Motorola 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58 MANAGEMENT'S DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

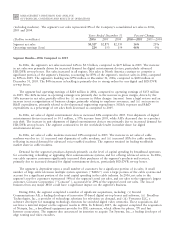

Networks and Enterprise Segment

The Networks and Enterprise segment designs, manufactures, sells, installs and services: (i) cellular

infrastructure systems and wireless broadband systems to public carriers and other wireless service providers

(referred to as the ""public networks'' market), and (ii) analog and digital two-way radio, voice and data

communications products and systems, as well as wireless broadband systems, to a wide range of public safety,

government, utility, transportation and other worldwide enterprise markets (referred to as the ""private networks''

market). In January 2007, the segment completed the acquisition of Symbol Technologies Inc. (""Symbol''), a

leader in designing, developing, manufacturing and servicing products and systems used in end-to-end enterprise

mobility solutions. Symbol will become the cornerstone of the segment's enterprise mobility strategy. In 2006, the

segment's net sales represented 26% of the Company's consolidated net sales, compared to 32% in 2005 and 35% in

2004.

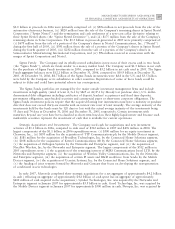

Years Ended December 31 Percent Change

(Dollars in millions)

2006

2005 2004

2006 Ì 2005

2005Ì2004

Segment net sales $11,245 $11,202 $10,465 0% 7%

Operating earnings 1,521 1,939 1,550 (22)% 25%

Segment ResultsÌ2006 Compared to 2005

The segment's net sales were $11.2 billion in both 2006 and 2005. The slight increase in net sales was primarily

driven by higher net sales in the Europe, Middle East and Africa region (""EMEA'') and Latin America, partially

offset by lower net sales in North America and Asia. In the private networks market, net sales were up in all

regions, driven by increased demand for enhanced mission-critical communications systems. Net sales to the public

networks market decreased, primarily due to decreases in: (i) Asia, due in part to delays in the granting of 3G

licenses in China that have led service providers to slow their near-term capital investment and competitive pricing,

(ii) North America, primarily due to customer expenditures returning to historic trends compared to an

exceptionally strong 2005, and (iii) Latin America, partially offset by a slight increase in net sales in EMEA.

The segment's operating earnings were $1.5 billion in 2006, compared to operating earnings of $1.9 billion in

2005. The 22% decrease in operating earnings was primarily due to: (i) a decrease in gross margin, due to an

unfavorable product/regional mix and competitive pricing in the public networks market, and (ii) an increase in

reorganization of business charges, primarily related to employee severance. As a percentage of net sales, both R&D

expenditures and SG&A expenses were flat compared to 2005.

Net sales into U.S. markets represented approximately 51% of the segment's total net sales in 2006, compared

to approximately 52% in 2005. Due to the nature of the segment's business, many of the agreements we enter into

are long-term contracts that require sizeable investments by our customers. Net sales to the segment's top

five commercial customers, plus the U.S. government and its public safety agencies, represented approximately 34%

of the segment's net sales in 2006. The loss of one of these major customers could have a significant impact on the

segment's business and, because many of these contracts are long-term in nature, could impact revenue and earnings

over several quarters. The segment's backlog was $4.4 billion at December 31, 2006, compared to $4.1 billion at

December 31, 2005.

In the private networks business, natural disasters and terrorist-related worldwide events in 2005 continued to

place an emphasis on mission-critical communications systems. Spending by the segment's private networks market

customers is affected by government budgets at the national, state and local levels.

In the public networks business, Sprint Nextel selected the segment to play a major role in the Sprint Nextel

WiMAX infrastructure roll-out. The segment has been a long-standing proponent of WiMAX and is now

participating in 22 WiMAX trials globally. The segment also maintained momentum in infrastructure development

and services in 2006 by continuing to deliver outstanding technologies and services for wireless and wireline

carriers. The segment has 55 commercial deployments of push-to-talk over cellular (""PoC'') technology with

customers operating in 39 countries through 2006.

Sprint Nextel is the segment's largest customer and the segment has been Sprint Nextel's sole supplier of iDEN

network infrastructure equipment for more than ten years. Sprint Nextel uses Motorola's proprietary iDEN

technology to support its nationwide wireless service business. Motorola is currently operating under a supply

agreement for iDEN infrastructure equipment that covers the period from January 1, 2005 through December 31,