Neiman Marcus 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Neiman Marcus annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

NEIMAN MARCUS GROUP INC

10-K

Annual report pursuant to section 13 and 15(d)

Filed on 10/02/2003

Filed Period 08/02/2003

Table of contents

-

Page 1

NEIMAN MARCUS GROUP INC

10-K

Annual report pursuant to section 13 and 15(d) Filed on 10/02/2003 Filed Period 08/02/2003

-

Page 2

...9659 to

The Neiman Marcus Group, Inc.

(Exact name of registrant as specified in its charter) Delaware (State or other jurisdiction of incorporation or organization) One Marcus Square 1618 Main Street Dallas, Texas (Address of principal executive offices) 75201 (Zip code) 95-4119509 (I.R.S. Employer...

-

Page 3

DOCUMENTS INCORPORATED BY REFERENCE. Part III of this report incorporates information from the registrant's definitive Proxy Statement relating to the registrant's Annual Meeting of Shareholders to be held on January 16, 2004, which will be filed on or about November 25, 2003.

-

Page 4

... Schedules and Reports on Form 8-K. Signatures. 1 Directors and Executive Officers of the Registrant. Executive Compensation. Security Ownership of Certain Beneficial Owners and Management. Certain Relationships and Related Transactions. Principal Accounting Fees and Services. Market for the...

-

Page 5

... are located in Manhattan at 58th Street and Fifth Avenue. Both Neiman Marcus and Bergdorf Goodman stores offer high-end fashion apparel and accessories, primarily from leading designers. Neiman Marcus Direct, the Company's upscale direct marketing operation, conducts catalogue and online sales...

-

Page 6

... markets that may not be large enough to support full-line stores. The Company operates two Bergdorf Goodman stores in Manhattan at 58th Street and Fifth Avenue. The main Bergdorf Goodman store consists of 250,000 gross square feet and features high-end women's apparel and unique fashion accessories...

-

Page 7

..., Bergdorf Goodman and Neiman Marcus Direct are located in Dallas, Texas; New York, New York; and Irving, Texas, respectively. As of September 15, 2003, the approximate aggregate gross square footage used in the Company's operations was as follows:

Owned Subject to Ground Lease

Owned

Leased

Total...

-

Page 8

... the lease on the Bergdorf Goodman Men's Store expires in 2010, with two 10-year renewal options. Most leases provide for monthly fixed amount rentals or contingent rentals based upon sales in excess of stated amounts and normally require the Company to pay real estate taxes, insurance, common area...

-

Page 9

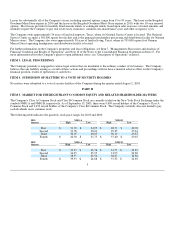

... fifty-two weeks of operations.

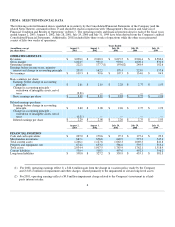

(in millions, except per share data) August 2, 2003 August 3, 2002 Years Ended July 28, 2001 July 29, 2000 July 31, 1999

OPERATING RESULTS Revenues Gross margin Operating earnings Earnings before income taxes, minority interest and change in accounting principle Net...

-

Page 10

... the Company's objectives and expectations concerning, among other things, its:

productivity and profitability; merchandising and marketing strategies; inventory performance; store renovation and expansion plans; capital expenditures; liquidity; and development of its management information...

-

Page 11

• significant increases in paper, printing and postage costs; • litigation that may have an adverse effect on the financial results or reputation of the Company; • changes in the Company's relationships with designers, vendors and other sources of merchandise;

7

-

Page 12

...exchange rates; • impact of funding requirements related to the Company's noncontributory defined benefit pension plan; • changes in the Company's relationships with certain of its key sales associates; • changes in key management personnel; • changes in the Company's proprietary credit card...

-

Page 13

... to gross margin at the time the goods are sold. Income and Expenses Related to Securitization. Pursuant to applicable accounting principles, the Company's current credit card securitization program qualifies for sale treatment related to those receivables transferred to third-party investors (Sold...

-

Page 14

... stores may require two to five years to develop a customer base necessary to generate the cash flows of the Company's more mature stores. To the extent management's estimates for sales growth and gross margin improvement are not realized, future annual assessments could result in impairment charges...

-

Page 15

... be required to pay amounts in excess of recorded reserves, the Company's effective tax rate in a given financial statement period could be materially impacted. Litigation. The Company is periodically involved in various legal actions arising in the normal course of business. Management is required...

-

Page 16

... In September 2002, the Company opened a new store in Coral Gables, Florida and in October 2002 opened a new store in Orlando, Florida. The Company currently plans to open one new Neiman Marcus store in San Antonio, Texas during fiscal year 2006. In 2003, average store revenues per gross square foot...

-

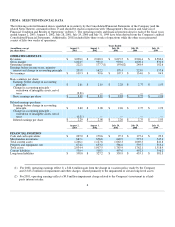

Page 17

... Total OPERATING PROFIT MARGIN Specialty Retail Stores Direct Marketing Total COMPARABLE REVENUES (2) Specialty Retail Stores Direct Marketing Total STORE COUNT (3) Neiman Marcus and Bergdorf Goodman stores: Open at beginning of period Opened during the period Open at end of period Clearance centers...

-

Page 18

... Company opened a new clearance store in the Denver, Colorado area (November 2002) and completed a 71,000 square foot expansion and remodel of the Las Vegas Neiman Marcus store. In the fourth quarter of 2003, the Company opened another new clearance center in Miami, Florida (May 2003). Sales derived...

-

Page 19

... Vegas Neiman Marcus store in the second quarter of 2003 and the opening of a new clearance center in the fourth quarter of 2003. Segment operating earnings. Operating earnings for the Specialty Retail Stores segment were $198.2 million for 2003 compared to $170.5 million for the prior year period...

