Neiman Marcus 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175

|

|

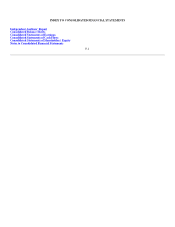

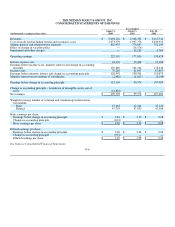

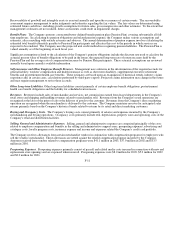

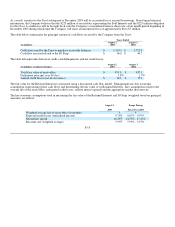

THE NEIMAN MARCUS GROUP, INC.

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY

Common

Stocks Additional

Paid-In

Capital

Accumulated

Other

Comprehensive

Income (Loss)

Retained

Earnings

Treasury

Stock

Total

Shareholders'

Equity

(in thousands)

Class

A

Class

B

BALANCE AT JULY 29, 2000 $ 275 $ 200 $ 422,186 $ — $ 403,081 $ — $ 825,742

Issuance of 299 shares under stock option plan 3 — 6,122 — — — 6,125

Other equity transactions — — 4,418 — — — 4,418

Comprehensive income:

Net earnings — — — — 107,484 — 107,484

Unrealized loss on financial instruments, net of

tax — — — (1,029) — — (1,029)

Total comprehensive income 106,455

BALANCE AT JULY 28, 2001 278 200 432,726 (1,029) 510,565 — 942,740

Issuance of 339 shares under stock option plan 3 — 7,529 — — — 7,532

Other equity transactions (1) — 3,533 — — — 3,532

Comprehensive income:

Net earnings — — — — 99,574 — 99,574

Unrealized gain on financial instruments, net of

tax — — — 1,945 — — 1,945

Other, net of tax — — — (10) — — (10)

Total comprehensive income 101,509

BALANCE AT AUGUST 3, 2002 280 200 443,788 906 610,139 — 1,055,313

Issuance of 392 shares under stock option plan 4 — 10,676 — — — 10,680

Acquisition of treasury stock (15,020) (15,020)

Other equity transactions (2) (3) 4,056 — — — 4,051

Comprehensive income:

Net earnings — — — — 109,303 — 109,303

Unrealized loss on financial instruments, net of

tax — — — (172) — — (172)

Minimum pension liability, net of tax — — — (26,744) — — (26,744)

Other, net of tax — — — 437 — — 437

Total comprehensive income — — — — — — 82,824

BALANCE AT AUGUST 2, 2003 $ 282 $ 197 $ 458,520 $ (25,573)$ 719,442 $ (15,020)$ 1,137,848

See Notes to Consolidated Financial Statements.

F-6