Motorola 2006 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

93

earnings that the Company intends to reinvest indefinitely, provisions have been made for the estimated U.S. federal

income taxes applicable to undistributed earnings of non-U.S. subsidiaries. Undistributed earnings that the Company

intends to reinvest indefinitely, and for which no U.S. Federal income taxes has been provided, aggregate

$4.0 billion, $2.8 billion and $5.6 billion at December 31, 2006, 2005 and 2004, respectively. The portion of

earnings not reinvested indefinitely may be distributed without additional U.S. federal income taxes charges given

the U.S. federal tax provisions accrued on undistributed earnings and the utilization of available foreign tax credits.

On October 22, 2004, the American Jobs Creation Act of 2004 (""the Act'') was signed into law. The Act

provides for a special one-time tax incentive for U.S. multinationals to repatriate accumulated earnings from their

foreign subsidiaries by providing an 85 percent dividends received deduction for certain qualifying dividends. The

Company repatriated approximately $4.6 billion of accumulated earnings under the Act and recorded an associated

tax benefit of $265 million in 2005. The Company finalized certain actions maximizing the tax benefit attributable

to the repatriation of foreign earnings under the provisions of the Act and recognized an additional $68 million of

net tax benefits relating to these actions during 2006.

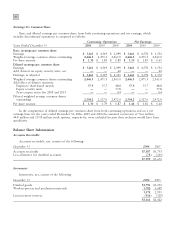

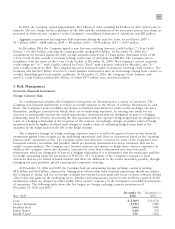

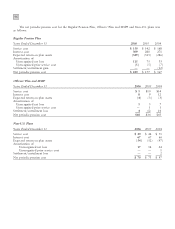

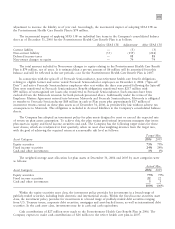

Differences between income tax expense (benefit) computed at the U.S. federal statutory tax rate of 35% and

income tax expense (benefit) are as follows:

Years Ended December 31

2006

2005 2004

Income tax expense at statutory rate $1,613 $2,244 $1,089

Taxes on non-U.S. earnings (449) (460) (528)

State income taxes 77 121 66

Tax benefit on qualifying repatriations (68) (265) Ì

Tax on undistributed non-U.S. earnings 194 202 327

Research credits (34) (23) (72)

Foreign export sales and section 199 deduction (22) (13) (30)

Non-deductible acquisition charges 4211

Goodwill impairments ÌÌ44

Tax benefit on disposition of subsidiaries Ì(81) Ì

Other provisions 247 233 42

Charitable contributions (28) ÌÌ

Valuation allowance (187) (88) (26)

Other 221 90

$1,349 $1,893 $1,013

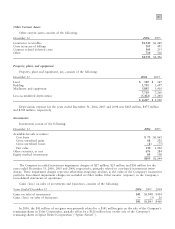

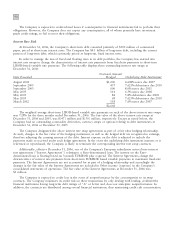

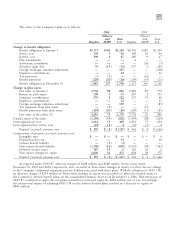

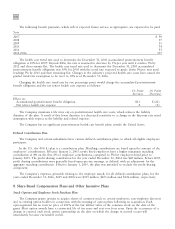

Significant components of deferred tax assets (liabilities) are as follows:

December 31

2006

2005

Inventory $ 163 $ 223

Employee benefits 915 881

Capitalized items 915 1,033

Tax basis differences on investments 110 (104)

Depreciation tax basis differences on fixed assets 89 63

Undistributed non-U.S. earnings (329) (229)

Tax carryforwards 1,515 2,098

Available for sale securities (23) (60)

Business reorganization 38 14

Long-term financing reserves 9152

Warranty and customer reserves 398 356

Deferred revenue 224 101

Valuation allowances (740) (896)

Deferred charges 46 45

Other (357) (146)

$2,973 $3,531

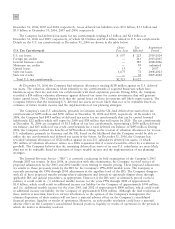

Gross deferred tax assets were $8.7 billion, $9.9 billion and $9.8 billion at December 31, 2006, 2005 and 2004,

respectively. Deferred tax assets, net of valuation allowances, were $8.0 billion, $9.0 billion and $8.9 billion at