-

Page 20

... one new Neiman Marcus store in Tampa, Florida and one new clearance store in Atlanta, Georgia, each of which was opened during the first quarter of 2002. In addition, the Company opened a new clearance store in Grapevine, Texas in April 2002. Comparable revenues for the fifty-two weeks ended July...

-

Page 21

... new policy, which was effective as of April 28, 2002, eligible employees earn vacation pay ratably over the course of the year in which the services are rendered. Pursuant to the previous plan, eligible employees received an annual vacation grant at the beginning of each service year. Such grants...

-

Page 22

... (inventory less accounts payables) and increased funding of the Company's Pension Plan compared to the prior year period. A significant portion of the higher net investment in inventories in the current year relates to the two new Neiman Marcus stores and two new clearance stores opened since the...

-

Page 23

... as of August 3, 2002. In prior years, the Company's Board of Directors authorized various stock repurchase programs and increases in the number of shares subject to repurchase. During the second quarter of 2003, the Company repurchased 524,177 shares at an average purchase price of $28.65. As...

-

Page 24

...required, the Company's policy is to contribute amounts that are deductible for federal income tax purposes. In the third quarter of 2003, the Company made a required contribution of $11.5 million and a voluntary contribution of $13.5 million to the Pension Plan for the plan year ended July 31, 2002...

-

Page 25

... end of 2004. OFF-BALANCE SHEET ARRANGEMENTS Pursuant to a revolving credit card securitization program, the Company transfers substantially all of its credit card receivables to a wholly-owned subsidiary, Neiman Marcus Funding Corporation, which in turn sells such receivables to the Neiman Marcus...

-

Page 26

... and second quarters of each year. The increases in working capital needs during the first and second quarters have typically been financed with cash flows from operations, borrowings under the Company's Credit Agreement and cash provided from the Company's proprietary credit card securitization...

-

Page 27

...contractually-defined rate of one month LIBOR plus 0.27 percent annually. The distributions to the Class A Certificate holders are payable from the finance charge income generated by the credit card receivables held by the Trust. At August 2, 2003, the Company estimates a 100 basis point increase in...

-

Page 28

... reported within the time periods specified in the Securities and Exchange Commission's rules and forms. In the ordinary course of business, the Company routinely enhances its information systems by either upgrading its current systems or implementing new systems. No change occurred in the Company...

-

Page 29

... Vice President and General Manager of the Dallas NorthPark Neiman Marcus store prior thereto. Ronald L. Frasch - 54 Chairman and Chief Executive Officer of Bergdorf Goodman since April 2000. Prior to joining the Company Mr. Frasch served as President of GFT, USA, a manufacturer of designer apparel...

-

Page 30

...accounting regulations of the Securities and Exchange Commission are not required under the related instructions or are not applicable. 3.

Reports on Form 8-K

On May 8, 2003 the Company filed a Current Report on Form 8-K under Item 9 to disclose under Regulation FD the Company's press release dated...

-

Page 31

...Restated Rights Agreement, dated as of August 8, 2002, between the Company and Mellon Investor Services LLC, as Rights Agent, incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended August 3, 2002. The Neiman Marcus Group, Inc. 1987 Stock Incentive Plan...

-

Page 32

... Trustee Resignation and Agent Appointment Agreement dated as of July 2, 2000 by and among the Company, Neiman Marcus Funding Corporation, The Chase Manhattan Bank and The Bank of New York, incorporated herein by reference to the Company's Annual Report on Form 10-K for the fiscal year ended July 29...

-

Page 33

... Release between the Company and Gerald A. Sampson dated January 1, 2003, incorporated herein by reference to the Company's Quarterly Report on Form 10-Q for the quarter ended February 1, 2003. Computation of Ratio of Earnings to Fixed Charges (Unaudited). (1) The Neiman Marcus Group, Inc. Code...

-

Page 34

*

Management contract or compensatory plan or arrangement filed pursuant to Item 14(c) of Form 10-K. 30

-

Page 35

INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Independent Auditors' Report Consolidated Balance Sheets Consolidated Statements of Earnings Consolidated Statements of Cash Flows Consolidated Statements of Shareholders' Equity Notes to Consolidated Financial Statements F-1

-

Page 36

INDEPENDENT AUDITORS' REPORT Board of Directors and Shareholders The Neiman Marcus Group, Inc. Dallas, Texas We have audited the accompanying consolidated balance sheets of The Neiman Marcus Group, Inc. and subsidiaries as of August 2, 2003 and August 3, 2002, and the related consolidated statements...

-

Page 37

THE NEIMAN MARCUS GROUP, INC. CONSOLIDATED BALANCE SHEETS

(in thousands, except shares) August 2, 2003 August 3, 2002

ASSETS CURRENT ASSETS Cash and cash equivalents Undivided interests in NMG Credit Card Master Trust Accounts receivable Merchandise inventories Deferred income taxes Other current ...

-

Page 38

THE NEIMAN MARCUS GROUP, INC. CONSOLIDATED STATEMENTS OF EARNINGS

August 2, 2003 Years Ended August 3, 2002 July 28, 2001

(in thousands, except per share data)

Revenues Cost of goods sold including buying and occupancy costs Selling, general and administrative expenses Effect of change in vacation...

-

Page 39

... earnings to net cash provided by operating activities: Depreciation Amortization of intangible assets Deferred income taxes Effect of change in vacation policy Impairment and other charges Minority interest Other - primarily costs related to defined benefit pension and other long-term benefit plans...

-

Page 40

... of tax Total comprehensive income BALANCE AT JULY 28, 2001 Issuance of 339 shares under stock option plan Other equity transactions Comprehensive income: Net earnings Unrealized gain on financial instruments, net of tax Other, net of tax Total comprehensive income BALANCE AT AUGUST 3, 2002 Issuance...

