Neiman Marcus 2002 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175

|

|

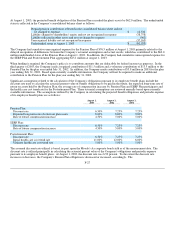

Letters of Credit. The Company had approximately $8.5 million of outstanding irrevocable letters of credit relating to purchase

commitments and insurance and other liabilities at August 2, 2003.

The Company had approximately $2.7 million in surety bonds at August 2, 2003 relating primarily to merchandise imports, state sales

tax and utility requirements.

Other. The Company's other principal commercial commitments are comprised of Pension Plan funding obligations, short-term

merchandise purchase commitments, short-term construction commitments, common area maintenance costs, tax and insurance

obligations and contingent rent payments. Substantially all of the Company's merchandise purchase commitments are cancelable up

to 30 days prior to the vendor's scheduled shipment date.

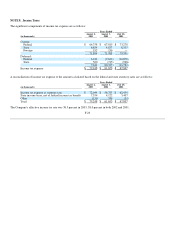

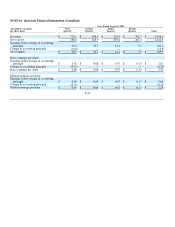

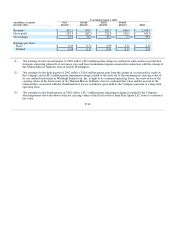

NOTE 13. Earnings Per Share

The weighted average shares used in computing basic and diluted earnings per share (EPS) are presented in the table below. No

adjustments were made to net earnings for the computations of basic and diluted EPS during the periods presented.

Years Ended

(in thousands of shares)

August 2,

2003

August 3,

2002

July 28,

2001

Weighted average shares outstanding 47,750 47,726 47,479

Less: shares of non-vested restricted stock (288)(282)(359)

Shares for computation of basic EPS 47,462 47,444 47,120

Effect of dilutive stock options and restricted stock 333 391 466

Shares for computation of diluted EPS 47,795 47,835 47,586

Shares represented by antidilutive stock options 1,469 1,223 954

Antidilutive stock options were not included in the computation of diluted EPS because the exercise price of those options was greater

than the average market price of the common shares.

F-30