Motorola 2006 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

compared to earnings from continuing operations of $2.1 billion, or $0.87 per diluted share from continuing

operations, in 2004.

The $3.3 billion increase in earnings from continuing operations before income taxes is primarily attributed to:

(i) a $1.5 billion increase in gross margin, primarily due to the $5.6 billion increase in total net sales, (ii) a

$1.4 billion increase in gains on sales of investments and businesses, (iii) a $553 million increase in income

classified as Other, (iv) a $271 million increase in net interest income, and (v) a $31 million decrease in expenses

classified as Other, as presented in Other income (expense). These improvements in earnings were partially offset

by: (i) a $284 million increase in R&D expenditures, and (ii) a $120 million increase in SG&A expenses.

Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the ""Severance Plan'') which permits the

Company to offer eligible employees severance benefits based on years of service and employment grade level in

the event that employment is involuntarily terminated as a result of a reduction-in-force or restructuring. Each

separate reduction-in-force has qualified for severance benefits under the Severance Plan and, therefore, such

benefits are accounted for in accordance with Statement No. 112, ""Accounting for Postemployment Benefits''

(""SFAS 112''). Under the provisions of SFAS 112, the Company recognizes termination benefits based on formulas

per the Severance Plan at the point in time that future settlement is probable and can be reasonably estimated

based on estimates prepared at the time a restructuring plan is approved by management. Exit costs primarily

consist of future minimum lease payments on vacated facilities. At each reporting date, the Company evaluates its

accruals for exit costs and employee separation costs to ensure the accruals are still appropriate. In certain

circumstances, accruals are no longer required because of efficiencies in carrying out the plans or because

employees previously identified for separation resigned from the Company and did not receive severance or were

redeployed due to circumstances not foreseen when the original plans were initiated. The Company reverses

accruals through the income statement line item where the original charges were recorded when it is determined

they are no longer required.

The Company realized cost-saving benefits of approximately $54 million in 2006 from the plans that were

initiated during 2006, representing: (i) $31 million of savings in R&D expenditures, (ii) $14 million of savings in

SG&A expenses, and (iii) $9 million of savings in Costs of sales. Beyond 2006, the Company expects the

reorganization plans initiated during 2006 to provide annualized cost savings of approximately $214 million,

representing: (i) $101 million of savings in R&D expenditures, (ii) $72 million of savings in SG&A expenses, and

(iii) $41 million of savings in Cost of sales.

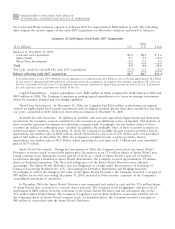

2006 Charges

During the year ended December 31, 2006, the Company committed to implement various productivity

improvement plans aimed principally at: (i) reducing costs in its supply-chain activities, (ii) integrating the former

Networks segment and Government and Enterprise Mobility Solutions segment into one organization, the

Networks and Enterprise segment, and (iii) reducing other operating expenses, primarily relating to engineering and

development costs. The Company recorded net reorganization of business charges of $213 million, including

$41 million of charges in Costs of sales and $172 million of charges under Other charges in the Company's

consolidated statement of operations. Included in the aggregate $213 million are charges of $191 million for

employee separation costs, $15 million for fixed asset impairment charges and $30 million for exit costs, partially

offset by $23 million of reversals for accruals no longer needed. Total employees impacted by the actions

committed to in 2006 are 3,900.

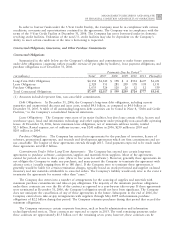

The following table displays the net reorganization of business charges by segment:

Year Ended December 31, 2006

Mobile Devices $ (1)

Networks and Enterprise 157

Connected Home Solutions 50

206

General Corporate 7

$213