-

Page 41

... been prepared in accordance with generally accepted accounting principles. The Company's businesses consist of specialty retail stores, primarily Neiman Marcus Stores and Bergdorf Goodman, and Neiman Marcus Direct, the Company's direct marketing operation. The Company owns a 51 percent interest in...

-

Page 42

... pay off their balances sooner than estimated, the income earned by the Company may decrease. Conversely, should the credit card customers pay off balances over a longer period of time, the income earned by the Company may increase. The finance charge collections are estimated using the current...

-

Page 43

..., customer preferences, age of merchandise and fashion trends. During the season, the Company records both temporary and permanent markdowns. Temporary markdowns are recorded at the time of sale and reduce the retail value of only the goods sold. Permanent markdowns are designated for clearance...

-

Page 44

... stores may require two to five years to develop a customer base necessary to generate the cash flows of the Company's more mature stores. To the extent management's estimates for sales growth and gross margin improvement are not realized, future annual assessments could result in impairment charges...

-

Page 45

... rate of return on assets held by the Pension Plan and the average rate of compensation increase by Pension Plan participants. These actuarial assumptions are reviewed annually based upon currently available information. Self-insurance and Other Employee Benefit Reserves. Management uses estimates...

-

Page 46

... direct response advertising amounts included in other current assets in the consolidated balance sheets were $11.0 million as of August 2, 2003 and $7.1 million as of August 3, 2002. All other advertising costs, including costs incurred by the Company's online operations related to website design...

-

Page 47

...-Scholes option-pricing model for 2003, 2002 and 2001:

August 2, 2003 Years Ended August 3, 2002 July 28, 2001

(in thousands, except per share data)

Net earnings: As reported Less: stock-based employee compensation expense determined under fair value based method, net of related taxes Pro forma...

-

Page 48

... earnings per share using the treasury stock method. NOTE 2. Securitization of Credit Card Receivables Pursuant to a revolving credit card securitization program, the Company transfers substantially all of its credit card receivables to a wholly-owned subsidiary, Neiman Marcus Funding Corporation...

-

Page 49

... by the Company from the Trust:

Years Ended August 2, August 3, 2003 2002

(in millions)

Collections used by the Trust to purchase receivable balances Cash flow received related to the IO Strip

$ $

1,719.9 $ 46.0 $

1,721.0 44.7

The table belowprovides historical credit card delinquencies and...

-

Page 50

...change Expected Credit Losses (annual rate) Impact on fair value of 10 percent adverse change Impact on fair value of 20 percent adverse change Net Interest Spread Impact on fair value of 10 percent adverse change Impact on fair value of 20 percent adverse change Discount Rate (weighted average rate...

-

Page 51

...-balance sheet financing:

Amounts Recorded Pro forma On-Balance Sheet Financing

(in millions)

Assets: Undivided interests in NMG Credit Card Master Trust Accounts receivable Long-term liability: Borrowings pursuant to credit card securitization program Income: Finance charge income Gains on sales...

-

Page 52

... share by $0.08 for the period. NOTE 4. Accrued Liabilities The significant components of accrued liabilities are as follows:

(in thousands) August 2, 2003 August 3, 2002

Accrued salaries and related liabilities Self-insurance reserves Amounts due customers Income taxes payable Sales returns Sales...

-

Page 53

... of interest payable under a "competitive bid" borrowing is based on one of two pricing options selected by the Company. The pricing options are based on either LIBOR plus a competitive bid margin or an absolute rate, both determined in the competitive auction process. Changes in the ratings of the...

-

Page 54

... common stock. The loans are secured by a pledge of the purchased shares and bear interest at an annual rate of 5.0 percent, payable quarterly. Pursuant to the terms of the Loan Plan, each executive officer's loan will become due and payable seven months after his or her employment with the Company...

-

Page 55

... of the Company's 1997 and 1987 Stock Incentive Plans as of August 2, 2003, August 3, 2002 and July 28, 2001 and changes during the fiscal years ended on those dates are presented in the following table:

August 2, 2003 WeightedAverage Exercise Price Shares August 3, 2002 WeightedAverage Exercise...

-

Page 56

... General provided certain management, accounting, financial, legal, tax and other corporate services to the Company. The fees for these services were based on Harcourt General's costs and were subject to the approval of a special review committee of the Board of Directors of the Company who were...

-

Page 57

... Years Ended August 3, 2002 July 28, 2001

(in thousands)

Income tax expense at statutory rate State income taxes, net of federal income tax benefit Other Total

$ $

72,044 $ 7,354 (150) 79,248 $

56,785 $ 4,122 746 61,653 $

62,454 5,407 (54) 67,807

The Company's effective income tax rate was...

-

Page 58

...employees additional pension benefits. Benefits under both plans are based on the employees' years of service and compensation over defined periods of employment. When funding is required, the Company's policy is to contribute amounts that are deductible for federal income tax purposes. Pension Plan...

-

Page 59

... employees hired prior to March 1, 1989 are eligible for certain limited postretirement health care benefits (Postretirement Plan) if they have met certain service and minimum age requirements. The cost of these benefits is accrued during the years in which an employee provides services. The Company...

-

Page 60

...of year Actual return on assets Company contributions Benefits paid Fair value of assets at end of year

$

$

145,945 $ 12,692 30,760 (6,353) 183,044 $

167,982 (16,119) - (5,918) 145,945

The funded status of the Company's employee benefit plans is as follows:

Pension Plan (in thousands) 2003 2002...

-

Page 61

...available information, the Company will not be required to make an additional contribution to the Pension Plan for the plan year ending July 31, 2003. Significant assumptions related to the calculation of the Company's obligations pursuant to its employee benefit plans include the discount rate used...

-

Page 62

... the employees' years of service and compensation over defined periods of employment. NOTE 10. Effect of Change in Vacation Policy During the third quarter of 2002, the Company terminated its prior vacation plan and the Board of Directors of the Company approved a new policy related to vacation pay...

