Neiman Marcus 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

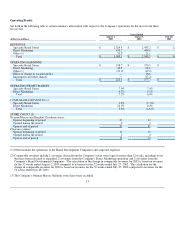

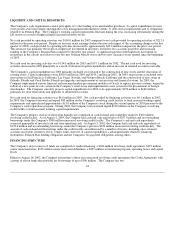

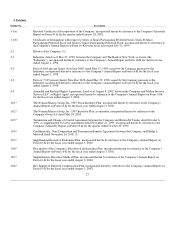

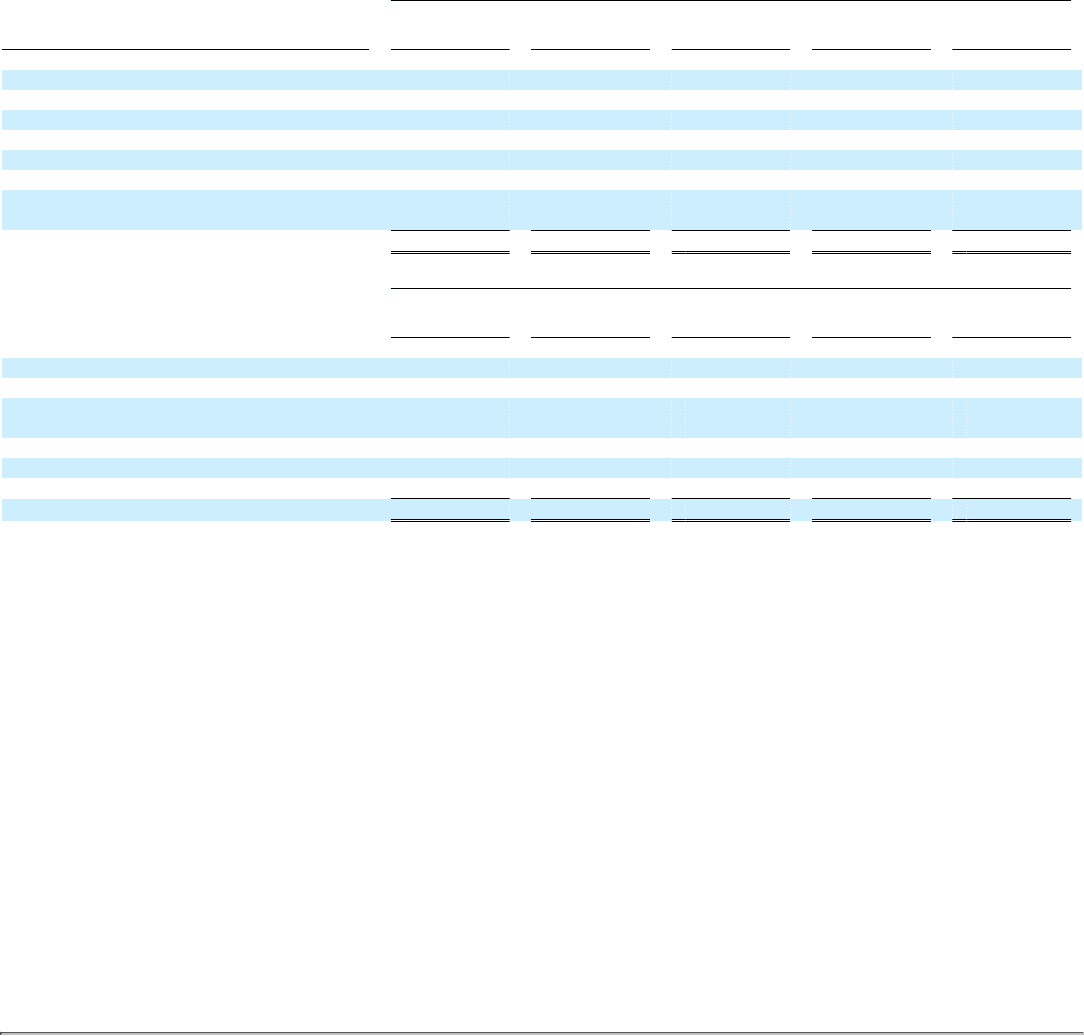

The estimated significant contractual cash obligations and other commercial commitments at August 2, 2003 are summarized in the

following table:

Payments Due By Period

(in thousands) Total

Fiscal Year

2004

Fiscal Years

2005 - 2006

Fiscal Years

2007 - 2008

Fiscal Year

2009 and

Beyond

Contractual obligations

Senior notes $ 125,000 $ — $ — $ 125,000 $ —

Senior debentures 125,000 — — — 125,000

Capital lease obligations 1,700 1,100 600 — —

Operating lease obligations 780,300 44,600 84,500 72,100 579,100

Construction commitments 8,600 7,800 800 — —

NMG Credit Card Master Trust Class A

Certificates 225,000 — 225,000 — —

$ 1,265,600 $ 53,500 $ 310,900 $ 197,100 $ 704,100

Amount of Commitment Expiration Period

Total

Fiscal Year

2004

Fiscal Years

2005 - 2006

Fiscal Years

2007 - 2008

Fiscal Year

2009 and

Beyond

Other commercial commitments

Revolving credit facility:

Outstanding commitment at August 2,

2003 $ 300,000 $ — $ 300,000 $ — $ —

Money market lending facility 25,000 — 25,000 — —

Letters of credit 8,500 8,400 100 — —

Surety bonds 2,700 2,100 600 — —

$ 336,200 $ 10,500 $ 325,700 $ — $ —

The Company's other principal commercial commitments are comprised of Pension Plan funding obligations, short-term merchandise

purchase commitments, common area maintenance costs, tax and insurance obligations and contingent rent payments. Substantially

all of the Company's merchandise purchase commitments are cancelable up to 30 days prior to the vendor's scheduled shipment date.

At August 1, 2003 (the most recent measurement date), the Company's actuarially calculated projected benefit obligation was $245.0

million and the fair value of the assets was $183.0 million resulting in an underfunded status of $62.0 million. In addition, the

Company was required to record an additional minimum pension liability of $39.3 million and reduce shareholders' equity, net of

taxes, by $23.8 million during 2003. These adjustments did not affect the Company's reported earnings or Pension Plan funding

requirements.

When funding is required, the Company's policy is to contribute amounts that are deductible for federal income tax purposes. In the

third quarter of 2003, the Company made a required contribution of $11.5 million and a voluntary contribution of $13.5 million to the

Pension Plan for the plan year ended July 31, 2002. In addition, the Company made contributions of $5.8 million in 2003 for the plan

year ending July 31, 2003. Based upon currently available information, the Company will not be required to make an additional

contribution to the Pension Plan for the plan year ending July 31, 2003.

While the Company's contributions to the Pension Plan exceed the minimum funding requirements under ERISA and IRS rules and

regulations, the significant decrease in the U.S. equity and bond markets during recent years contributed substantially to the

underfunded status. To the extent the U.S. equity and bond markets do not recover or continue to deteriorate, the Company's cash

funding requirements will increase. The Company expects to generate adequate cash flows from operating activities to meet the

Pension Plan funding requirements. The

20