Neiman Marcus 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

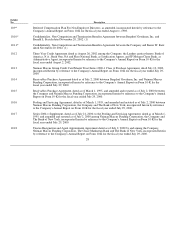

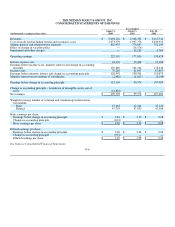

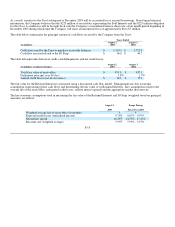

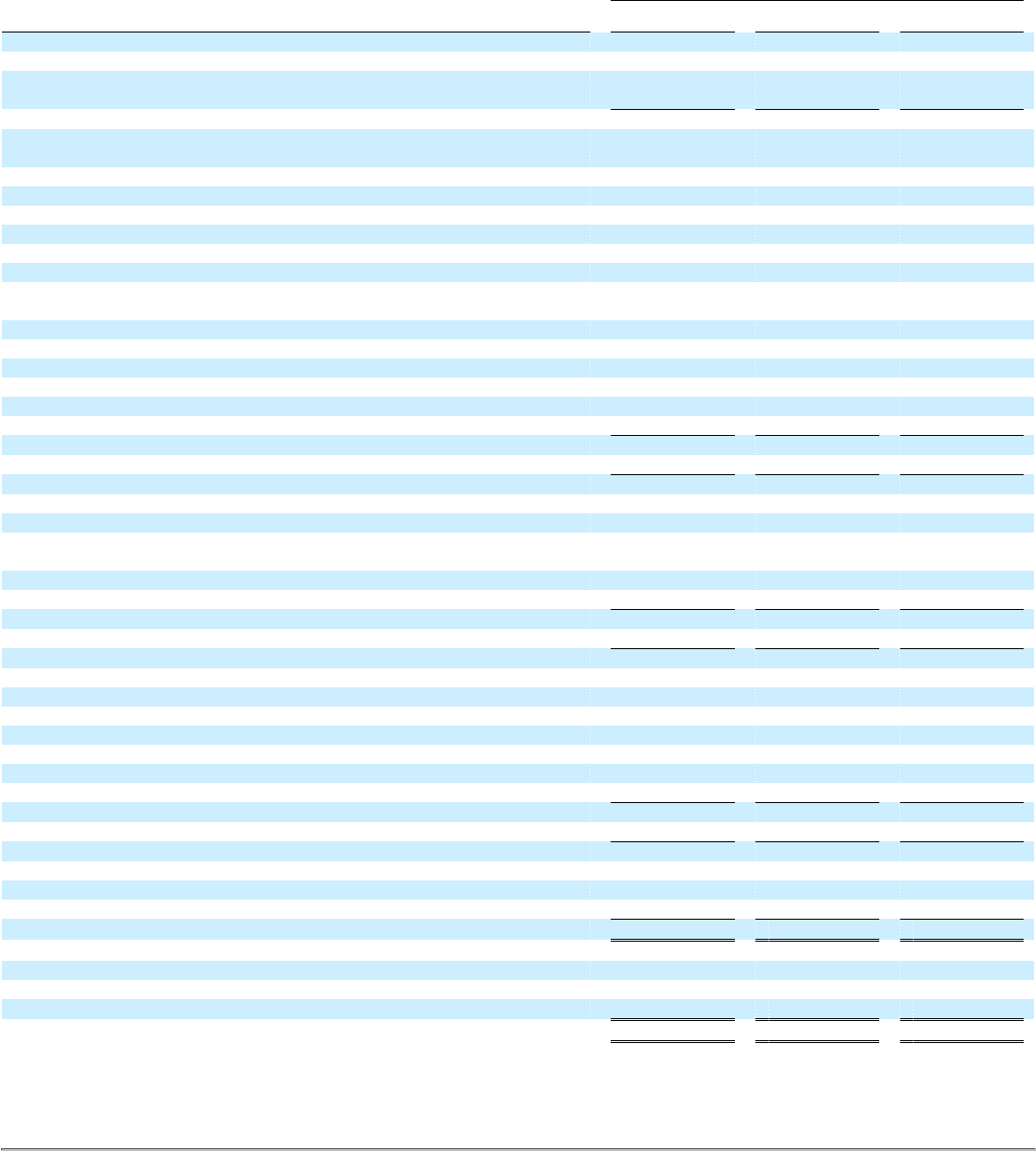

THE NEIMAN MARCUS GROUP, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Years Ended

(in thousands)

August 2,

2003

August 3,

2002

July 28,

2001

CASH FLOWS - OPERATING ACTIVITIES

Net earnings $ 109,303 $ 99,574 $ 107,484

Change in accounting – non-cash writedown of intangible assets, net of

taxes 14,801 — —

Earnings before change in accounting principle 124,104 99,574 107,484

Adjustments to reconcile net earnings to net cash provided by operating

activities:

Depreciation 78,976 76,809 73,104

Amortization of intangible assets — 5,284 5,905

Deferred income taxes 7,444 (10,335) (11,784)

Effect of change in vacation policy — (16,576) —

Impairment and other charges — 13,233 9,763

Minority interest 2,488 1,017 3,149

Other – primarily costs related to defined benefit pension and other

long-term benefit plans 24,189 13,987 (211)

Changes in operating assets and liabilities:

(Increase) decrease in accounts receivable (2,817) 929 (1,428)

Increase in merchandise inventories (30,218) (7,977) (73,523)

(Increase) decrease in other current assets (22,135) 2,402 13,251

Increase in accounts payable and accrued liabilities 17,770 34,047 6,177

Funding of defined benefit pension plan (30,760)— —

NET CASH PROVIDED BY OPERATING ACTIVITIES 169,041 212,394 131,887

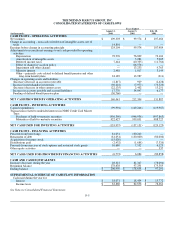

CASH FLOWS - INVESTING ACTIVITIES

Capital expenditures (99,994) (149,246) (119,987)

Transactions related to undivided interests in NMG Credit Card Master

Trust:

Purchases of held-to-maturity securities (956,390) (946,936) (997,863)

Maturities of held-to-maturity securities 922,427 959,051 988,727

NET CASH USED FOR INVESTING ACTIVITIES (133,957)(137,131)(129,123)

CASH FLOWS - FINANCING ACTIVITIES

Proceeds from borrowings 81,051 130,240 —

Repayment of debt (81,051) (130,000) (80,000)

Acquisition of treasury stock (15,020) — —

Distributions paid (2,432) (1,688) (7,320)

Proceeds from exercises of stock options and restricted stock grants 10,680 7,532 6,125

Other equity activities — — 337

NET CASH (USED FOR) PROVIDED BY FINANCING ACTIVITIES (6,772)6,084 (80,858)

CASH AND CASH EQUIVALENTS

Increase (decrease) during the year 28,312 81,347 (78,094)

Beginning balance 178,638 97,291 175,385

Ending balance $ 206,950 $ 178,638 $ 97,291

SUPPLEMENTAL SCHEDULE OF CASH FLOW INFORMATION

Cash paid during the year for:

Interest $ 18,071 $ 18,434 $ 15,772

Income taxes $ 61,860 $ 62,858 $ 76,462

See Notes to Consolidated Financial Statements.

F-5