-

Page 63

... the vacation time that would have been granted to employees on April 28, 2002 pursuant to the previous plan, was eliminated and credited to operating earnings in the third quarter of 2002. NOTE 11. Impairment and Other Charges In the fourth quarter of 2002, the Company recorded a $3.1 million...

-

Page 64

... maintenance costs, tax and insurance obligations and contingent rent payments. Substantially all of the Company's merchandise purchase commitments are cancelable up to 30 days prior to the vendor's scheduled shipment date. NOTE 13. Earnings Per Share The weighted average shares used in computing...

-

Page 65

... Years Ended August 3, 2002 July 28, 2001

(in thousands)

Net earnings Other comprehensive income (loss): Unrealized (loss) gain on financial instruments, net of tax Additional minimum pension liability, net of tax Other, net of tax Total other comprehensive income (loss) Total comprehensive income...

-

Page 66

... 15. Segment Reporting The Company has identified two reportable segments: Specialty Retail Stores and Direct Marketing. The Specialty Retail Stores segment includes all Neiman Marcus and Bergdorf Goodman retail stores, including Neiman Marcus clearance stores. The Direct Marketing segment conducts...

-

Page 67

... Information (Unaudited)

(in millions, except for per share data) First Quarter Second Quarter Year Ended August 2, 2003 Third Quarter Fourth Quarter

Total

Revenues Gross profit Earnings before change in accounting principle Change in accounting principle Net earnings Basic earnings per share...

-

Page 68

... in connection with the closing of the Neiman Marcus Galleries store in Seattle, Washington. Net earnings for the third quarter of 2002 reflect a $16.6 million pretax gain from the change in vacation policy made by the Company and an $8.2 million pretax impairment charge related to the write-off...

-

Page 69

... duly authorized. THE NEIMAN MARCUS GROUP, INC. By: /s/ Nelson A. Bangs Nelson A. Bangs Senior Vice President and General Counsel Dated: October 1, 2003 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the...

-

Page 70

Exhibit 3.2

BYLAWS OF THE NEIMAN MARCUS GROUP, INC. (As amended through December 1, 2002)

-

Page 71

TABLE OF CONTENTS ARTICLE I. PREAMBLE ARTICLE II. ARTICLE III. ARTICLE IV. ARTICLE V. ARTICLE VI. ARTICLE VII. ARTICLE VIII. ARTICLE IX. MEETINGS OF STOCKHOLDERS DIRECTORS OFFICERS STOCK NOTICES GENERAL PROVISIONS INDEMNIFICATION AMENDMENTS i

-

Page 72

...notice of the meeting or in a duly executed waiver of notice thereof. Section 2. Annual Meetings. The Annual Meeting of Stockholders shall be held on such date and at such time as shall be designated from to time by the Board of Directors and stated in the notice of the meeting, at which meeting the...

-

Page 73

... appear on the Corporation's books, of the stockholder who is proposing such business, and the name and address of the beneficial owner, if any, on whose behalf the proposal is made; (b) the number and class of shares of stock of the Corporation that are beneficially owned on the date of such notice...

-

Page 74

... Stock issued by the Corporation acting separately by class or series, to elect, under specified circumstances, directors at an annual or special meeting of stockholders, the Board of Directors shall consist of not less than six nor more than twelve persons, the exact number to be fixed from time...

-

Page 75

.... The business of the Corporation shall be managed by or under the direction of the Board of Directors which may exercise all such powers of the Corporation and do all such lawful acts and things as are not by statute or by the Certificate of Incorporation or by these Bylaws directed or required to...

-

Page 76

... exercise all the powers and authority of the Board of Directors in the management of the business and affairs of the Corporation. Each committee shall keep regular minutes and report to the Board of Directors when required. Section 9. Compensation. The directors may be paid their expenses, if any...

-

Page 77

...Chief Executive Officers, Vice Presidents, Assistant Secretaries, Assistant Treasurers and other officers. Any number of offices may be held by the same person. The officers of the Corporation need not be stockholders of the Corporation nor need such officers be directors of the Corporation. Section...

-

Page 78

... chief accounting officer of the Corporation and shall be in charge of its books of account and accounting records and of its accounting procedures. He shall have such other duties and powers as may be designated from time to time by the Board of Directors or the President. Any Assistant Controllers...

-

Page 79

... Corporation with the same effect as if he or she were an officer, transfer agent or registrar at the date of the issue. All certificates for shares of stock shall be consecutively numbered as the same are issued. The name of the person owning the shares represented thereby with the number of shares...

-

Page 80

... meeting; provided, however, that the Board of Directors may fix a new record date for the adjourned meeting. Section 6. Beneficial Owners. The Corporation shall be entitled to recognize the exclusive right of a person registered on its books as the owner of shares to receive dividends, and to vote...

-

Page 81

... or special meeting, and may be paid in cash, in property, or in shares of the capital stock. Section 2. Fiscal Year. The fiscal year of the Corporation shall be fixed by resolution of the Board of Directors. Section 3. Corporate Seal. The corporate seal shall have inscribed thereon the name of...

-

Page 82

...shall indemnify any person who was or is a party or is threatened to be made a party to any threatened, pending or completed action or suit by or in the right of the Corporation to procure a judgment in its favor by reason of the fact that he is or was a director or officer of the Corporation, or is...

-

Page 83

... was serving at the request of the Corporation as a director, officer, employee or agent. The provisions of this Section 4 shall not be deemed to be exclusive or to limit in any way the circumstance in which a person may be deemed to have met the applicable standard of conduct set forth in Sections...

-

Page 84

... 8. Insurance. The Corporation may purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the Corporation or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership...

-

Page 85

... Certificate of Incorporation of the Corporation) required by law, the Certificate of Incorporation, or these Bylaws, the affirmative vote of the holders of at least 66 2/3 percent of the combined voting power of all the then-outstanding shares of the Voting Stock, voting together as a single class...

