Motorola 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

103

The employee stock purchase plan allows eligible participants to purchase shares of the Company's common

stock through payroll deductions of up to 10% of eligible compensation on an after-tax basis. Plan participants

cannot purchase more than $25,000 of stock in any calendar year. The price an employee pays per share is 85% of

the lower of the fair market value of the Company's stock on the close of the first trading day or last trading day

of the purchase period. The plan has two purchase periods, the first one from October 1 through March 31 and

the second one from April 1 through September 30. For the years ended December 31, 2006, 2005 and 2004,

employees purchased 8.3 million, 11.7 million and 13.1 million shares, respectively, at prices ranging from $19.07 to

$19.82, $12.66 to $12.72 and $10.31 to $15.33, respectively.

Prior to January 1, 2006, the Company accounted for stock options under the intrinsic value method.

Accordingly, the Company did not recognize expense related to employee stock options because the exercise price

of such options equaled the fair value of the underlying stock on the grant date. The Company previously disclosed

the fair value of its stock options in its footnotes.

The Company adopted SFAS No. 123R, ""Share-Based Payment'' (""SFAS 123R'') using the modified

prospective transition method, which requires the application of the accounting standard as of January 1, 2006, the

first day of the Company's fiscal year 2006. The Company's consolidated financial statements for prior periods have

not been restated to reflect, and do not include, the impact of SFAS 123R.

Under SFAS 123R, the Company recognized $174 million, net of taxes, of compensation expense related to

stock options and employee stock purchases for 2006, which was allocated to the Company's consolidated

statement of operations as follows:

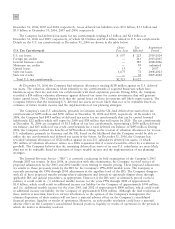

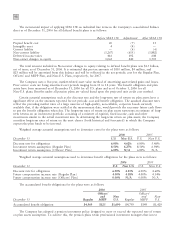

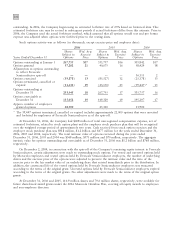

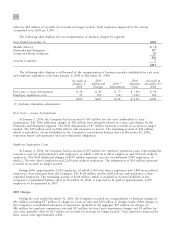

Year Ended December 31

2006

Share-based compensation expense included in:

Costs of sales $30

Selling, general and administrative expenses 138

Research and development expenditures 84

Share-based compensation expense related to employee stock options and employee stock purchases

included in operating earnings 252

Tax benefit 78

Share-based compensation expense related to employee stock options and employee stock purchases, net

of tax $ 174

Decrease in Basic earnings per share $(0.07)

Decrease in Diluted earnings per share $(0.07)

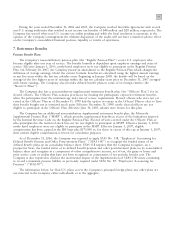

Upon adoption of SFAS 123R, the Company continued to calculate the value of each employee stock option,

estimated on the date of grant, using the Black-Scholes option pricing model. The weighted-average estimated fair

value of employee stock options granted during 2006, 2005 and 2004 was $9.23, $5.75, and $7.74, respectively,

using the following weighted-average assumptions:

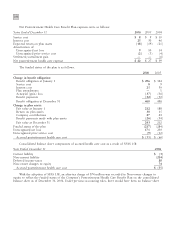

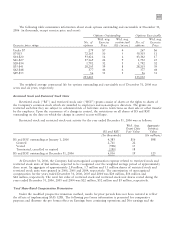

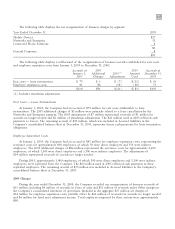

2006

2005 2004

Expected volatility 36.2% 35.2% 46.7%

Risk-free interest rate 5.0% 3.9% 3.7%

Dividend yield 0.8% 1.0% 0.9%

Expected life (years) 6.5 5.0 5.0

In 2006, the Company began using the implied volatility for traded options on the Company's stock as the

expected volatility assumption required in the Black-Scholes model. Prior to 2006, the Company used a blended

volatility rate using a combination of historical stock price volatility and market-implied volatility for purposes of

its pro forma information. The selection of the implied volatility approach was based upon the availability of

actively traded options on the Company's stock and the Company's assessment that implied volatility is more

representative of future stock price trends than historical volatility.

The risk-free interest rate assumption is based upon the average daily closing rates during the year for

U.S. treasury notes that have a life which approximates the expected life of the option. The dividend yield

assumption is based on the Company's historical and future expectation of dividend payouts. The expected life of

employee stock options represents the weighted-average period the stock options are expected to remain