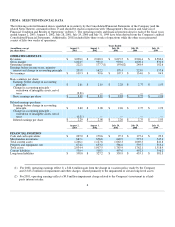

Neiman Marcus 2002 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

represent reductions to the amounts paid by the Company to acquire the merchandise. These allowances reduce the cost of the

acquired merchandise and are recognized as an increase to gross margin at the time the goods are sold. The amounts of vendor

reimbursements received by the Company did not have a significant impact on the year-over-year change in gross margin in 2003.

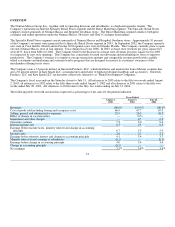

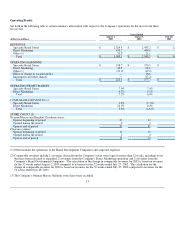

Selling, general and administrative expenses. Selling, general and administrative expenses (SG&A) were 25.9 percent of revenues in

2003 compared to 26.3 percent of revenues in the prior year period.

SG&A decreased as a percentage of revenues in 2003 primarily due to 1) lower catalogue production and circulation costs for the

Direct Marketing segment due to a planned reduction in catalogue circulation in the first and second quarters of 2003, partially offset

by planned increases in catalogue production and circulation costs during the third and fourth quarters of 2003, 2) the elimination of

amortization of the Company's intangible assets upon implementation of a new accounting principle in the first quarter of 2003 and 3)

lower costs related to incentive compensation.

The decreases in SG&A were offset, in part, by 1) higher retirement and other benefits expenses, 2) increased advertising costs for the

Specialty Retail Stores segment due to increased costs related to the Company's customer loyalty programs as well as a decrease in

vendor advertising allowances recorded as a reduction to advertising expenses as a result of the adoption of new accounting rules

effective beginning in the third quarter of 2003 and 3) increased preopening costs incurred in connection with the opening of two

Neiman Marcus stores in the first quarter of 2003, the opening of a new clearance store in the second quarter of 2003, the completion

of the remodel of the Las Vegas Neiman Marcus store in the second quarter of 2003 and the opening of a new clearance center in the

fourth quarter of 2003.

Segment operating earnings. Operating earnings for the Specialty Retail Stores segment were $198.2 million for 2003 compared to

$170.5 million for the prior year period. This increase was primarily the result of increased sales, reduced markdowns in the first and

second quarter of 2003 compared to the prior year offset, in part, by increased markdowns in the third and fourth quarters of 2003 and

increased SG&A expenses (primarily benefits, advertising and preopening expenses) as percentages of revenues.

Operating earnings for Direct Marketing increased to $45.8 million for 2003 from $22.8 million for the prior year period, primarily as

a result of increased sales and reduced online marketing costs and lower catalogue production and circulation costs, as percentages of

revenues, in the first and second quarters of 2003, due to the planned reduction in catalogue circulation, partially offset by increased

online marketing costs and planned increases in catalogue production and circulation costs as a percentage of revenues during the third

and fourth quarters of 2003.

Interest expense, net. Net interest expense was $16.3 million for 2003 and $15.4 million for the prior year period. Net interest

expense increased primarily due to a decrease in capitalized interest charges associated with store construction and reduced investment

interest income offset, in part, by reduced interest costs associated with lower borrowings on the Company's revolving credit facility.

Seasonal borrowings under the Company's revolving credit facility reached $80 million in the second quarter of 2003 compared to

$130 million in the prior year.

Income taxes. The Company's effective income tax rate was 38.5 percent in 2003 and 38.0 percent in the prior year period. The

Company expects its effective tax rate to increase to 39.0 percent in 2004 primarily due to higher state income taxes.

Change in accounting principle – writedown of intangible assets, net of taxes. The Company adopted the provisions of Statement of

Financial Accounting Standards (SFAS) No. 142, "Goodwill and Other Intangible Assets" as of the beginning of the first quarter of

2003. SFAS No. 142 established a new fair value-based accounting model for the valuation of goodwill and indefinite-lived

intangible assets recorded in connection with business combinations. Pursuant to the provisions of SFAS No. 142, goodwill and

indefinite-lived intangible assets are measured for impairment by applying a fair value-based test at least annually and are not

amortized. Based upon its review procedures and the valuation results of an independent third party appraisal firm, the Company

recorded a $24.1 million writedown in the carrying value of the indefinite-lived intangible assets of its Direct Marketing segment. The

writedown ($14.8 million, net of taxes) is reflected as a change in accounting principle in the accompanying consolidated statements

of earnings.

15