-

Page 86

... NMG, including Executive, the Board of Directors of NMG has determined that stock option and restricted stock awards should be combined with appropriate post-employment and other restrictions designed to protect the legitimate business interests of NMG and its Affiliates; WHEREAS, NMG and Executive...

-

Page 87

... prevent the dilution of its goodwill and unauthorized use or disclosure of its Confidential Information to avoid irreparable harm to its legitimate business interests; (d) in the specialty retail business, his participation in or direction of NMG's day-to-day operations and strategic planning as 2

-

Page 88

... engage in any of the following activities (the "Restricted Activities"): (a) He will not directly or indirectly disparage NMG or its Affiliates, any products, services, or operations of NMG or its Affiliates, or any of the former, current, or future officers, directors, or employees of NMG or its...

-

Page 89

..., supplier, or vendor of NMG or any of its Affiliates or to divert all or any part of such person's or entity's business from NMG or any of its Affiliates; and (d) He will not associate directly or indirectly, as an employee, officer, director, agent, partner, stockholder, owner, representative, or...

-

Page 90

... with respect to the end of Executive's employment with NMG. However, nothing in this Agreement is intended to limit any earned, vested benefits (other than any entitlement to severance or separation pay, if any) that Executive may have under the applicable provisions of any benefit plan of NMG in...

-

Page 91

... medium, concerning or evidencing sales; costs; pricing; strategies; forecasts and long range plans; financial and tax information; personnel information; business, marketing and operational projections, plans and opportunities; and customer, vendor, and supplier information; but excluding: any such...

-

Page 92

... Frasch ("Executive") and Bergdorf Goodman, Inc., a New York corporation, ("Bergdorf"), and replaces and supersedes in its entirety that certain Termination and Change of Control Agreement between Executive and The Neiman Marcus Group, Inc., a Delaware corporation ("NMG"), dated April 27, 2000 (the...

-

Page 93

...'s employment for any reason other than for "Cause," his "Total Disability," or his death, subject to paragraphs 1(c) and 1(d) below, Bergdorf shall provide Executive with benefits ("Termination Benefits") consisting of: (1) an amount equivalent to one and one-half times his then-current annual base...

-

Page 94

... due thereunder. 2. Executive acknowledges and agrees that (a) Bergdorf is engaged in a highly competitive business; (b) Bergdorf has expended considerable time and resources to develop goodwill with its customers, vendors, and others, and to create, protect, and exploit Confidential Information; 3

-

Page 95

... use or disclosure of its Confidential Information to avoid irreparable harm to its legitimate business interests; (d) in the specialty retail business, his participation in or direction of Bergdorf's day-to-day operations and strategic planning are an integral part of Bergdorf's continued success...

-

Page 96

... a customer, supplier, or vendor of Bergdorf, NMG or their Affiliates or to divert all or any part of such person's or entity's business from Bergdorf, NMG or their Affiliates; and (d) He will not associate directly or indirectly, as an employee, officer, director, agent, partner, stockholder, owner...

-

Page 97

...to the end of Executive's employment with Bergdorf. However, nothing in this Agreement is intended to limit any earned, vested benefits (other than any entitlement to severance or separation pay, if any) that Executive may have under the applicable provisions of any benefit plan of Bergdorf in which...

-

Page 98

... and obligations under this Agreement shall survive the end of his employment with Bergdorf, and such promises and obligations shall inure to the benefit of any Affiliates, subsidiaries, divisions, successors, or assigns of Bergdorf. BERGDORF GOODMAN, INC. /s/ Ronald L. Frasch RONALD L. FRASCH By...

-

Page 99

It is acknowledged and agreed that the 2000 Agreement is hereby replaced and superseded by this Agreement. THE NEIMAN MARCUS GROUP, INC. By: 8 /s/ Marita O'Dea Marita O'Dea, Senior Vice President

-

Page 100

... medium, concerning or evidencing sales; costs; pricing; strategies; forecasts and long range plans; financial and tax information; personnel information; business, marketing and operational projections, plans and opportunities; and customer, vendor, and supplier information; but excluding any such...

-

Page 101

... is employed "at will" as President and Chief Executive Officer of Neiman Marcus Stores and either Executive or NMG may terminate Executive's employment at any time, with or without notice, and for any reason; WHEREAS, in connection with the restructuring of the compensation and benefits provided...

-

Page 102

... from the current location, which change causes Executive to resign her employment with NMG, will be deemed a termination by NMG. A transfer of employment between NMG and its Affiliates shall not be considered as a termination of employment for purposes of this Agreement. (b) NMG shall require any...

-

Page 103

... interests; (d) in the specialty retail business, her participation in or direction of NMG's day-to-day operations and strategic planning as a result of her promotion will be an integral part of NMG's continued success and goodwill; (e) given her new position and responsibilities, she necessarily...

-

Page 104

..., supplier, or vendor of NMG or any of its Affiliates or to divert all or any part of such person's or entity's business from NMG or any of its Affiliates; and (d) She will not associate directly or indirectly, as an employee, officer, director, agent, partner, stockholder, owner, representative, or...

-

Page 105

... or any of its Affiliates listed on a national securities exchange or actively traded in the over-the-counter market if she and the members of her immediate family do not, directly or indirectly, hold more than a total of one (1) percent of all such shares of stock or other securities issued...

-

Page 106

... obligations under this Agreement shall survive the end of her employment with NMG, and such promises and obligations shall inure to the benefit of any Affiliates, subsidiaries, divisions, successors, or assigns of NMG. THE NEIMAN MARCUS GROUP, INC. /s/ Karen W. Katz Karen W. Katz 6 By: /s/ Marita...

