class A Certificates) representing undivided interests in the credit card portfolio to

third-party investors (Sold Interests). In addition, the Company holds various certificates issued by the Trust representing its

undivided interests in the credit card portfolio (Retained Interests) and rights to certain residual cash flows comprised of excess

finance charge collections (IO Strip). Pursuant to applicable accounting principles, the Company's current securitization program

qualifies for sale treatment related to the Sold Interests. As a result, the Company recognizes a gain or loss equal to the difference

between the consideration received for the Sold Interests and the allocated cost basis of the receivables sold.

The Retained Interests are shown as "Undivided interests in NMG Credit Card Master Trust" on the Company's consolidated balance

sheets. Recourse to the Company with respect to the sale of credit card receivables is limited to the Retained Interests held by the

Company. The certificates representing the Retained Interests are securities that the Company intends to "hold to maturity" and are

carried at amortized cost. The IO Strip is treated as an "available-for-sale" security and is carried at its estimated fair value. Changes

in the fair value of the IO Strip are reflected as a component of other comprehensive income. Such amounts, approximated a gain of

$0.6 million ($0.4 million, net of tax) as of August 2, 2003. All income, net of related expenses, pertaining to both the Sold Interests

and the Retained Interests are reflected as a reduction of selling, general and administrative expenses in the Company's consolidated

statements of earnings.

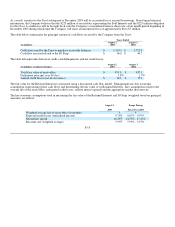

Income is recorded on the Retained Interests and the IO Strip on the basis of their estimated effective yield to maturity. The Retained

Interests and the IO Strip are also evaluated for impairment and are deemed to have suffered an other-than-temporary impairment if

their fair values have declined below amortized cost and the discounted value of the remaining future cash flows has decreased from

the prior period, when holding the discount rate constant. If the assets are deemed impaired, they are written down to fair value,

which establishes a new cost basis, with a corresponding charge to earnings.

Determining the fair value of the Sold and Retained Interests requires estimates related to: 1) the gross future finance charge

collections to be generated by the total credit card portfolio; 2) future finance charge collections allocable to the Sold Interests; 3)

future credit losses and 4) discount rates. Items that were considered in making judgments and preparing estimates and factors that

might lead to future variations in consolidated financial results in the event of differences between actual and estimated results are as

follows:

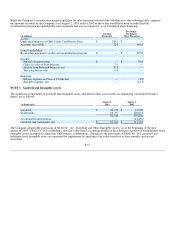

• Finance charge income is billed at a contractual rate monthly and warrants little judgment or estimation. The expected credit

card customer payment rate is based on historical payment rates adjusted for recent payment rate trends. To the extent credit

card customers pay off their balances sooner than estimated, the income earned by the Company may decrease. Conversely,

should the credit card customers pay off balances over a longer period of time, the income earned by the Company may increase.

• The finance charge collections are estimated using the current portfolio yield experience and estimated short-term interest rates

over the estimated life of the receivables. To the extent current portfolio yield experience decreases and short-term interest rates

increase beyond the estimates, the finance charge collections may be reduced.

F-8