Motorola 2006 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

118

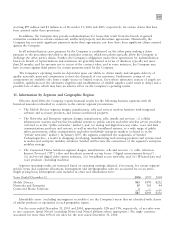

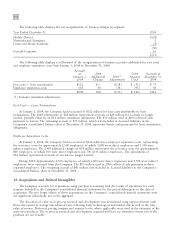

Amortized intangible assets, excluding goodwill by business segment:

2006

2005

Gross Gross

Carrying Accumulated Carrying Accumulated

December 31 Amount Amortization Amount Amortization

Mobile Devices $154 $ 41 $36 $14

Networks and Enterprise 273 151 250 119

Connected Home Solutions 463 344 382 304

$890 $536 $668 $437

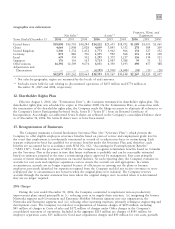

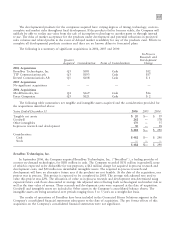

The following tables display a rollforward of the carrying amount of goodwill from January 1, 2005 to

December 31, 2006, by business segment:

January 1, December 31,

Segment 2006 Acquired Adjustments 2006

Mobile Devices $ 17 $ 52 $Ì $ 69

Networks and Enterprise 539 73 (1) 611

Connected Home Solutions 793 211 22 1,026

$1,349 $336 $21 $1,706

January 1, December 31,

Segment 2005 Acquired Adjustments 2005

Mobile Devices $ 17 $Ì $ Ì $ 17

Networks and Enterprise 484 73 (18) 539

Connected Home Solutions 782 16 (5) 793

$1,283 $89 $(23) $1,349

The goodwill impairment test is performed at the reporting unit level and is a two-step analysis. First, the fair

value (""FV'') of each reporting unit is compared to its book value. If the FV of the reporting unit is less than its

book value, the Company performs a hypothetical purchase price allocation based on the reporting unit's FV to

determine the FV of the reporting unit's goodwill. FV is determined with the help of independent appraisal firms

using a combination of present value techniques and quoted market prices of comparable businesses. No

impairment charges were required for the year ended December 31, 2006 or December 31, 2005. For the year

ended December 31, 2004, the Company determined that goodwill related to a sensor group, which was

subsequently divested in 2005, was impaired by a total of $125 million.