Neiman Marcus 2002 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

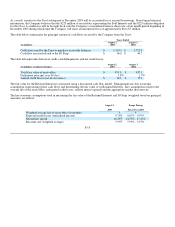

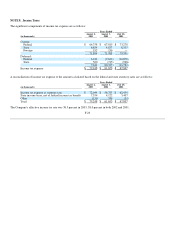

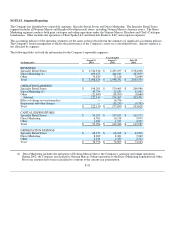

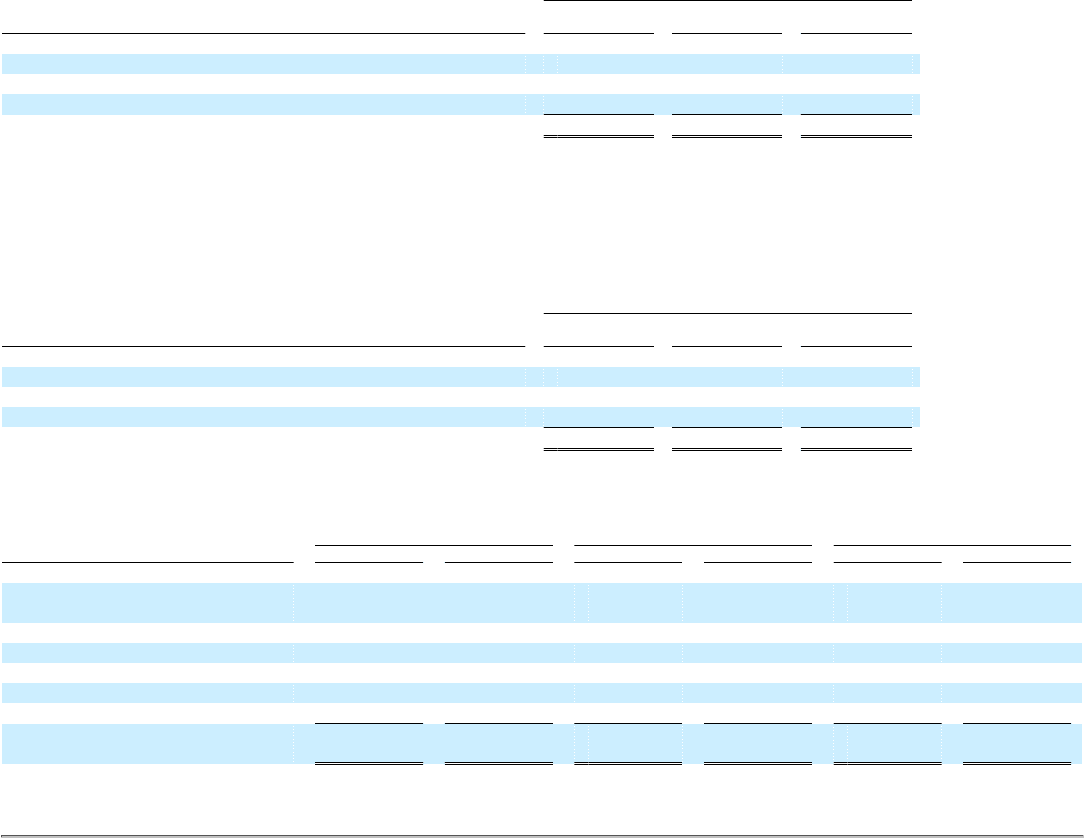

The components of the SERP Plan expense are as follows:

Years Ended

(in thousands)

August 2,

2003

August 3,

2002

July 28,

2001

Service cost $ 1,159 $ 961 $ 838

Interest cost 3,700 3,199 2,942

Net amortization of losses and prior service costs 1,181 200 695

SERP Plan expense $ 6,040 $ 4,360 $ 4,475

Retirees and active employees hired prior to March 1, 1989 are eligible for certain limited postretirement health care benefits

(Postretirement Plan) if they have met certain service and minimum age requirements. The cost of these benefits is accrued during the

years in which an employee provides services. The Company paid postretirement health care benefit claims of $2.3 million during

2003, $1.7 million during 2002 and $1.8 million during 2001.

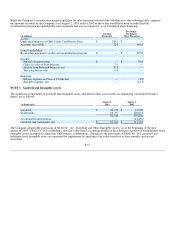

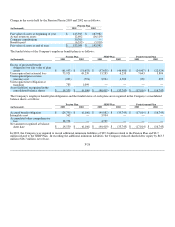

The components of Postretirement Plan expense are as follows:

Years Ended

(in thousands)

August 2,

2003

August 3,

2002

July 28,

2001

Service cost $ 92 $ 86 $ 65

Interest cost 1,614 1,214 723

Net amortization and deferral 322 — (447)

Postretirement expense $ 2,028 $ 1,300 $ 341

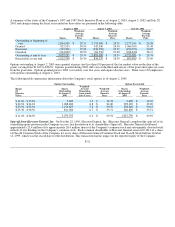

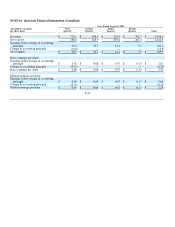

The changes in the benefit obligations and the reconciliations of the funded status of the Company's Pension Plan, SERP Plan and

Postretirement Plan to the consolidated balance sheets are as follows:

Pension Plan SERP Plan Postretirement Plan

(in thousands) 2003 2002 2003 2002 2003 2002

Projected benefit obligations at

beginning of year $ 197,599 $ 178,061 $ 46,480 $ 43,564 $ 22,924 $ 17,392

Service cost 9,110 8,422 1,159 961 92 86

Interest cost 15,196 13,571 3,700 3,199 1,614 1,214

Plan amendments — — — — — 295

Actuarial loss (gain) 29,446 3,462 7,665 (205) 2,035 5,041

Benefits paid, net (6,354)(5,917)(1,366)(1,039)(1,758)(1,104)

Projected benefit obligations at end

of year $ 244,997 $ 197,599 $ 57,638 $ 46,480 $ 24,907 $ 22,924

F-25