Motorola 2006 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

113

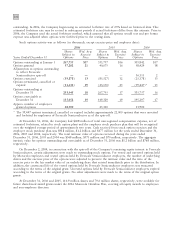

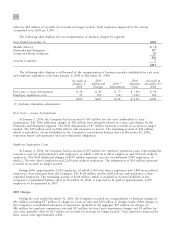

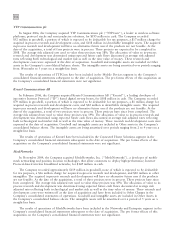

The following table displays the net reorganization of business charges by segment:

Year Ended December 31, 2005

Mobile Devices $27

Networks and Enterprise 52

Connected Home Solutions 4

83

General Corporate 8

$91

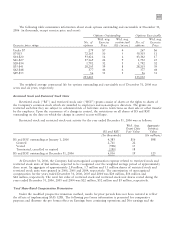

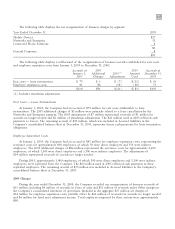

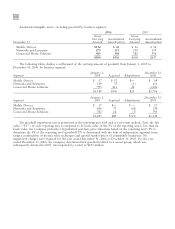

The following table displays a rollforward of the reorganization of business accruals established for exit costs

and employee separation costs from January 1, 2005 to December 31, 2005:

Accruals at 2005 2005 Accruals at

January 1, Additional 2005(1) Amount December 31,

2005 Charges Adjustments Used 2005

Exit costs Ì lease terminations $ 73 $ 5 $ (7) $(21) $ 50

Employee separation costs 41 86 (14) (60) 53

$114 $91 $(21) $(81) $103

(1) Includes translation adjustments.

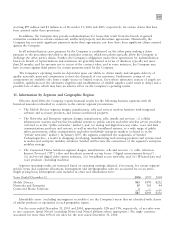

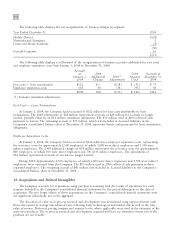

Exit Costs Ì Lease Terminations

At January 1, 2005, the Company had an accrual of $73 million for exit costs attributable to lease

terminations. The 2005 additional charges of $5 million were primarily related to a lease cancellation by the

Networks and Enterprise segment. The 2005 adjustments of $7 million represented reversals of $1 million for

accruals no longer needed and $6 million of translation adjustments. The $21 million used in 2005 reflected cash

payments to lessors. The remaining accrual of $50 million, which was included in Accrued liabilities in the

Company's consolidated balance sheet at December 31, 2005, represents future cash payments for lease termination

obligations.

Employee Separation Costs

At January 1, 2005, the Company had an accrual of $41 million for employee separation costs, representing the

severance costs for approximately 400 employees, of which 50 were direct employees and 350 were indirect

employees. The 2005 additional charges of $86 million represented the severance costs for approximately 2,600

employees, of which 1,300 were direct employees and 1,300 were indirect employees. The adjustments of

$14 million represented reversals of accruals no longer needed.

During 2005, approximately 1,400 employees, of which 300 were direct employees and 1,100 were indirect

employees, were separated from the Company. The $60 million used in 2005 reflected cash payments to these

separated employees. The remaining accrual of $53 million was included in Accrued liabilities in the Company's

consolidated balance sheet at December 31, 2005.

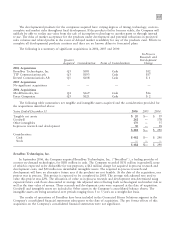

2004 Charges

During the year ended December 31, 2004, the Company recorded net reorganization of business reversals of

$15 million, including $4 million of reversals in Costs of sales and $11 million of reversals under Other charges in

the Company's consolidated statement of operations. Included in the aggregate $15 million are charges of

$54 million for employee separation costs, partially offset by $63 million of reversals for accruals no longer needed

and $6 million for fixed asset adjustment income. Total employees impacted by these actions were approximately

800.