Motorola 2006 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

transition. FIN 48 is effective beginning January 1, 2007. The adoption of FIN 48 is not expected to have a

material effect on the Company's consolidated results of operations or cash flows. The Company estimates that the

adoption of FIN 48 will cause an increase in noncurrent liabilities and an equal offsetting increase in noncurrent

deferred tax assets in the range of $900 million to $1.0 billion. The amount of cash ultimately payable with regard

to the uncertain tax positions is not affected by the balance sheet reclassification estimated upon the adoption of

FIN 48 and will be a function of Motorola's overall tax situation when the underlying tax issues are resolved,

taking into account the availability of deferred tax assets that may reduce tax otherwise due.

In March 2006, the FASB issued SFAS No. 156, ""Accounting for Servicing of Financial Assets Ì An

Amendment of SFAS No. 140'' (""SFAS 156''). Among other requirements, SFAS 156 requires an entity to recognize

a servicing asset or servicing liability each time it undertakes an obligation to service a financial asset by entering

into a servicing contract when there is either: (i) a transfer of the requirements for sale accounting, (ii) a transfer

of the servicer's financial assets to a qualifying special-purpose entity in a guaranteed mortgage securitization in

which the transferor retains all of the resulting securities and classifies them as either available-for-sale securities or

trading securities in accordance with SFAS 115, ""Accounting for Certain Investments in Debt and Equity

Securities'', or (iii) an acquisition or assumption of an obligation to service a financial asset that does not relate to

financial assets of the servicer or its consolidated affiliates. SFAS 156 is effective for fiscal years beginning after

September 15, 2006. The Company does not believe the adoption of SFAS 156 will have a material effect on the

Company's consolidated results of operations, financial position or cash flows.

2. Discontinued Operations

During 2006, the Company completed the sale of its automotive electronics business, which was a component

of the Networks and Enterprise segment, to Continental AG for $856 million in net cash received. The Company

recorded a gain on sale of business of $399 million before income taxes, which is included in Earnings (loss) from

discontinued operations, net of tax, in the Company's consolidated statements of operations.

During the second quarter of 2004, the Company completed the separation of its semiconductor operations

into a separate subsidiary, Freescale Semiconductor, Inc. (""Freescale Semiconductor''). Under the terms of the

Master Separation and Distribution Agreement entered into between Motorola and Freescale Semiconductor,

Freescale Semiconductor has agreed to indemnify Motorola for substantially all past, present and future liabilities

associated with the semiconductor business. In July 2004, an initial public offering (""IPO'') of a minority interest

of approximately 32.5% of Freescale Semiconductor was completed. As a result of the IPO the Company recorded

additional paid-in capital of $397 million related to the excess of the IPO price over the book value of the shares

sold. Concurrently in July 2004, Freescale Semiconductor issued senior debt securities in an aggregate principal

amount of $1.25 billion. On December 2, 2004, Motorola completed the spin-off of its remaining 67.5% equity

interest in Freescale Semiconductor. The spin-off was effected by way of a pro rata non-cash dividend to Motorola

stockholders, which reduced retained earnings by $2.5 billion. Holders of Motorola stock at the close of business

on November 26, 2004 received a dividend of .110415 shares of Freescale Semiconductor Class B common stock

per share of Motorola common stock. No fractional shares of Freescale Semiconductor were issued. Stockholders

entitled to fractional shares of Freescale Semiconductor Class B common stock in the distribution received the cash

value instead. The equity distribution was structured to be tax-free to Motorola stockholders for U.S. tax purposes

(other than with respect to any cash received in lieu of fractional shares).

The financial results of the automotive electronics business and Freescale Semiconductor have been reflected as

discontinued operations in the accompanying financial statements and related disclosures for all periods presented.

As a result, the footnote disclosures have been revised to exclude amounts related to the automotive electronics

business and Freescale Semiconductor.

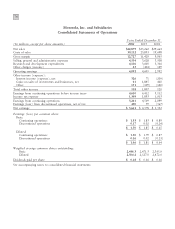

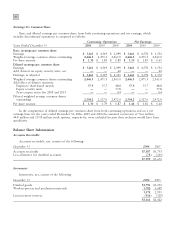

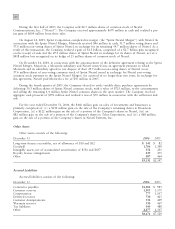

The following table displays summarized financial information for discontinued operations:

Years Ended December 31

2006

2005 2004

Net sales (including sales to other Motorola businesses of $0 million, $3 million and

$1,173 million for the years ended December 31, 2006, 2005 and 2004, respectively) $860 $1,581 $5,685

Operating earnings 87 118 352

Gains (loss) on sales of investments and businesses, net 399 16 (44)

Earnings before income taxes 482 135 381

Income tax expense 82 76 948

Earnings (loss) from discontinued operations, net of tax 400 59 (567)