Motorola 2006 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

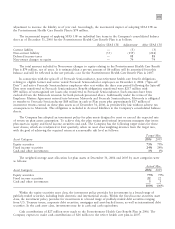

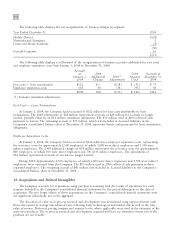

111

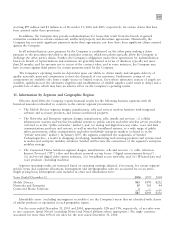

Geographic area information

Property, Plant, and

Net Sales* Assets** Equipment

Years Ended December 31 2006 2005 2004 2006 2005 2004 2006 2005 2004

United States $18,808 $16,701 $14,244 $24,212 $23,635 $18,932 $1,089 $1,010 $1,061

China 4,664 2,908 2,928 4,649 3,843 3,532 278 189 209

United Kingdom 1,306 1,532 1,452 1,773 1,962 966 134 127 132

Germany 874 882 700 1,195 990 968 131 118 138

Israel 659 534 502 1,195 1,372 1,217 156 134 125

Singapore 176 156 163 3,713 2,993 3,388 39 35 32

Other nations 16,392 12,549 9,674 6,051 4,330 5,193 498 457 388

Adjustments and

Eliminations Ì Ì Ì (4,195) (3,958) (4,048) (58) (50) (28)

$42,879 $35,262 $29,663 $38,593 $35,167 $30,148 $2,267 $2,020 $2,057

* Net sales by geographic region are measured by the locale of end customer.

** Excludes assets held for sale relating to discontinued operations of $635 million and $774 million at

December 31, 2005 and 2004, respectively.

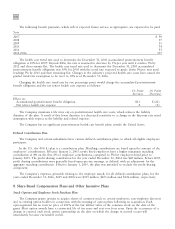

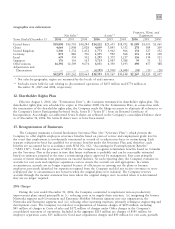

12. Shareholder Rights Plan

Effective August 1, 2006 (the ""Termination Date''), the Company terminated its shareholder rights plan. The

shareholder rights plan was scheduled to expire in November 2008. On the Termination Date, in connection with

the termination of the shareholder rights plan, the Company made the filings necessary to eliminate all references to

the Company's Junior Participating Preferred Stock, Series B (""Series B'') from its Restated Certificate of

Incorporation. Accordingly, no authorized Series B shares are reflected in the Company's consolidated balance sheet

as of December 31, 2006. No Series B shares were or have been issued.

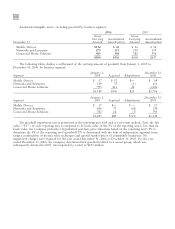

13. Reorganization of Businesses

The Company maintains a formal Involuntary Severance Plan (the ""Severance Plan'') which permits the

Company to offer eligible employees severance benefits based on years of service and employment grade level in

the event that employment is involuntarily terminated as a result of a reduction-in-force or restructuring. Each

separate reduction-in-force has qualified for severance benefits under the Severance Plan and, therefore, such

benefits are accounted for in accordance with SFAS No. 112, ""Accounting for Postemployment Benefits''

(""SFAS 112''). Under the provisions of SFAS 112, the Company recognizes termination benefits based on formulas

per the Severance Plan at the point in time that future settlement is probable and can be reasonably estimated

based on estimates prepared at the time a restructuring plan is approved by management. Exit costs primarily

consist of future minimum lease payments on vacated facilities. At each reporting date, the Company evaluates its

accruals for exit costs and employee separation costs to ensure the accruals are still appropriate. In certain

circumstances, accruals are no longer required because of efficiencies in carrying out the plans or because

employees previously identified for separation resigned from the Company and did not receive severance or were

redeployed due to circumstances not foreseen when the original plans were initiated. The Company reverses

accruals through the income statement line item where the original charges were recorded when it is determined

they are no longer required.

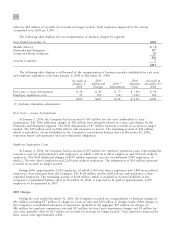

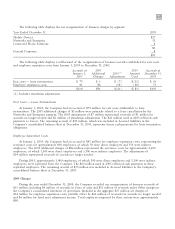

2006 Charges

During the year ended December 31, 2006, the Company committed to implement various productivity

improvement plans aimed principally at: (i) reducing costs in its supply-chain activities, (ii) integrating the former

Networks segment and Government and Enterprise Mobility Solutions segment into one organization, the

Networks and Enterprise segment, and (iii) reducing other operating expenses, primarily relating to engineering and

development costs. The Company recorded net reorganization of business charges of $213 million, including

$41 million of charges in Costs of sales and $172 million of charges under Other charges in the Company's

consolidated statement of operations. Included in the aggregate $213 million are charges of $191 million for

employee separation costs, $15 million for fixed asset impairment charges and $30 million for exit costs, partially