Motorola 2006 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

104

outstanding. In 2006, the Company began using an estimated forfeiture rate of 25% based on historical data. This

estimated forfeiture rate may be revised in subsequent periods if actual forfeitures differ from this estimate. Prior to

2006, the Company used the actual forfeiture method, which assumed that all options would vest and pro forma

expense was adjusted when options were forfeited prior to the vesting dates.

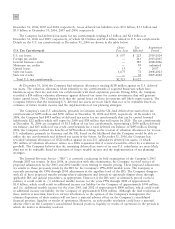

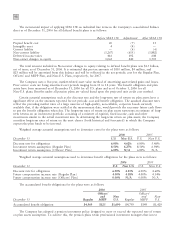

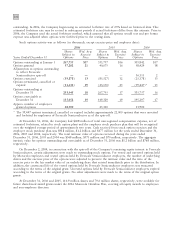

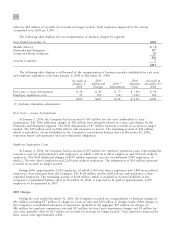

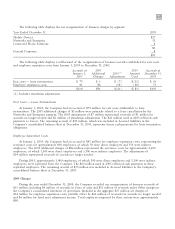

Stock options activity was as follows (in thousands, except exercise price and employee data):

2006

2005 2004

Shares Wtd. Avg. Shares Wtd. Avg. Shares Wtd. Avg.

Subject to Exercise Subject to Exercise Subject to Exercise

Years Ended December 31 Options Price Options Price Options Price

Options outstanding at January 1 267,755 $17 335,757 $16 305,842 $17

Options granted 37,202 21 40,675 16 58,429 18

Adjustments to options outstanding

to reflect Freescale

Semiconductor spin-off ÌÌ Ì Ì 36,111 2

Options exercised (59,878) 13 (85,527) 12 (25,178) 13

Options terminated, cancelled or

expired (11,634) 19 (23,150) 25 (39,447)* 15

Options outstanding at

December 31 233,445 18 267,755 17 335,757 16

Options exercisable at

December 31 135,052 19 149,329 19 195,297 17

Approx. number of employees

granted options 28,900 25,300 33,900

* The 39,447 options terminated, cancelled or expired includes approximately 22,000 options that were unvested

and forfeited by employees of Freescale Semiconductor as of the spin-off.

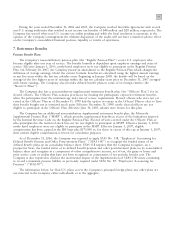

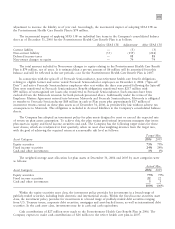

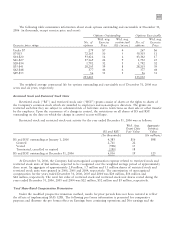

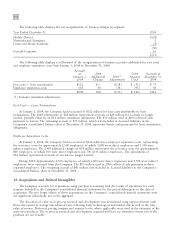

At December 31, 2006, the Company had $408 million of total unrecognized compensation expense, net of

estimated forfeitures, related to stock option plans and the employee stock purchase plan that will be recognized

over the weighted average period of approximately two years. Cash received from stock option exercises and the

employee stock purchase plan was $918 million, $1.2 billion and $477 million for the years ended December 31,

2006, 2005 and 2004, respectively. The total intrinsic value of options exercised during the years ended

December 31, 2006, 2005 and 2004 was $568 million, $571 million and $70 million, respectively. The aggregate

intrinsic value for options outstanding and exercisable as of December 31, 2006 was $1.2 billion and $768 million,

respectively.

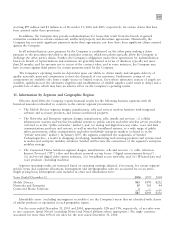

On December 2, 2004, in connection with the spin-off of the Company's remaining equity interest in Freescale

Semiconductor, certain adjustments were made to outstanding stock options. For vested and unvested options held

by Motorola employees and vested options held by Freescale Semiconductor employees, the number of underlying

shares and the exercise price of the options were adjusted to preserve the intrinsic value and the ratio of the

exercise price to the fair market value of an underlying share that existed immediately prior to the distribution. In

addition, the contractual life of the vested options held by Freescale Semiconductor employees was truncated

according to the terms of the original grant. Unvested options held by Freescale Semiconductor employees expired

according to the terms of the original grants. No other adjustments were made to the terms of the original option

grants.

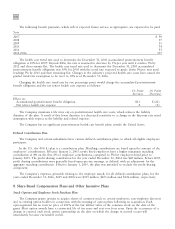

At December 31, 2006 and 2005, 110.9 million shares and 79.6 million shares, respectively, were available for

future share-based award grants under the 2006 Motorola Omnibus Plan, covering all equity awards to employees

and non-employee directors.