Motorola 2006 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

PART II

Item 5: Market for Registrant's Common Equity, Related Stockholder Matters and Issuer

Purchases of Equity Securities

Motorola's common stock is listed on the New York and Chicago Stock Exchanges. The number of

stockholders of record of Motorola common stock on January 31, 2007 was 75,892.

The remainder of the response to this Item incorporates by reference Note 16, ""Quarterly and Other Financial

Data (unaudited)'' of the Notes to Consolidated Financial Statements appearing under ""Item 8: Financial

Statements and Supplementary Data''.

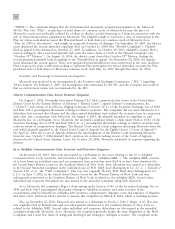

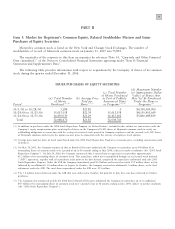

The following table provides information with respect to acquisitions by the Company of shares of its common

stock during the quarter ended December 31, 2006.

ISSUER PURCHASES OF EQUITY SECURITIES

(d) Maximum Number

(c) Total Number (or Approximate Dollar

of Shares Purchased Value) of Shares that

(a) Total Number (b) Average Price as Part of Publicly May Yet Be Purchased

of Shares Paid per Announced Plans Under the Plans or

Period Purchased(1)(4) Share(1)(2) or Programs(3)(4) Programs(5)

10/1/06 to 10/28/06 5,284 $25.82 0 $4,500,000,000

10/29/06 to 11/25/06 15,613,158 $22.39 15,613,158 $4,150,401,669

11/26/06 to 12/31/06 16,430,030 $21.29 16,425,602 $3,800,689,819

Total 32,048,472 $21.83 32,038,760

(1) In addition to purchases under the 2006 Stock Repurchase Program (as defined below), included in this column are transactions under the

Company's equity compensation plans involving the delivery to the Company of 8,445 shares of Motorola common stock to satisfy tax

withholding obligations in connection with the vesting of restricted stock granted to Company employees and the surrender of 1,267 shares

of Motorola common stock to pay the option exercise price in connection with the exercise of employee stock options.

(2) Average price paid per share of stock repurchased under the 2006 Stock Repurchase Program is execution price, excluding commissions paid

to brokers.

(3) On May 18, 2005, the Company announced that its Board of Directors authorized the Company to repurchase up to $4 billion of its

outstanding shares of common stock over a period of up to 36 months ending in May 2008, subject to market conditions (the ""2005 Stock

Repurchase Program''). On July 24, 2006, the Company announced that it entered into an agreement to repurchase approximately

$1.2 billion of its outstanding shares of common stock. This repurchase, which was accomplished through an accelerated stock buyback

(""ASB'') agreement, together with all repurchases made prior to the date thereof, completed the repurchases authorized under the 2005

Stock Repurchase Program. Under the ASB the Company immediately paid $1.2 billion and received an initial 37.9 million shares in July

followed by an additional 11.3 million shares in August. In October, the Company received an additional 1.3 million shares, as the final

adjustment under the ASB. The total shares repurchased under the ASB were 50.5 million.

(4) The 1.3 million shares delivered under the ASB that were delivered in October, but paid for in July, have not been reflected in October

purchases.

(5) The Company also announced on July 24, 2006 that its Board of Directors authorized the Company to repurchase up to an additional

$4.5 billion of its outstanding shares of common stock over a period of up to 36 months ending in June 2009, subject to market conditions

(the ""2006 Stock Repurchase Program'').