Neiman Marcus 2002 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

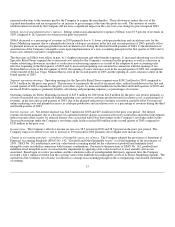

setting original retail values for merchandise held for sale incorrectly, 2) failure to identify a decline in perceived value of inventories

and process the appropriate retail value markdowns and 3) overly optimistic or conservative shrinkage estimates. The Company

believes it has the appropriate merchandise valuation and pricing controls in place to minimize the risk that its inventory values would

be materially misstated.

Consistent with industry business practice, the Company receives allowances from certain of its vendors in support of the merchandise

purchased by the Company for resale. Certain allowances are received to reimburse the Company for markdowns taken and/or to

support the gross margins earned by the Company in connection with the sales of the vendor's merchandise. These allowances are

recognized as an increase to gross margin when the allowances are earned by the Company and approved by the vendor. Other

allowances received by the Company represent reductions to the amounts paid by the Company to acquire the merchandise. These

allowances reduce the cost of the acquired merchandise and are recognized as an increase to gross margin at the time the goods are

sold.

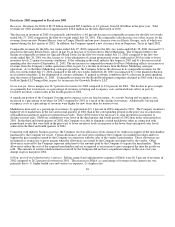

Income and Expenses Related to Securitization. Pursuant to applicable accounting principles, the Company's current credit card

securitization program qualifies for sale treatment related to those receivables transferred to third-party investors (Sold Interests). As

a result, the Company recognizes a gain or loss equal to the difference between the consideration received for the Sold Interests and

the allocated cost basis of the receivables sold. The portion of the credit card receivables that continue to be held by the Company

(Retained Interests) are shown as "Undivided interests in NMG Credit Card Master Trust" on the Company's consolidated balance

sheets. All income, net of related expenses, pertaining to both the Sold Interests and the Retained Interests are reflected as a reduction

of selling, general and administrative expenses in the Company's consolidated statements of earnings.

Assumptions related to the future performance of the Company's credit card portfolio have a significant impact on the calculation of

the gain or loss on the sale of the Sold Interests, the carrying values of Retained Interests and the recognition of income on the

Retained Interests. Determining the fair value of the Sold and Retained Interests requires estimates related to: 1) the gross future

finance charge collections to be generated by the total credit card portfolio; 2) future finance charge collections allocable to the Sold

Interests; 3) future credit losses and 4) discount rates. Items that were considered in making judgments and preparing estimates and

factors that might lead to future variations in consolidated financial results in the event of differences between actual and estimated

results are as follows:

• Finance charge income is billed at a contractual rate monthly and warrants little judgment or estimation. The expected credit

card customer payment rate is based on historical payment rates adjusted for recent payment rate trends. To the extent credit

card customers pay off their balances sooner than estimated, the income earned by the Company may decrease. Conversely,

should the credit card customers pay off balances over a longer period of time, the income earned by the Company may increase.

• The finance charge collections are estimated using the current portfolio yield experience and estimated short-term interest rates

over the estimated life of the receivables. To the extent current portfolio yield experience decreases and short-term interest rates

increase beyond the estimates, the finance charge collections may be reduced.

• Credit losses expected from the portfolio are based on historical write-off rates, adjusted for recent write-off trends and

management's outlook of future trends. To the extent there are positive or negative factors affecting the credit card customers'

ability or intent to pay off the outstanding balance (e.g., level of discretionary income, level of consumer debt, bankruptcy

legislation), the actual bad debts to be realized could exceed or be less than the amounts estimated. Credit losses in excess of

those estimated reduce the income earned by the Company. Conversely, credit losses less than those estimated increase the

income earned by the Company.

• The assumed cash flow discount rates are based on prevailing market interest rates and management's estimate of an appropriate

risk premium for each respective Retained Interest. The actual discount rates used are subject to interest rate fluctuations.

The most sensitive assumptions in calculating the fair values are the credit card customers' payment rate, the estimate for credit losses,

relative interest spreads and the assumed cash flow discount rates. Assumptions related to the future performance of the Company's

credit card portfolio have a significant impact on the calculation of the gain or loss on the sale of the Sold Interests, the carrying values

of the Retained Interests and the recognition of income on the Retained Interests.

9