Neiman Marcus 2002 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As a result, transfers to the Trust subsequent to December 2003 will be accounted for as secured borrowings. Based upon historical

information, the Company believes that the $225 million of receivables representing the Sold Interests and the $225 million obligation

for the Class A certificates will be brought back onto the Company's consolidated balance sheet over a four month period beginning in

December 2003 during which time the Company will incur an incremental loss of approximately $6 to $7 million.

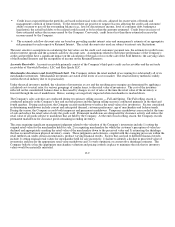

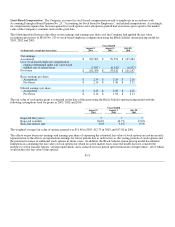

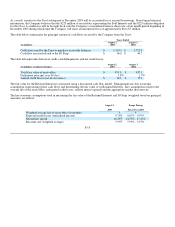

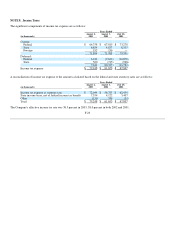

The table below summarizes the principal amount of cash flows received by the Company from the Trust:

Years Ended

(in millions)

August 2,

2003

August 3,

2002

Collections used by the Trust to purchase receivable balances $ 1,719.9 $ 1,721.0

Cash flow received related to the IO Strip $ 46.0 $ 44.7

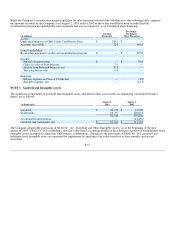

The table belowprovides historical credit card delinquencies and net credit losses:

(in millions, except percentages)

August 2,

2003

August 3,

2002

Total face value of receivables $ 471.0 $ 437.1

Delinquent principal over 90 days 1.8%1.5%

Annual credit losses (net of recoveries) $ 14.3 $ 15.9

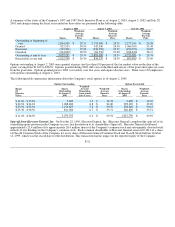

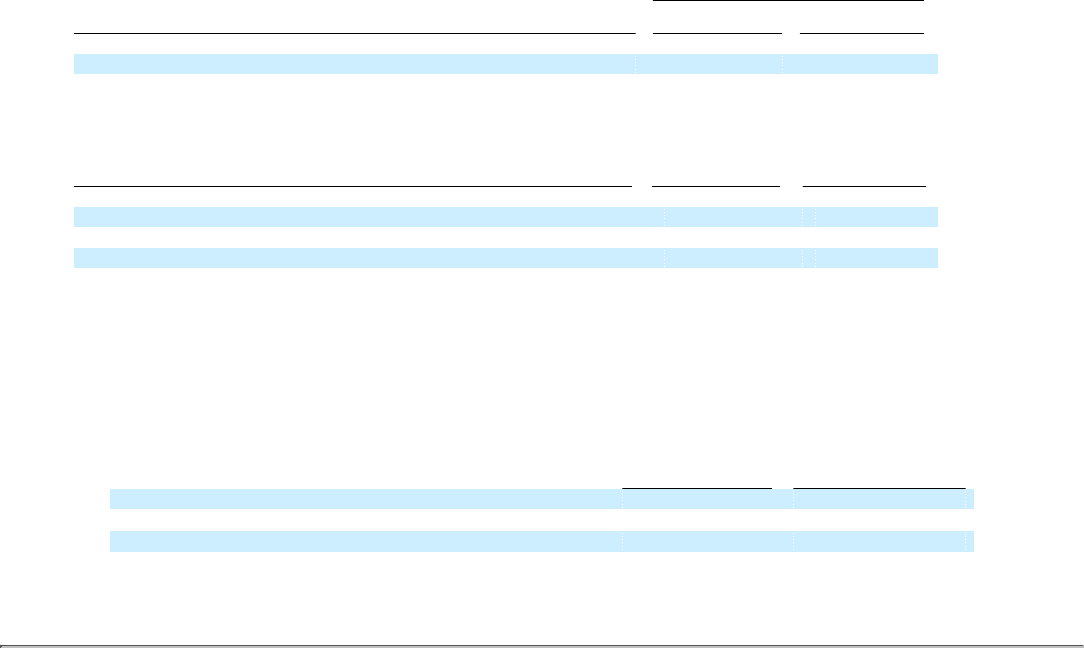

The fair value for the Retained Interests is estimated using a discounted cash flow model. Management uses key economic

assumptions in projecting future cash flows and determining the fair value of its Retained Interests. Key assumptions relate to the

average life of the receivables, anticipated credit losses, relative interest spreads and the appropriate market discount rate.

The key economic assumptions used in measuring the fair value of the Retained Interests and IO Strip (weighted based on principal

amounts) are follows:

August 2,

2003

Range During

Fiscal Year 2003

Weighted average life of receivables (in months) 4 4

Expected credit losses (annualized percent) 0.79%0.67% - 0.79%

Net interest spread 16.36%14.73% - 17.45%

Discount rate (weighted average) 5.95%5.95% - 5.97%

F-15