Motorola 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

2007. The segment's sales of iDEN network infrastructure equipment decreased from 2005 to 2006 and is expected

to continue to decline in 2007.

During 2006, the segment completed a number of significant acquisitions, including: (i) Orthogon Systems LLC,

a leader in wireless Ethernet connectivity and orthogonal frequency division multiplexing (""OFDM'') technology for

fixed wireless equipment, and (ii) NextNet Wireless, Inc., a former Clearwire Corporation subsidiary and a leading

provider of OFDM-based non-line-of-sight (""NLOS'') wireless broadband infrastructure equipment.

The acquisition of Symbol is an important step forward for our enterprise mobility strategy. Consistent with

the segment's focus on extending our seamless mobility leadership, the acquisition unites the adjacent assets,

expertise, customer bases, supplier bases and industry-leading products to enhance the segment's leading position in

the enterprise mobility market.

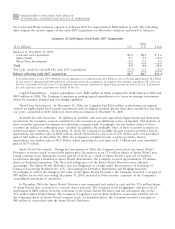

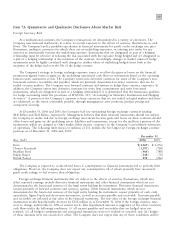

Segment ResultsÌ2005 Compared to 2004

In 2005, the segment's net sales increased 7% to $11.2 billion, compared to $10.5 billion in 2004. The increase

in net sales was primarily driven by higher net sales in North America and EMEA, partially offset by lower net sales

in Asia and Latin America. In 2005 compared to 2004, net sales to the private networks market were up in all

regions, driven by increased demand for enhanced mission-critical communications systems and the continued focus

on homeland security initiatives. Net sales to the public networks market: (i) increased in EMEA and North

America, primarily due to increased demand for cellular infrastructure equipment and related services, and

(ii) decreased in Asia, due in part to delays in the granting of 3G licenses in China that have led service providers

to slow their near-term capital investment, and in Latin America.

The segment's operating earnings increased to $1.9 billion in 2005, compared to operating earnings of

$1.6 billion in 2004. The 25% increase in operating earnings was primarily due to: (i) an increase in gross margin,

driven by the 7% increase in net sales, and (ii) improvements in cost structure for the public networks market. This

improvement in operating results was partially offset by: (i) an increase in SG&A expenses, primarily due to

increased selling and sales support expenses associated with the increase in net sales, and (ii) an increase in R&D

expenditures, driven by increased investment in next-generation technologies across the segment. As a percentage of

net sales in 2005 compared to 2004, R&D expenditures decreased and SG&A expenses increased.

Net sales into U.S. markets represented approximately 52% of the segment's total net sales in 2005, compared to

approximately 50% in 2004. Net sales to the segment's top five commercial customers, plus the U.S. government and

its public safety agencies, represented approximately 37% of the segment's net sales in 2005. The loss of one of these

major customers could have a significant impact on the segment's business and, because many of these contracts are

long-term in nature, could impact revenue and earnings over several quarters. The segment's backlog was $4.1 billion

at December 31, 2005, compared to $4.2 billion at December 31, 2004.

On August 12, 2005, Sprint Corporation and Nextel Communications, Inc. completed their merger transaction

(the ""Sprint Nextel Merger'') that was announced in December 2004. In 2005, the combined company, Sprint

Nextel, was the segment's largest customer, representing 14% of the segment's net sales. The segment did not

experience any significant impact to its business in 2005 as a result of the Sprint Nextel Merger.

In 2005, the segment continued to build on its industry-leading position in push-to-talk over cellular (""PoC'')

technology, executing agreements to launch our PoC product application on both GSM and CDMA2000 networks.

The segment had 44 commercial deployments of PoC technology with customers operating in 33 countries and

territories through 2005. In addition, the segment signed a contract with Earthlink to deliver equipment and services

enabling them to become a Metro WiFi broadband provider in Philadelphia, Anaheim and other cities.

Connected Home Solutions Segment

The Connected Home Solutions segment designs, manufactures, sells and services: (i) cable television, Internet

Protocol (""IP'') video and broadcast network set-top boxes (""digital entertainment devices''), (ii) end-to-end

digital video system solutions, (iii) broadband access networks, and (iv) IP-based data and voice products