-

Page 107

... medium, concerning or evidencing sales; costs; pricing; strategies; forecasts and long range plans; financial and tax information; personnel information; business, marketing and operational projections, plans and opportunities; and customer, vendor, and supplier information; but excluding any such...

-

Page 108

... NMG, including Executive, the Board of Directors of NMG has determined that stock option and restricted stock awards should be combined with appropriate post-employment and other restrictions designed to protect the legitimate business interests of NMG and its Affiliates; WHEREAS, NMG and Executive...

-

Page 109

... from the current location, which change causes Executive to resign his employment with NMG, will be deemed a termination by NMG. A transfer of employment between NMG and its Affiliates shall not be considered as a termination of employment for purposes of this Agreement. (b) NMG shall require any...

-

Page 110

... Information to the disadvantage of NMG or its Affiliates or for his own or a third party's benefit; (g) in the specialty retail business, his participation in or direction of NMG's day-to-day operations, strategic planning, and legal affairs are an integral part of NMG's continued success...

-

Page 111

... Confidential Information to any person other than an officer, director, or employee of NMG to the extent necessary for the proper performance of his responsibilities unless authorized to do so by NMG, compelled to do so by law or valid legal process, or required to do so by the Texas Disciplinary...

-

Page 112

... of its Affiliates would result in the inevitable disclosure or use of Confidential Information for the Competitor's benefit or to the detriment of NMG; and (e) He will not associate directly or indirectly, in a non-legal capacity as an employee, officer, director, agent, partner, stockholder, owner...

-

Page 113

on a national securities exchange or actively traded in the over-the-counter market if he and the members of his immediate family do not, directly or indirectly, hold more than a total of one (1) percent of all such shares of stock or other securities issued and outstanding. Executive acknowledges ...

-

Page 114

... and obligations under this Agreement shall survive the end of his employment with NMG, and such promises and obligations shall inure to the benefit of any Affiliates, subsidiaries, divisions, successors, or assigns of NMG. THE NEIMAN MARCUS GROUP, INC. /s/ Nelson A. Bangs Nelson A. Bangs 7 By...

-

Page 115

... medium, concerning or evidencing sales; costs; pricing; strategies; forecasts and long range plans; financial and tax information; personnel information; business, marketing and operational projections, plans and opportunities; and customer, vendor, and supplier information; but excluding any such...

-

Page 116

... of the normal working days during six consecutive calendar months or 50% or more of the normal working days during twelve consecutive calendar months, or (ii) Executive has become totally and permanently incapable of performing the usual duties of his employment with NMG on account of a physical or...

-

Page 117

... NMG, including Executive, the Board of Directors of NMG has determined that stock option and restricted stock awards should be combined with appropriate post-employment and other restrictions designed to protect the legitimate business interests of NMG and its Affiliates; WHEREAS, NMG and Executive...

-

Page 118

... from the current location, which change causes Executive to resign his employment with NMG, will be deemed a termination by NMG. A transfer of employment between NMG and its Affiliates shall not be considered as a termination of employment for purposes of this Agreement. (b) NMG shall require any...

-

Page 119

...interests; (d) in the specialty retail business, his participation in or direction of NMG's day-to-day operations and strategic planning as a result of his promotion will be an integral part of NMG's continued success and goodwill; (e) given his new position and responsibilities, he necessarily will...

-

Page 120

..., supplier, or vendor of NMG or any of its Affiliates or to divert all or any part of such person's or entity's business from NMG or any of its Affiliates; and (d) He will not associate directly or indirectly, as an employee, officer, director, agent, partner, stockholder, owner, representative, or...

-

Page 121

... or any of its Affiliates listed on a national securities exchange or actively traded in the over-the'-counter market if he and the members of his immediate family do not, directly or indirectly, hold more than a total of one (1) percent of all such shares of stock or other securities issued...

-

Page 122

... and obligations under this Agreement shall survive the end of his employment with NMG, and such promises and obligations shall inure to the benefit of any Affiliates, subsidiaries, divisions, successors, or assigns of NMG. THE NEIMAN MARCUS GROUP, INC. /s/ James E. Skinner James E. Skinner 6 By...

-

Page 123

... medium, concerning or evidencing sales; costs; pricing; strategies; forecasts and long range plans; financial and tax information; personnel information; business, marketing and operational projections, plans and opportunities; and customer, vendor, and supplier information; but excluding: any such...

-

Page 124

... NMG, including Executive, the Board of Directors of NMG has determined that stock option and restricted stock awards should be combined with appropriate post-employment and other restrictions designed to protect the legitimate business interests of NMG and its Affiliates; WHEREAS, NMG and Executive...

-

Page 125

... from the current location, which change causes Executive to resign her employment with NMG, will be deemed a termination by NMG. A transfer of employment between NMG and its Affiliates shall not be considered as a termination of employment for purposes of this Agreement. (b) NMG shall require any...

-

Page 126

... interests; (d) in the specialty retail business, her participation in or direction of NMG's day-to-day operations and strategic planning as a result of her promotion will be an integral part of NMG's continued success and goodwill; (e) given her new position and responsibilities, she necessarily...

-

Page 127

..., supplier, or vendor of NMG or any of its Affiliates or to divert all or any part of such person's or entity's business from NMG or any of its Affiliates; and (d) She will not associate directly or indirectly, as an employee, officer, director, agent, partner, stockholder, owner, representative, or...

-

Page 128

... or any of its Affiliates listed on a national securities exchange or actively traded in the over-thecounter market if she and the members of her immediate family do not, directly or indirectly, hold more than a total of one (1) percent of all such shares of stock or other securities issued...

-

Page 129

... and obligations under this Agreement shall survive the end of her employment with NMG, and such promises and obligations shall inure to the benefit of any Affiliates, subsidiaries, divisions, successors, or assigns of NMG. THE NEIMAN MARCUS GROUP, INC. s/s Marita O'Dea Marita O'Dea By: 6 /s/ Nelson...

