Neiman Marcus 2002 Annual Report Download - page 146

Download and view the complete annual report

Please find page 146 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

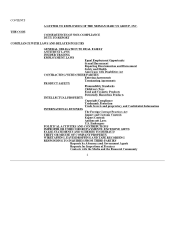

services compared with competitors who purchase similar products from the seller. Thus, while employees are encouraged to

negotiate the best possible prices, terms, and cooperative advertising arrangements, they must not affirmatively seek terms that are

better than those offered to competing retailers.

In addition to price fixing, resale price maintenance, and price discrimination, antitrust laws prohibit other noncompetitive

activities including: predatory pricing (i.e., selling below cost); group boycotts; allocation of customers, territories, products or

services; unlawful tying of separate products; certain exclusivity agreements; monopolization; unlawful termination of dealers,

suppliers or distributors; and, under certain circumstances, attempts to engage in many of these types of activities. Moreover, antitrust

laws generally prohibit any unfair or deceptive trade practices or methods of competition, including misleading advertising,

disparaging a competitor's products or services, harassing a competitor and stealing trade secrets or confidential business information.

The above description does not exhaust the reach of all antitrust laws. It does demonstrate, however, that antitrust laws,

which attempt to ensure that superior market position is achieved only by superior products and performance, affect nearly every

business decision made by employees on the Company's behalf. The costs and consequences of an antitrust investigation or litigation

can be serious for individual employees, as well as for the Company itself, even if the employees and the Company are ultimately

vindicated. Individual violators of antitrust laws can be imprisoned for up to three (3) years and fined in excess of $350,000 per

violation. Corporations that violate antitrust laws can be subject to criminal penalties in excess of $10 million per violation. In

addition, companies can be subject to treble damage awards in civil lawsuits.

INSIDER TRADING

Employees shall not trade securities of the Company or other firms based on material non-public information.

Employees also shall not provide such non-public information to individuals outside the Company.

It is a cornerstone of federal securities laws that a purchaser and seller of securities should be on as equal footing as is

possible with respect to information regarding the issuer of the securities being traded. Consequently, federal securities laws forbid the

purchase or sale of a security based upon "inside" information unavailable to the other party. Federal securities laws also prohibit

employers, directors, officers and employees from knowingly or recklessly failing to take steps to prevent the trading on, or tipping of,

inside information by those whom they directly or indirectly control.

The consequences of insider trading can be severe. Employees who trade on inside information, or tip information to others,

are subject to civil penalties of up to three (3) times the profit gained or loss avoided, criminal fines of up to $1 million, and

incarceration of up to ten (10) years. If the Company or supervisory personnel fail to take appropriate steps to prevent insider trading

by employees, they are subject to civil penalties up to the greater of $1 million or three (3) times the profit gained or loss avoided as a

result of the employee's violation, as well as criminal penalties of up to $2.5 million.

Employees who know material information which has not been publicly disclosed, and which concerns the financial

condition, earnings or business of the Company, or any important development in which the Company is or may be involved, shall not

buy or sell shares of stock or other securities of the Company (or puts, calls, options or other rights to buy or sell such securities) until

a reasonable time after public disclosure of such inside information. Employees also shall not disclose such inside information to

individuals not employed by the Company until a reasonable time after the Company publicly discloses

9