Motorola 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

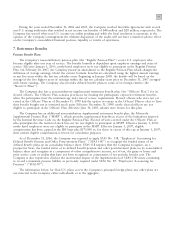

91

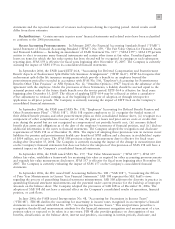

Stockholders' Equity

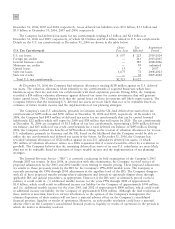

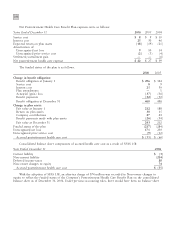

Derivative instruments activity, net of tax, included in Non-owner changes to equity within Stockholders'

Equity for the years ended December 31, 2006 and 2005 is as follows:

2006

2005

Balance at January 1 $2$(272)

Increase in fair value 75 28

Reclassifications to earnings (61) 246

Balance at December 31 $16 $2

Fair Value Hedges

The Company recorded income of $0.6 million, $1.5 million and $0.1 million for the years ended

December 31, 2006, 2005 and 2004, respectively, representing the ineffective portions of changes in the fair value of

fair value hedge positions. These amounts are included in Other within Other income (expense) in the Company's

consolidated statements of operations. The above amounts include the change in the fair value of derivative

contracts related to the changes in the difference between the spot price and the forward price. These amounts are

excluded from the measure of effectiveness. Expense (income) related to fair value hedges that were discontinued

for the years ended December 31, 2006, 2005 and 2004 are included in the amounts noted above.

Cash Flow Hedges

The Company recorded income (expense) of $13 million, $1 million and $(12) million for the years ended

December 31, 2006, 2005 and 2004, respectively, representing the ineffective portions of changes in the fair value of

cash flow hedge positions. These amounts are included in Other within Other income (expense) in the Company's

consolidated statements of operations. The above amounts include the change in the fair value of derivative

contracts related to the changes in the difference between the spot price and the forward price. These amounts are

excluded from the measure of effectiveness. Expense (income) related to cash flow hedges that were discontinued

for the years ended December 31, 2006, 2005 and 2004 are included in the amounts noted above.

During the years ended December 31, 2006, 2005 and 2004, on a pre-tax basis, income (expense) of

$(98) million, $21 million and $(27) million, respectively, was reclassified from equity to earnings in the

Company's consolidated statements of operations. If exchange rates do not change from year-end, the Company

estimates that $16 million of pre-tax net derivative income included in Non-owner changes to equity within

Stockholders' equity would be reclassified into earnings within the next twelve months and will be reclassified in

the same period that the hedged item affects earnings. The actual amounts that will be reclassified into earnings

over the next twelve months will vary from this amount as a result of changes in market conditions.

At December 31, 2006, the maximum term of derivative instruments that hedge forecasted transactions was

two years. However, the weighted average duration of the Company's derivative instruments that hedge forecasted

transactions was seven months.

Net Investment in Foreign Operations Hedge

At December 31, 2006 and 2005, the Company did not have any hedges of foreign currency exposure of net

investments in foreign operations.

Investments Hedge

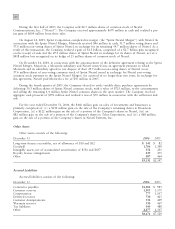

During the first quarter of 2006, the Company entered into a zero-cost collar derivative (the ""Sprint Nextel

Derivative'') to protect itself economically against price fluctuations in its 37.6 million shares of Sprint Nextel

Corporation (""Sprint Nextel'') non-voting common stock. During the second quarter of 2006, as a result of Sprint

Nextel's spin-off of Embarq Corporation through a dividend to Sprint Nextel shareholders, the Company received

approximately 1.9 million shares of Embarq Corporation. The floor and ceiling prices of the Sprint Nextel

Derivative were adjusted accordingly. The Sprint Nextel Derivative was not designated as a hedge under the