-

Page 130

... medium, concerning or evidencing sales; costs; pricing; strategies; forecasts and long range plans; financial and tax information; personnel information; business, marketing and operational projections, plans and opportunities; and customer, vendor, and supplier information; but excluding any such...

-

Page 131

...and is being promoted to an executive position as President and Chief Executive Officer of Neiman Marcus Direct, a division of NMG; WHEREAS either Executive or NMG may terminate Executive's employment at any time, with or without notice, and for any reason; WHEREAS, the Board of Directors of NMG has...

-

Page 132

... prevent the dilution of its goodwill and unauthorized use or disclosure of its Confidential Information to avoid irreparable harm to its legitimate business interests; (d) in the specialty retail business, his participation in or direction of NMG's day-to-day operations and strategic planning as 2

-

Page 133

... engage in any of the following activities (the "Restricted Activities"): (a) He will not directly or indirectly disparage NMG or its Affiliates, any products, services, or operations of NMG or its Affiliates, or any of the former, current, or future officers, directors, or employees of NMG or its...

-

Page 134

..., supplier, or vendor of NMG or any of its Affiliates or to divert all or any part of such person's or entity's business from NMG or any of its Affiliates; and (d) He will not associate directly or indirectly, as an employee, officer, director, agent, partner, stockholder, owner, representative, or...

-

Page 135

... with respect to the end of Executive's employment with NMG. However, nothing in this Agreement is intended to limit any earned, vested benefits (other than any entitlement to severance or separation pay, if any) that Executive may have under the applicable provisions of any benefit plan of NMG in...

-

Page 136

... medium, concerning or evidencing sales; costs; pricing; strategies; forecasts and long range plans; financial and tax information; personnel information; business, marketing and operational projections, plans and opportunities; and customer, vendor, and supplier information; but excluding: any such...

-

Page 137

...)

Years Ended July 28, 2001

(in thousands, except ratios)

August 2, 2003

August 3, 2002 (1)

July 29, 2000

July 31, 1999

Fixed Charges: Interest on debt Amortization of debt discount and expense Interest element of rentals Total fixed charges Earnings: Earnings before income taxes, minority...

-

Page 138

Exhibit 14.1 CODE of ETHICS and CONDUCT THE NEIMAN MARCUS GROUP, INC.

-

Page 139

... TO EMPLOYEES OF THE NEIMAN MARCUS GROUP, INC. THE CODE CONSEQUENCES OF NON-COMPLIANCE DUTY TO REPORT COMPLIANCE WITH LAWS AND RELATED POLICIES GENERAL OBLIGATION TO DEAL FAIRLY ANTITRUST LAWS INSIDER TRADING EMPLOYMENT LAWS Equal Employment Opportunity Sexual Harassment Reporting Discrimination...

-

Page 140

ADVERTISING RECORD KEEPING Preparation of Records Retention of Records E-MAIL, VOICE MAIL AND THE INTERNET Appropriate Use Privacy Creation and Retention of Messages CONFLICTS OF INTEREST Gifts Entertainment DRUG AND ALCOHOL USE AND TESTING ENVIRONMENTAL COMPLIANCE IMPLEMENTATION OF THE CODE THE ...

-

Page 141

... Officers within these units to whom questions and reports of violations may be addressed. Employees may discuss matters with whomever they feel most comfortable: their supervisor, a member of the Compliance Committee, their Compliance Officer or any lawyer in the Company's Legal Department...

-

Page 142

.... Each employee will be required to certify that he or she understands the Code and will abide by it. We must rely on each employee's good judgement and recognition that only employees who abide by the Code and the Company's policies have a place with us. Working together, we can take personal pride...

-

Page 143

... with applicable laws and Company policies. For purposes of this Code, (i) all references to the employees of The Neiman Marcus Group, Inc. or the "Company" shall also include all employees of Neiman Marcus Stores, Neiman Marcus Direct, Neiman Marcus Online, Bergdorf Goodman, Inc., Bergdorf Graphics...

-

Page 144

... Committee. Any employee who believes the supervisor to whom he or she has reported a violation or suspected violation has not taken appropriate action should promptly contact his or her designated Compliance Officer, the Legal Department or the Compliance Committee directly. The Company will not...

-

Page 145

...to the customer, costs and competitive pressure in the marketplace. Employees must not communicate either directly or indirectly with competitors concerning sensitive information such as prices charged, sale dates or percentages, business or marketing strategies, profit margins or credit and billing...

-

Page 146

... important development in which the Company is or may be involved, shall not buy or sell shares of stock or other securities of the Company (or puts, calls, options or other rights to buy or sell such securities) until a reasonable time after public disclosure of such inside information. Employees...

-

Page 147

... the Company; a stock split or change in dividend; significant litigation; or changes in customary earnings and earnings trends. What constitutes public disclosure? Information effectively is disclosed to the public if it is contained in an annual or quarterly report to stockholders, a press release...

-

Page 148

..., Associate Relations, his or her designated Compliance Officer, the Compliance Committee, or the Legal Department. Any manager or executive to whom discrimination or harassment is reported must immediately forward that information to the Human Resources Department for investigation. The Company...

-

Page 149

...are provided with a healthy work environment, employees who contract diseases that are dangerous and easily communicable to co-workers must notify their supervisor, their Human Resources Department, their designated Compliance Officer, or the Compliance Committee. AMERICANS WITH DISABILITIES ACT The...

-

Page 150

.... Employees involved in buying apparel made from such fabrics are responsible for obtaining from vendors copies of test results indicating that the fabrics used in clothing sold to the Company meet the flammability standards. Alternatively, vendors may provide copies of applicable Continuing...

-

Page 151

... to the Legal Department. TRADEMARK PROTECTION A trademark is a word, symbol, name, device or any combination of these things used to identify a product or line of products or services and to distinguish them from the products and services of other companies. The Company owns a number of trademarks...

