Motorola 2006 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

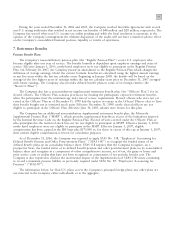

97

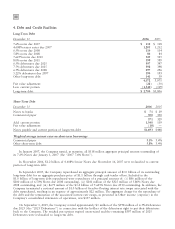

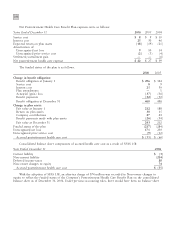

The status of the Company's plans is as follows:

2006

2005

Officers'

Officers'

and Non

and Non

Regular MSPP U.S.

Regular MSPP U.S.

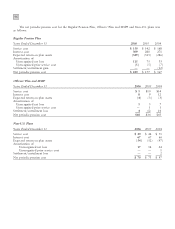

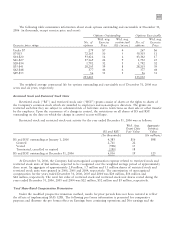

Change in benefit obligation:

Benefit obligation at January 1 $5,175 $160 $1,520 $4,741 $185 $1,310

Service cost 150 5 40 142 10 44

Interest cost 309 8 67 280 9 67

Plan amendments ÌÌ Ì 4Ì Ì

Settlement/curtailment ÌÌ ÌÌ (20) (3)

Actuarial (gain)loss 76 (13) (10) 277 6 264

Foreign exchange valuation adjustment Ì Ì 195 Ì Ì (148)

Employee contributions ÌÌ 12ÌÌ 11

Tax payments Ì (3) Ì Ì (16) Ì

Benefit payments (229) (20) (26) (269) (14) (25)

Benefit obligation at December 31 5,481 137 1,798 5,175 160 1,520

Change in plan assets:

Fair value at January 1 3,736 92 896 3,483 87 772

Return on plan assets 508 3 55 247 2 155

Company contributions 270 6 122 275 33 62

Employee contributions ÌÌ 12ÌÌ 11

Foreign exchange valuation adjustment Ì Ì 119 Ì Ì (83)

Tax payments from plan assets Ì (3) Ì Ì (15) Ì

Benefit payments from plan assets (229) (20) (26) (269) (15) (21)

Fair value at December 31 4,285 78 1,178 3,736 92 896

Funded status of the plan (1,196) (59) (620) (1,439) (68) (624)

Unrecognized net loss 1,612 53 469 1,831 75 454

Unrecognized prior service cost (25) (2) 4 (31) (3) 4

Prepaid (accrued) pension cost $ 391 $ (8) $ (147) $ 361 $ 4 $ (166)

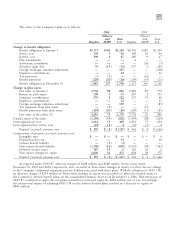

Components of prepaid (accrued) pension cost:

Intangible asset $Ì $Ì $Ì$Ì $Ì $ 4

Prepaid benefit cost ÌÌ 13ÌÌ 18

Current benefit liability Ì (3) (3) ÌÌ Ì

Non-current benefit liability (1,196) (56) (630) (1,023) (58) (563)

Deferred income taxes 587 19 2 526 24 2

Non-owner changes to equity 1,000 32 471 858 38 373

Prepaid (accrued) pension cost $ 391 $ (8) $ (147) $ 361 $ 4 $ (166)

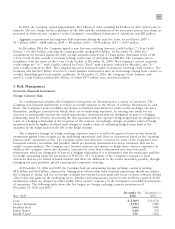

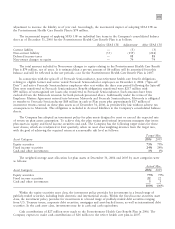

As required under SFAS 87, after-tax charges of $208 million and $188 million for the years ended

December 31, 2005 and 2004, respectively, were recorded in Non-owner changes in equity to reflect the net change

in the Company's additional minimum pension liability associated with these plans. With the adoption of SFAS 158,

an after-tax charge of $234 million to Non-owner changes in equity was recorded to reflect the funded status of

the Company's defined benefit plans on the consolidated balance sheet as of December 31, 2006. Had provisions of

SFAS 87 continued to apply, the Company would have increased equity by $206 million, net of tax. Accordingly,

the incremental impact of adopting SFAS 158 on the defined benefit plans resulted in a decrease to equity of

$440 million.