Neiman Marcus 2002 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

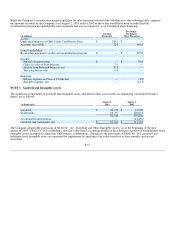

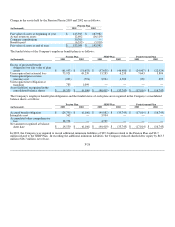

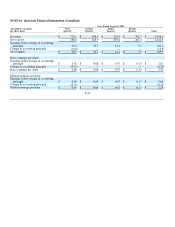

Change in the assets held by the Pension Plan in 2003 and 2002 are as follows:

Pension Plan

(in thousands) 2003 2002

Fair value of assets at beginning of year $ 145,945 $ 167,982

Actual return on assets 12,692 (16,119)

Company contributions 30,760 —

Benefits paid (6,353)(5,918)

Fair value of assets at end of year $ 183,044 $ 145,945

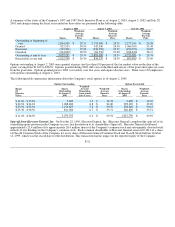

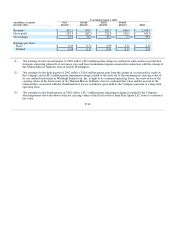

The funded status of the Company's employee benefit plans is as follows:

Pension Plan SERP Plan Postretirement Plan

(in thousands) 2003 2002 2003 2002 2003 2002

Excess of projected benefit

obligation over fair value of plan

assets $ (61,953) $ (51,653) $ (57,638) $ (46,480) $ (24,907) $ (22,924)

Unrecognized net actuarial loss 75,921 45,239 13,285 6,233 7,643 5,884

Unrecognized prior service

(income) cost (223) (791) 3,934 4,502 250 295

Unrecognized net obligation at

transition 785 1,099 — — — —

Asset (liability) recognized in the

consolidated balance sheets $ 14,530 $ (6,106)$ (40,419)$ (35,745)$ (17,014)$ (16,745)

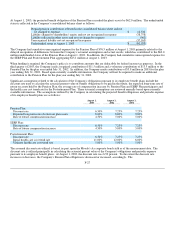

The Company's employee benefit plan obligations and the funded status of such plans are recognized in the Company's consolidated

balance sheets as follows:

Pension Plan SERP Plan Postretirement Plan

(in thousands) 2003 2002 2003 2002 2003 2002

Accrued benefit obligation $ (24,790) $ (6,106) $ (49,082) $ (35,745) $ (17,014) $ (16,745)

Intangible asset 562 — 3,934 — — —

Accumulated other comprehensive

loss 38,758 — 4,729 — — —

Net amount recognized at balance

sheet date $ 14,530 $ (6,106)$ (40,419)$ (35,745)$ (17,014)$ (16,745)

In 2003, the Company was required to record additional minimum liabilities of $39.3 million related to the Pension Plan and $8.7

million related to the SERP Plan. In recording the additional minimum liabilities, the Company reduced shareholders' equity by $43.5

million ($26.7 million, net of tax).

F-26