-

Page 152

...mandated. Employees shall not, at any time, either directly or indirectly, divulge, disclose or communicate to any person, firm, or corporation any confidential or non-public information concerning or relating to the business of the Company, including the names of any of its customers, the prices at...

-

Page 153

... of payment to any foreign official, employee or agent of a foreign official, political party official or candidate for political office to induce that person to affect any governmental act or decision or to assist the Company in obtaining or retaining business. This policy applies to payments in...

-

Page 154

... boycott provisions. As the Company is required to report boycott requests, employees must inform their designated Compliance Officer, the Compliance Committee, or the Legal Department of any such requests. U.S. EMBARGOES Employees shall conduct the Company's business in accordance with the trade...

-

Page 155

personal expense, as campaign finance and ethics laws and Company policy generally prohibit the use of Company funds, assets, services or facilities on behalf of a political party or candidate. Unless authorized by the Company, employees who engage in such political activities or make any public ...

-

Page 156

...the Company comply with the laws that the states have put into place. An employee shall never offer a customer the option or opportunity to ship a purchase in order to avoid paying sales tax. The Point of Sale (POS) system has been programmed to collect the proper sales tax in each store and account...

-

Page 157

...sue any devise to record, monitor or listen to communications between others without the prior approval of the Legal Department, and without consent of all parties to the communications required under the law. Without express permission from the Legal Department, employees may not use any electronic...

-

Page 158

... public reports, including financial reports filed with the Securities and Exchange Commission, reports regarding meetings with members of the financial community and previously issued press releases. Employees are to refer any such requests to the Chief Financial Officer, Vice President of Finance...

-

Page 159

... of specific products or services. Employees involved in the preparation or publication of advertising must seek advice from the Legal Department regarding specific laws and regulations before disseminating advertising claims. RECORD KEEPING Employees must accurately prepare all Company records to...

-

Page 160

... the period set forth in the record retention policy applicable to the relevant subsidiary or business unit of the Company. E-MAIL, VOICE MAIL AND THE INTERNET The Company encourages the use of electronic mail and voice mail because these methods of communication are efficient and effective. It also...

-

Page 161

..., like other official communications, e-mail messages sent via the Internet must responsibly represent the Company. Employees must not post confidential or sensitive Company information on the Internet, including websites, news groups, chat rooms, and other similar locations. Employees shall not...

-

Page 162

... or services from a supplier of the Company at less than retail price (other than the normal discount available to all employees of the Company or to the general public). In addition, an employee has a conflict if he or she, or a member of his or her family, may benefit from the employee's position...

-

Page 163

...retail value); or (2) they are product samples, clearly marked with company or brand names, and distributed to a large group of our employees on an equal basis. Any gift of more than nominal intrinsic value must be reported to Marita O'Dea, Lee Roever or Nina Fabian in the Human Resources Department...

-

Page 164

... with personal problems. Information regarding the EAP is available from the Human Resources Department. An employee whose job performance or behavior indicates that he or she may be unfit for duty shall not be permitted to work. If allowed under applicable state laws, the Company may require...

-

Page 165

... to answer all employee questions concerning the meaning and application of the Code and its related policies. Employees also may ask their supervisors to relay questions or concerns to a Compliance Officer, a member of the Compliance Committee, or to the Legal Department. TRAINING AND EDUCATION...

-

Page 166

...of wrongdoing and confers with Company management regarding any recommended corrective action. Employees are expected to cooperate in the investigation of alleged violations of the law or the Code. It is imperative, however, that employees not conduct even a preliminary investigation of any possible...

-

Page 167

... Code, and violations of any laws and that I should report such matters to my supervisor, any attorney in the Legal Department, my designated Compliance Officer, the Compliance Committee, or Associate Relations. The Company reserves the right to update, amend or modify the Code at any time without...

-

Page 168

Please return this form to your Department Manager or Human Resources Department. 31

-

Page 169

Exhibit 14.2 NEIMAN MARCUS GROUP CODE OF ETHICS FOR FINANCIAL PROFESSIONALS The Neiman Marcus Group ("NMG") encourages professional conduct in the practice of its financial management companywide. Employees of the finance organization hold an important and elevated role in corporate governance in ...

-

Page 170

... company reports and records, based on good faith judgment. Achieve responsible use of and control over all assets and resources employed or entrusted.

You are specifically prohibited from directly or indirectly taking any action to influence, coerce, manipulate or mislead NMG's independent public...

-

Page 171

..., Inc. NMGP, LLC NM Nevada Trust Neiman Marcus Funding Corporation Neiman Marcus Holdings, Inc. Neiman Marcus Special Events, Inc. Quality Call Care Solutions, Inc. Worth Avenue Leasing Company

Delaware Delaware Texas Texas Mexico Delaware Virginia Massachusetts Delaware California Delaware Ontario...

-

Page 172

...on Form S-8, and No. 333-49893 on Form S-3 of The Neiman Marcus Group, Inc. and subsidiaries of our report, dated September 18, 2003, appearing in the Annual Report on Form 10-K of The Neiman Marcus Group, Inc. for the year ended August 2, 2003. /s/DELOITTE & TOUCHE LLP Dallas, Texas October 1, 2003

-

Page 173

... financial information; and b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: October 1, 2003 BURTON M. TANSKY Burton M. Tansky President and Chief Executive Officer /s/

-

Page 174

... information; and b) any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. Date: October 1, 2003 JAMES E. SKINNER James E. Skinner Senior Vice President and Chief Financial Officer...

-

Page 175

...-Oxley Act of 2002, the undersigned officer of The Neiman Marcus Group, Inc. (the Company) hereby certifies, to such officer's knowledge, that: (i) the Annual Report on Form 10-K of the Company for the fiscal year ended August 2, 2003 (the Report) fully complies with the requirements of Section 13...