Neiman Marcus 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

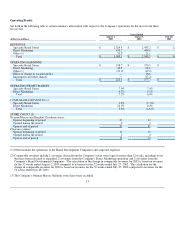

types of borrowing options under the Credit Agreement, a "committed" borrowing or a "competitive bid" borrowing. The rate of

interest payable under a "committed" borrowing is based on one of two pricing options selected by the Company, the level of

outstanding borrowings and the rating of the Company's senior unsecured long-term debt by Moody's and Standard & Poor's. The

pricing options available to the Company under a "committed" borrowing are based on either LIBOR plus 0.400 percent to 1.625

percent or a "base" rate, based on the higher of the Prime Rate or 0.500 percent plus the Federal Funds Rate, plus a "base" rate margin

of up to 0.625 percent. The rate of interest payable under a "competitive bid" borrowing is based on one of two pricing options

selected by the Company. The pricing options are based on either LIBOR plus a competitive bid margin or an absolute rate, both

determined in the competitive auction process. Changes in the ratings of the senior unsecured long-term debt do not represent an

event of default, accelerate repayment of any outstanding borrowings or alter any other terms of the Credit Agreement. The Credit

Agreement contains covenants that require the Company to maintain certain leverage and fixed charge ratios. At August 2, 2003, the

Company had no borrowings outstanding under its unsecured credit facility.

The Company also has an uncommitted money market lending arrangement of $25 million in place with one of its lending banks.

The arrangement expires on September 20, 2004 and as of August 2, 2003, the Company had no borrowings outstanding under this

arrangement.

In May 1998, the Company issued $250 million of unsecured senior notes and debentures to the public. The debt is comprised of

$125 million of 6.65 percent senior notes, due 2008 and $125 million of 7.125 percent senior debentures, due 2028. Interest on the

securities is payable semiannually. Based upon quoted prices, the fair value of the Company's senior notes and debentures was $265.0

million as of August 2, 2003 and $249.9 million as of August 3, 2002.

In prior years, the Company's Board of Directors authorized various stock repurchase programs and increases in the number of shares

subject to repurchase. During the second quarter of 2003, the Company repurchased 524,177 shares at an average purchase price of

$28.65. As of August 2, 2003, approximately 1.4 million shares remained available for repurchase under the Company's stock

repurchase programs.

19