Motorola 2006 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2006 Motorola annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

115

The developmental products for the companies acquired have varying degrees of timing, technology, costs-to-

complete and market risks throughout final development. If the products fail to become viable, the Company will

unlikely be able to realize any value from the sale of incomplete technology to another party or through internal

re-use. The risks of market acceptance for the products under development and potential reductions in projected

sales volumes and related profits in the event of delayed market availability for any of the products exist. Efforts to

complete all developmental products continue and there are no known delays to forecasted plans.

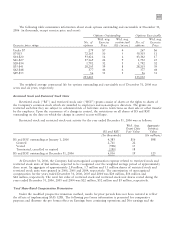

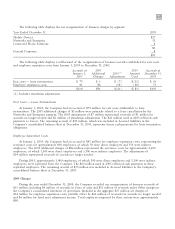

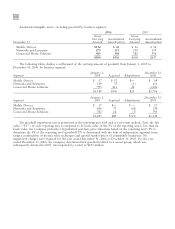

The following is a summary of significant acquisitions in 2006, 2005 and 2004:

In-Process

Research and

Quarter Development

Acquired Consideration Form of Consideration Charge

2006 Acquisitions

Broadbus Technologies, Inc. Q3 $181 Cash $12

TTP Communications plc Q3 $193 Cash $17

Kreatel Communications AB Q1 $108 Cash $ 1

2005 Acquisitions

No significant acquisitions Ì Ì Ì Ì

2004 Acquisitions

MeshNetworks, Inc. Q4 $169 Cash $16

Force Computers Q3 $121 Cash $ 2

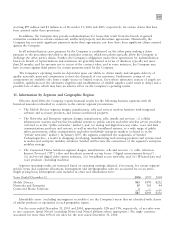

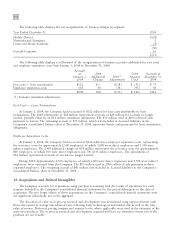

The following table summarizes net tangible and intangible assets acquired and the consideration provided for

the acquisitions identified above:

Years Ended December 31

2006

2005 2004

Tangible net assets $20 $Ì $ 39

Goodwill 262 Ì 178

Other intangibles 170 Ì55

In-process research and development 30 Ì18

$ 482 $Ì $ 290

Consideration:

Cash $ 482 $Ì $ 290

Stock ÌÌ Ì

$ 482 $Ì $ 290

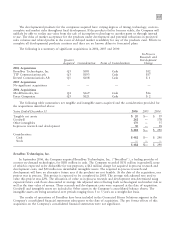

Broadbus Technologies, Inc.

In September 2006, the Company acquired Broadbus Technologies, Inc. (""Broadbus''), a leading provider of

content on-demand technologies, for $181 million in cash. The Company recorded $131 million in goodwill, none

of which is expected to be deductible for tax purposes, a $12 million charge for acquired in-process research and

development costs, and $30 million in identifiable intangible assets. The acquired in-process research and

development will have no alternative future uses if the products are not feasible. At the date of the acquisition, one

project was in process. This project is expected to be completed in 2008. The average risk adjusted rate used to

value this project was 22%. The allocation of value to in-process research and development was determined using

expected future cash flows discounted at average risk adjusted rates reflecting both technological and market risk as

well as the time value of money. These research and development costs were expensed at the date of acquisition.

Goodwill and intangible assets are included in Other assets in the Company's consolidated balance sheets. The

intangible assets are being amortized over periods ranging from 3 to 5 years on a straight-line basis.

The results of operations of Broadbus have been included in the Connected Home Solutions segment in the

Company's consolidated financial statements subsequent to the date of acquisition. The pro forma effects of this

acquisition on the Company's consolidated financial statements were not significant.