Neiman Marcus 2002 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

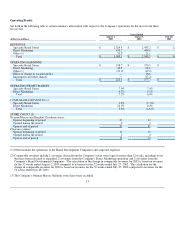

LIQUIDITY AND CAPITAL RESOURCES

The Company's cash requirements consist principally of 1) the funding of its merchandise purchases, 2) capital expenditures for new

store growth, store renovations and upgrades of its management information systems, 3) debt service requirements and 4) obligations

related to its Pension Plan. The Company's working capital requirements fluctuate during the year, increasing substantially during the

fall season as a result of higher planned seasonal inventory levels.

Net cash provided by operating activities was $169.0 million for 2003 compared to net cash provided by operating activities of $212.4

million for the prior year period. Despite an increase in net earnings (before the non-cash impact of the accounting change in the first

quarter of 2003), cash provided by operating activities decreased by approximately $43.4 million compared to the prior year period.

This decrease was primarily the result of a higher net investment in inventory (inventory less accounts payables) and increased

funding of the Company's Pension Plan compared to the prior year period. A significant portion of the higher net investment in

inventories in the current year relates to the two new Neiman Marcus stores and two new clearance stores opened since the beginning

of 2003.

Net cash used for investing activities was $134.0 million for 2003 and $137.1 million for 2002. The net cash used for investing

activities decreased in 2003 principally as a result of decreased capital expenditures and an increase in retained accounts receivable.

The Company's capital expenditures in 2003 primarily included costs related to the construction of new stores and the renovation of

existing stores. Capital expenditures were $100.0 million in 2003 and $149.2 million in 2002. In 2003, major projects included store

renovations in San Francisco, California; Las Vegas, Nevada; and Newport Beach, California and the construction of new stores in

Orlando, Florida and Coral Gables, Florida and upgrades and replacement of certain store and financial systems. In 2003, the

Company implemented various financial and non-merchandise procurement modules of Oracle to replace previous systems, began the

rollout of a new point-of-sale system in the Company's retail stores and implemented a new system for the procurement of foreign

merchandise. The Company currently projects capital expenditures for 2004 to be approximately $150 million to $160 million

primarily for store renovations and upgrades to information systems.

Net cash used for financing activities was $6.8 million in 2003. Net cash provided by financing activities was $6.1 million in 2002.

In 2003, the Company borrowed and repaid $80 million on the Company's revolving credit facility to fund seasonal working capital

requirements and repurchased approximately $15.0 million of the Company's stock during the second quarter of 2003 pursuant to the

Company's stock repurchase program. During 2002, the Company borrowed and repaid $130 million on the Company's revolving

credit facility to fund seasonal working capital requirements.

The Company's primary sources of short-term liquidity are comprised of cash on hand and availability under its $300 million

revolving credit facility. As of August 2, 2003, the Company had cash and cash equivalents of $207.0 million and no outstanding

borrowings under the Company's $300 million unsecured revolving credit facility. The Company's cash and cash equivalents

consisted principally of invested cash and store operating cash. At August 3, 2002, the Company had cash and cash equivalents of

$178.6 million and no outstanding borrowings under the Company's previous $450 million unsecured revolving credit facility. The

amount of cash on hand and borrowings under the credit facility are influenced by a number of factors, including sales, retained

accounts receivable, inventory levels, vendor terms, the level of capital expenditures, cash requirements related to financing

instruments, Pension Plan funding obligations and the Company's tax payment obligations, among others.

FINANCING STRUCTURE

The Company's major sources of funds are comprised of vendor financing, a $300 million revolving credit agreement, $125 million

senior unsecured notes, $125 million senior unsecured debentures, a $225 million securitization program, operating leases and capital

leases.

Effective August 26, 2002, the Company entered into a three-year unsecured revolving credit agreement (the Credit Agreement) with

a group of eleven banks that provides for borrowings of up to $300 million. The Company has two

18