Neiman Marcus 2002 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

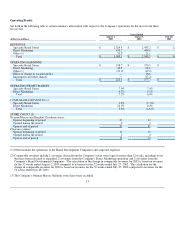

of SG&A to revenues for the Company's less mature stores, 3) an increased level of incentive compensation and 4) higher preopening

costs.

The increases in SG&A were partially offset by 1) a lower level of SG&A as a percentage of revenues for the Company's more mature

stores due, in part, to various cost reduction strategies initiated by the Company, 2) lower catalogue production and circulation costs

due to the elimination of certain unprofitable catalogues by Direct Marketing and 3) higher income earned in connection with the

Company's credit card portfolio.

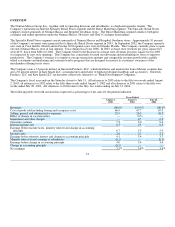

Segment operating earnings. Operating earnings for the Specialty Retail Stores segment were $170.5 million in 2002 compared to

$201.0 million in 2001. This decrease was primarily the result of lower sales and an increase in both buying and occupancy expenses

and SG&A expenses as a percentage of revenues derived from the Company's less mature stores in 2002. Operating earnings for

Direct Marketing increased to $22.8 million in 2002 from $11.1 million in 2001 primarily as a result of an improvement in the

operating performance of the Company's online operations and the elimination of certain unprofitable catalogues. Operating losses

reported as Other were $19.0 million compared to losses of $8.7 million in 2001. The increase in loss related to Other was primarily

due to lower earnings for the Brand Development companies as a result of a decline in earnings at Kate Spade LLC and increased

expenses for professional fees, medical expenses and incentive compensation.

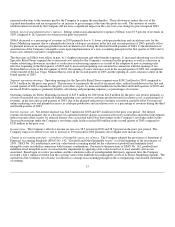

Effect of change in vacation policy. During the third quarter of 2002, the Company terminated its prior vacation plan and the Board of

Directors of the Company approved a new policy related to vacation pay for its employees. The new policy was communicated to

employees during the third quarter of 2002. Pursuant to the new policy, which was effective as of April 28, 2002, eligible employees

earn vacation pay ratably over the course of the year in which the services are rendered.

Pursuant to the previous plan, eligible employees received an annual vacation grant at the beginning of each service year. Such grants

were made in anticipation of future service; however, eligible employees were allowed to take vacation time to the extent of the

vacation grant as of the grant date. Further, in the event of termination, an employee was entitled to receive cash compensation to the

extent of the untaken balance of the annual grant. As a result, the Company recorded vacation expense ratably over the twelve months

prior to each annual grant such that the liability for the annual grant was fully recorded as of the grant date.

With the termination of the prior vacation plan, the previously recorded vacation liability of $16.6 million, which amount represented

the vacation time that would have been granted to employees on April 28, 2002 pursuant to the previous plan, was eliminated and

credited to operating earnings in the third quarter of 2002.

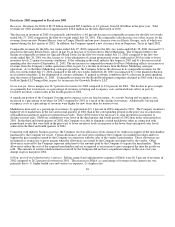

Impairment and other charges. In the fourth quarter of 2002, the Company recorded a $3.1 million pretax impairment charge. The

charge related to the write-down of the net carrying values of the fixed assets of three Kate Spade LLC stores to estimated fair value.

In the third quarter of 2002, the Company recorded an $8.2 million pretax impairment charge. The charge related to 1) the write-off of

the remaining net carrying value of its cost method investment in WeddingChannel.com, Inc. in light of its continued operating losses,

2) the write-down of the carrying values of the fixed assets of two Neiman Marcus Galleries stores to estimated fair value and 3) the

accrual of the estimated loss associated with the abandonment of excess warehouse space held by the Company pursuant to a long-

term operating lease. In the second quarter of 2002, the Company incurred expenses of approximately $2.0 million in connection with

certain cost reduction strategies. These expenses consisted primarily of severance costs and lease termination expenses incurred in

connection with the closing of the Neiman Marcus Galleries store in Seattle, Washington.

Interest expense net. Interest expense was $15.4 million for 2002 compared to $15.2 million for 2001. The increase in net interest

expense of $0.2 million was primarily due to increased interest costs associated with borrowings on the Company's Revolving Credit

Facility in the second quarter of 2002 and by lower investment interest income offset, in part, by an increase in capitalized interest

charges associated with store development.

Income taxes. The Company's effective income tax rate was 38 percent in both 2002 and 2001.

17